DLF Ltd.'s valuable land bank with more than 20 years of sales potential, strong balance sheet and good pipeline of growth in rental income and overall cash generation has analysts upbeat on the realtor.

After attending the company's analyst day, Morgan Stanley said the chairman's tone was conservative on the development business.

"He considers cash inflow to be the real metric and not GDV (gross development value) or pre-sales. He is more comfortable with significant upcoming growth in intellectual property business. The constraint is manpower, in terms of execution and maintaining the service quality and brand," it said.

The brokerage found management incrementally cautious on pre-sales guidance and capital allocation. DLF projects FY26 pre-sales of Rs 20,000 crore and a medium-term launch pipeline target of Rs 74,000 crore.

Nomura said investors may have been slightly disappointed by the management's conservative pre-sales guidance for FY26. "While we acknowledge DLF's robust cash generation and strong annuity income profile, we believe its current valuation already prices in the long-term growth potential," a note said.

Motilal Oswal said a projected 20% annual compounded growth over three years, coupled with healthy collections visibility, a large land bank to support long-term growth, a cash-positive balance sheet, steadily growing rental income, and reducing debt, has kept its confidence in DLF.

DLF Share Price Target

Morgan Stanley: 'Equal-weight' rating with target price of Rs 910, a 31% upside potential over previous close.

Nomura: 'Neutral' rating with target price of Rs 700, a 0.6% upside potential over previous close.

Motilal Oswal: 'Buy' rating with target price of Rs 954, a 37% upside potential over previous close.

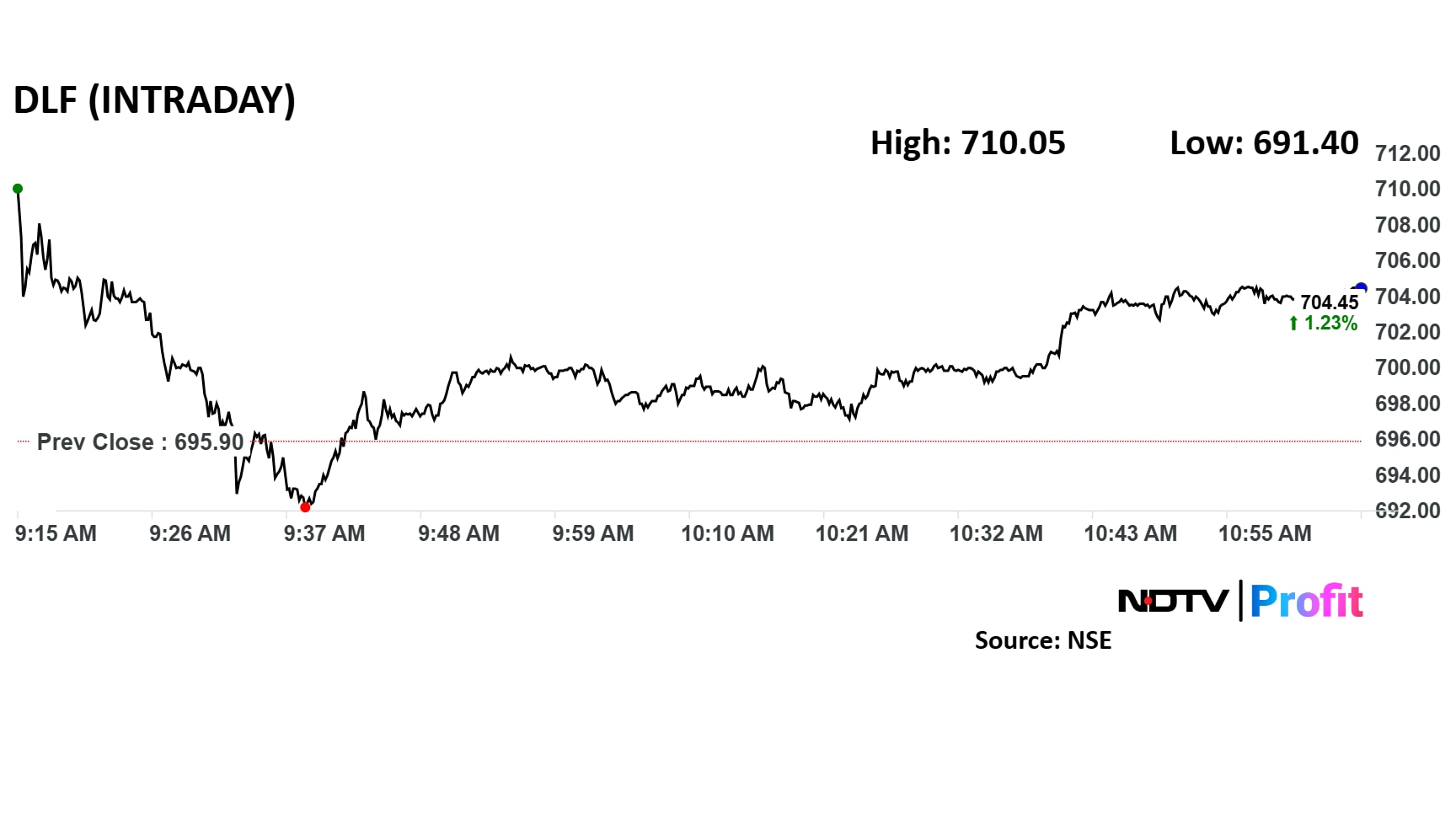

DLF Share Price Movement

DLF share price advanced 2% intraday to Rs 710 apiece. The scrip was trading 1.2% higher by 11:05 a.m. The benchmark NSE Nifty 50 was up 1.15%.

The stock has fallen 18% in the last 12 months and 14% on a year-to-date basis. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 62.

Of the 24 analysts tracking DLF, 21 have a 'buy' rating on the stock and three recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 33%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.