Elecon Engineering Co., a company that manufactures and sells power transmission and material handling equipment, has delivered staggering returns of nearly 5,000% in the last five years. While the scrip has delivered 0.72% returns on a year-to-date basis, the five-year return of the stock stands at 4,760.08%.

Experts' take on the counter is upbeat as all five analysts tracking the multibagger stock have a 'buy' call, according to Bloomberg data.

Analysts at Asian Markets Securities have a 'buy' rating. So do those at Share India Securities. Meanwhile, Dalal & Broacha Stock Broking Private Ltd. has 'accumulate' rating on the stock. The target price is set at Rs 729, implying a 14.1% potential upside.

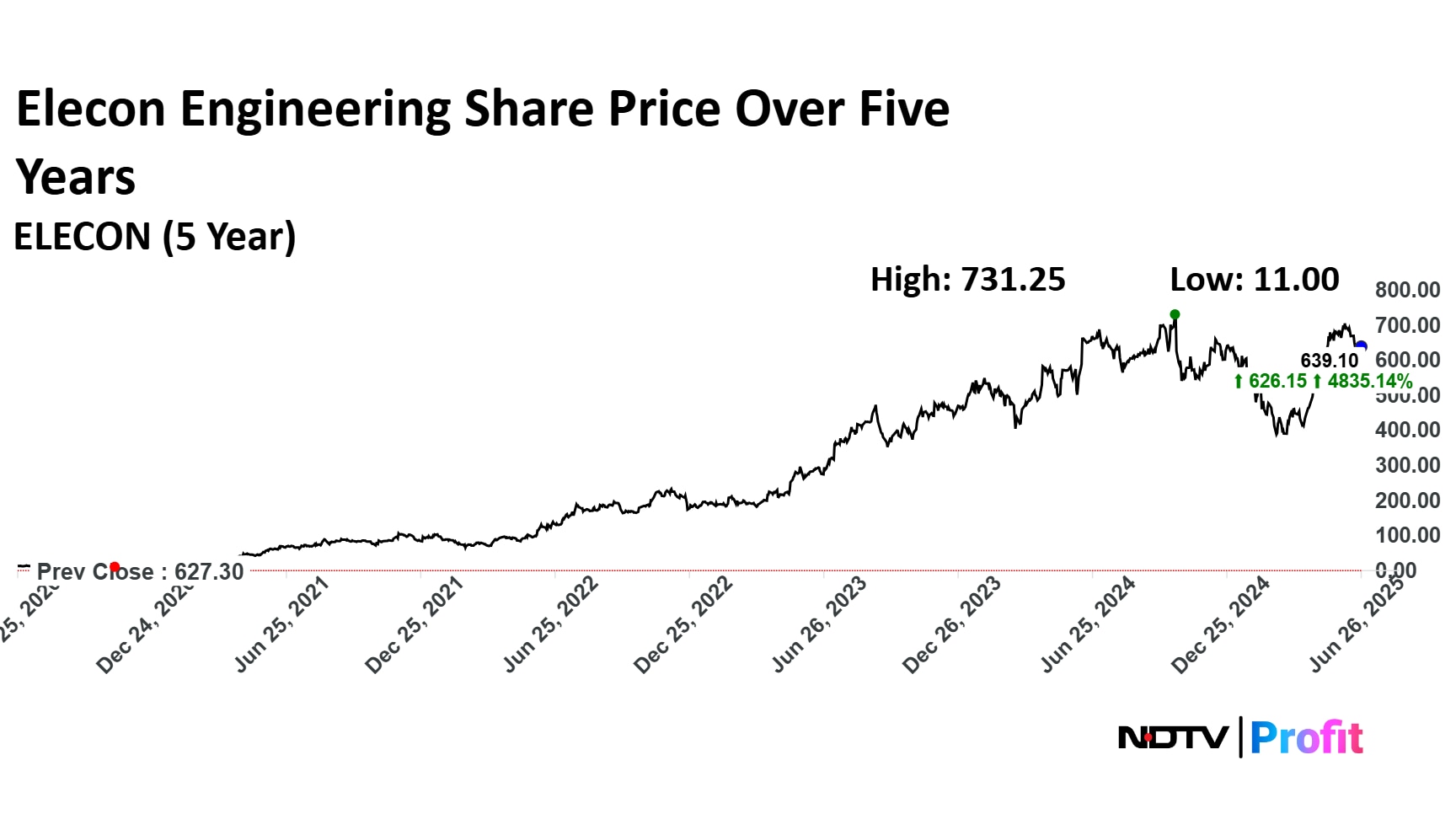

Elecon Engineering Share Price In Five Years

In the last five years, the stock's share price had hit a low of Rs 11 in October 2020, before it saw a steady climb over the years. The scrip's five-year high was Rs 731.25 in Oct 2024.

