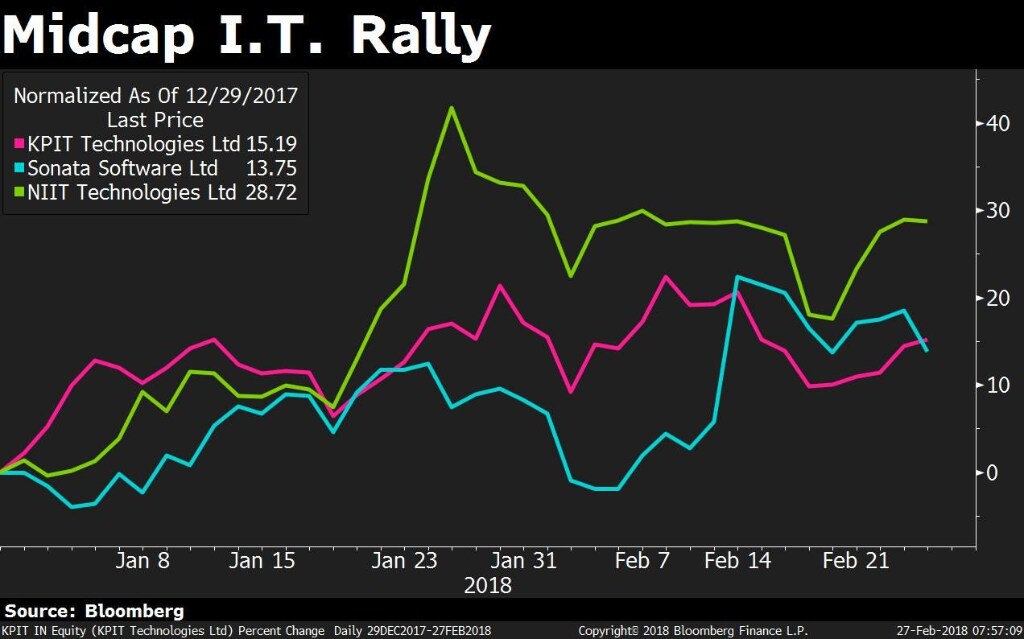

Mid-cap IT companies have beaten the benchmark Nifty IT Index, the best sectoral performer so far this year.

KPIT Technologies Ltd., which has gained more than 15 percent in 2018 along with its peers, may have room to rise more, the stochastics indicator suggests. The oscillator tracking the pace of price movements shows the stock is oversold, according to Bloomberg data.

KPIT Technologies has shown time correction—asset prices have not gone higher for a long time—in a market which has seen prices fall, said Ruchit Jain, technical analyst at Angel Broking. That's a positive sign and the share price is expected to move towards Rs 230 to Rs 240 in the short term, he said.

The stock has risen over 15 percent so far this year, compared to 9 percent rise in the Nifty IT index.

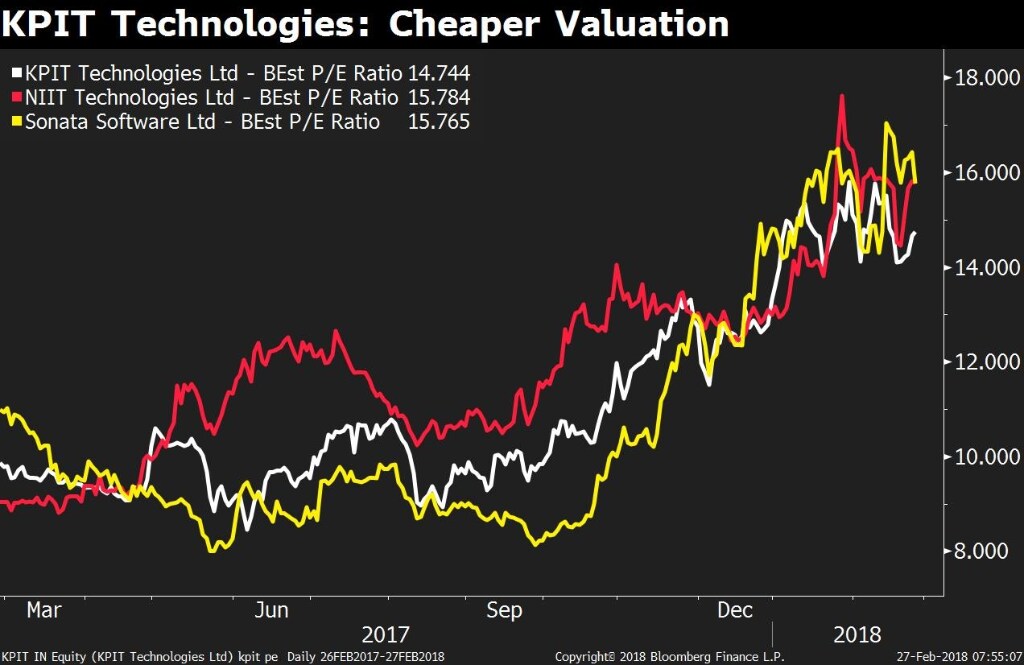

Cheaper Than Peers

KPIT Technologies is cheaper as it's trading at a discount based on its price-to-earnings multiple compared with peers like NIIT Technologies Ltd. and Sonata Software Ltd.

KPIT is inexpensive relative to its peers due to operational improvement and ability to generate cash, Abhishek Shindadkar, senior analyst at Equirius Securities Pvt. Ltd., told BloombergQuint over the phone. Restructuring has created interest in the stock and can rally towards Rs 230 per share, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.