Shares of Dixon Technologies Ltd. pared losses to end with gains on Thursday after the company announced that it will consider a stock split.

The company will consider a sub-division of shares at its board meeting on Feb. 2, along with quarterly results for the October-December period, according to its filings.

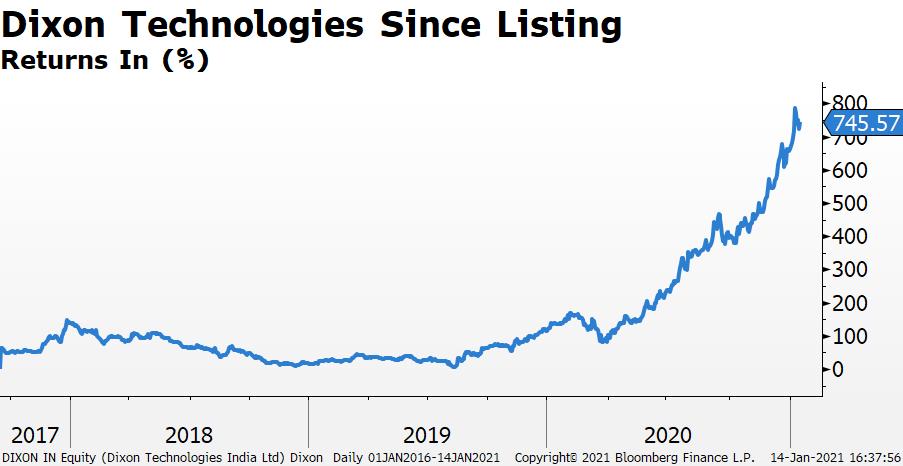

Shares recovered losses of as much as 3.2% to end 2.7% higher at Rs 15,100 on Thursday. The stock has surged 850% since its listing in September 2017 and hit a record of Rs 16,787 apiece on Jan. 8.

- Dixon Technologies was the fourth best performer among small caps in 2020 with 254% compared with a 21.5% rise in the Nifty Smallcap index itself.

- At the current levels, it is trading at 158 times its 12-month forward earnings.

- The promoter holding has remained around the 36% mark in the last three quarters.

- Foreign investors have increased their holdings to 16.21% as of September from 12.27% in June and 7.67% a year earlier.

Of the 21 analysts tracking Dixon Technologies, 17 have a 'buy' recommendation, three suggest 'hold' while one has a 'sell' rating. It is trading 18.5% higher than its 12-month consensus price target, according to Bloomberg data. Only two analysts have target prices that imply gains from current the current market price.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.