DLF Ltd. saw its share price rise nearly 4% on Thursday after global brokerage firm CLSA upgraded the stock to ‘High Conviction Outperform' from ‘Outperform'. CLSA has set a target price of Rs 975, citing strong growth prospects and an unjustified discount to the company's net asset value.

CLSA's upgrade is based on several positive factors that are expected to drive DLF's growth momentum. The brokerage highlighted that DLF's stock is currently trading at a 20% discount to its net asset value, despite robust pre-sales growth. CLSA believes this discount is unjustified given the company's strong sales outlook.

CLSA expects DLF's growth momentum to continue, driven by:

Adequate New Launches: DLF has a pipeline of new launches planned over the next 8-9 quarters, which is expected to sustain its growth trajectory.

Unsold Inventory: The company has a significant amount of unsold inventory, which provides a buffer and potential for future sales.

Strong Business Moats: DLF's established market presence and competitive advantages are seen as key strengths.

Healthy Balance Sheet: The company's financial health is robust, providing a solid foundation for continued expansion.

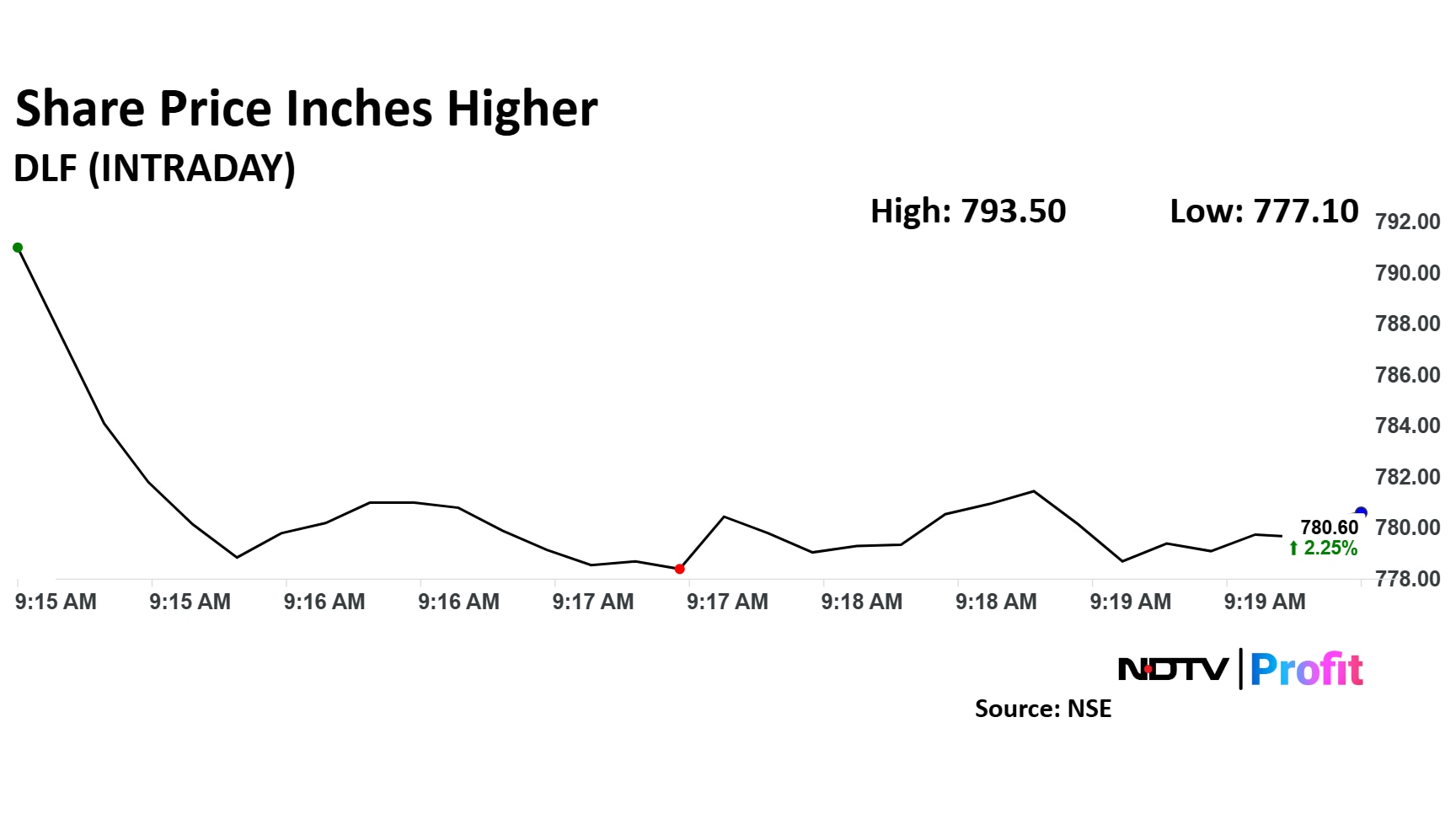

The scrip rose as much as 3.94% to Rs 793 apiece. It pared gains to trade 2% higher at Rs 778 apiece, as of 09:21 a.m. This compares to a flat NSE Nifty 50 Index.

It has declined 2.35% in the last 12 months. Total traded volume so far in the day stood at 0.27 times its 30-day average. The relative strength index was at 55.

Out of 21 analysts tracking the company, 19 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.