Share price of Zomato parent Eternal Ltd. fell 4% on Monday after FTSE and MSCI both announced weight changes. The weight reduction in both indices was announced owing to the reduction in the Foreign Ownership Limit from 100% to 49.5%.

Foreign outflows of $840 million are expected this week on account of the readjustment of weightage in both FTSE and MSCI. The FTSE reduction is expected to cause an outflow of $380 million by or on May 27, whereas the MSCI reduction will likely trigger an outflow of $460 million by or on May 30.

In FTSE, the direct reduction may lead to a full weight reduction in a single step, in contrast to headroom-related reductions, which are implemented in a phased manner.

On Friday, the stock gained close to 5%. Eternal's FPI limit had gone live on the NSDL site, but despite that, there was no update from NSDL. This implied that FPI was not near the ban or red flag limit. Street assumed it was temporary relief from MSCI/FTSE-related outflows.

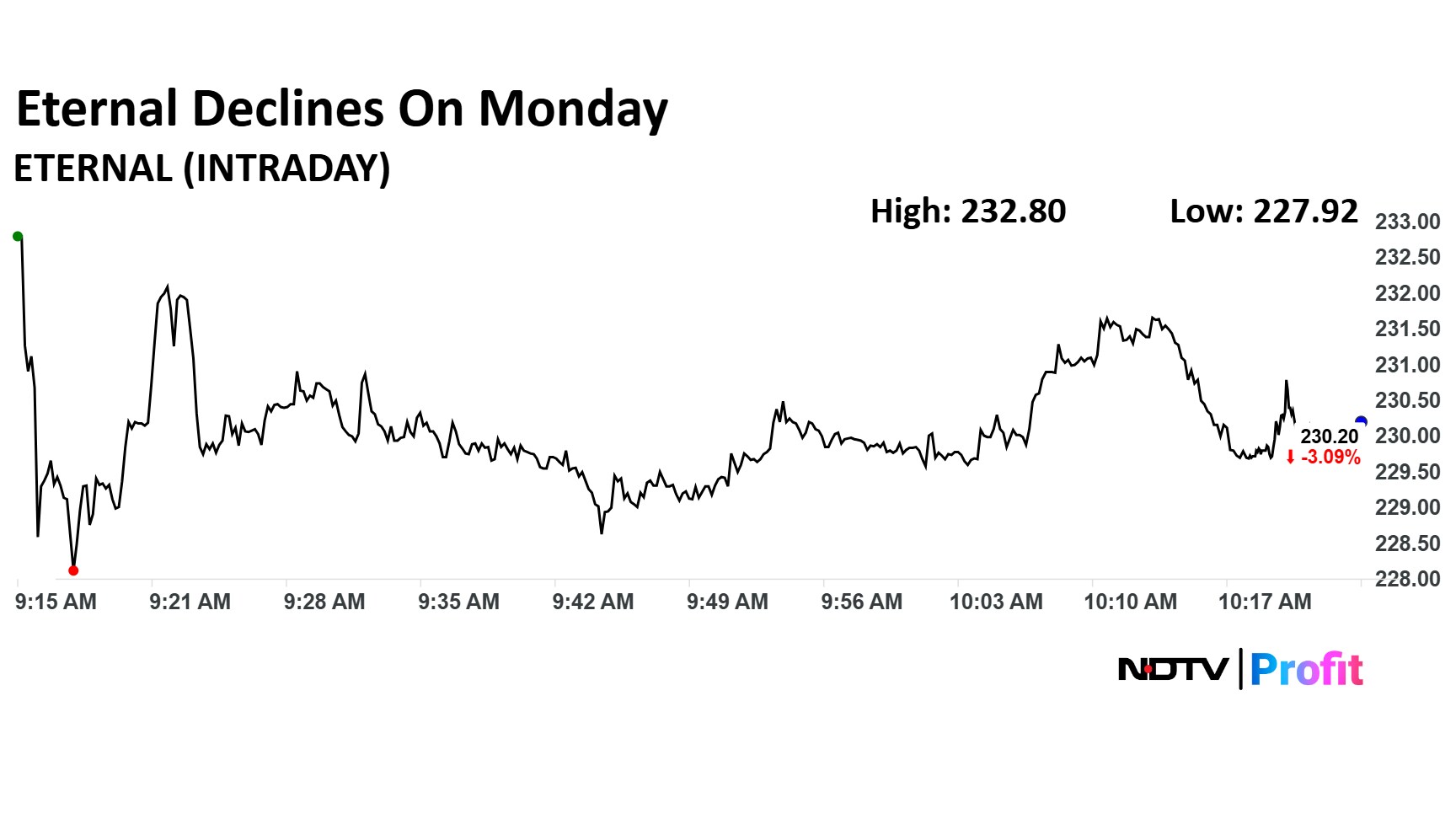

Eternal Share Price Today

The share price of Eternal fell as much as 4.05% to Rs 227.92 apiece, the lowest level since May 22. It pared losses to trade 3.35% lower at Rs 229.60 apiece, as of 10:17 a.m. This compares to a 0.71% advance in the NSE Nifty 50 Index.

The stock has fallen 17.39% on a year-to-date basis but risen 25.62% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 48.61.

Out of 30 analysts tracking the company, 24 maintain a 'buy' rating, two recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.