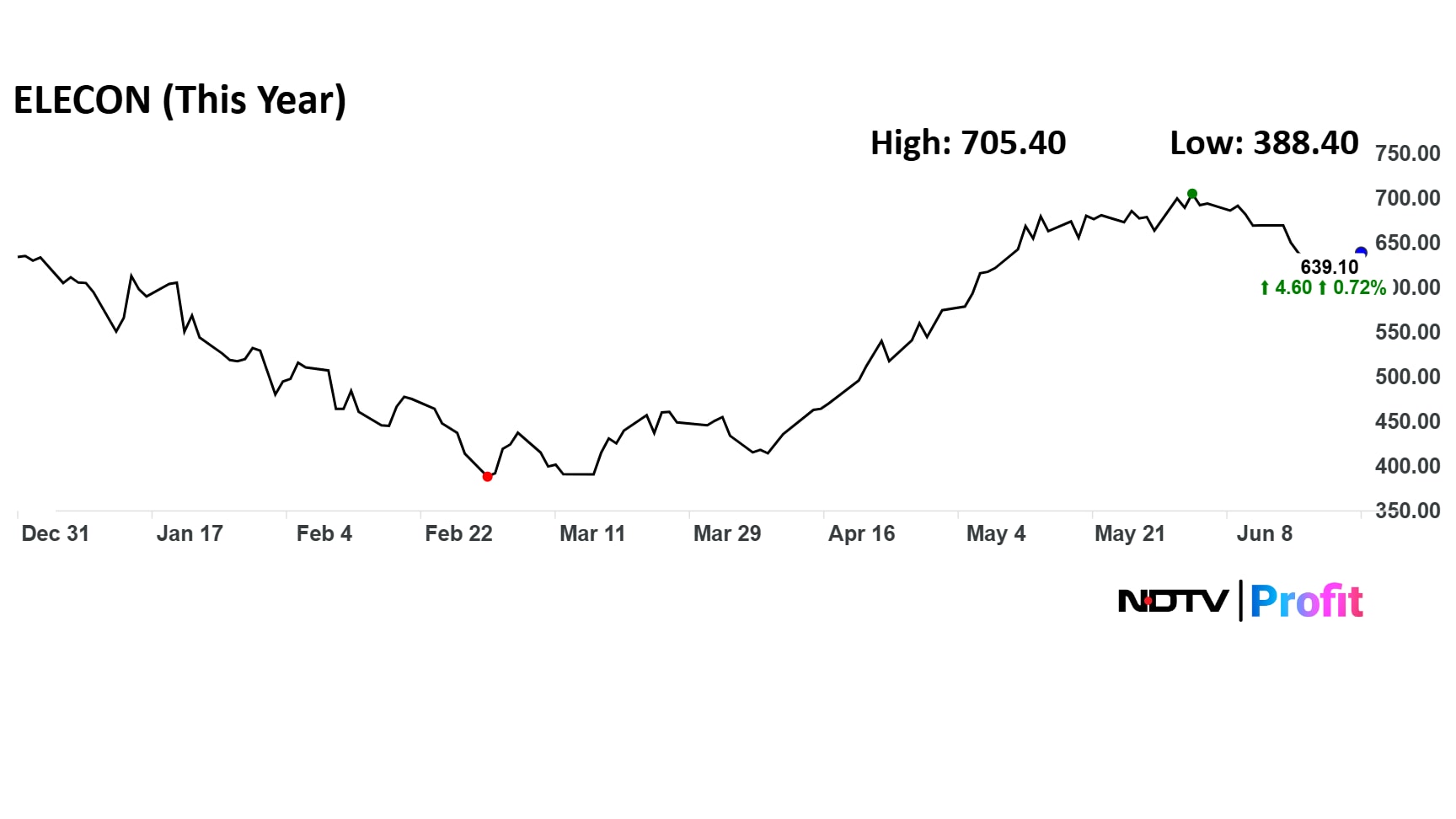

Elecon Engineering Price Last Year

The stock has delivered positive returns of 0.72% on a year-to-date basis, whereas the 12-month return is at a decline of 4.08%.

During this period, the scrip had hit a low of Rs 388.40 on March 3, before it advanced to a high of Rs 705.40 on June 4.

About The Company

Founded in 1951, Elecon Engineering specialises in engineering, procurement, and construction projects in India. It became a publicly listed company on BSE Ltd. in June 1962 and later on the National Stock Exchange of India in November 2006.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.