Shares of Data Patterns (India) Ltd. rose on Monday to hit eight-month high after its profit rose over 60% for the fourth quarter of financial year 2025.

The defence and aerospace electronics system provider recorded a consolidated net profit of Rs 114 crore for the quarter ended March, compared to Rs 71 crore in the same quarter of the previous fiscal, according to its stock exchange notification.

Revenue more than doubled to Rs 396 crore for the three months ended March, in comparison to Rs 183 crore reported in the same quarter of financial year 2024. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 60.7% year-on-year to Rs 149.5 crore. The Ebitda margin narrowed 1,340 points to 37.7%.

The company also announced a final dividend of Rs 7.9 per share.

The defence company secured orders worth Rs 355 crore in financial year 2025. The order book as of March stood at Rs 729.84 crore. So far in the first quarter of this fiscal, Data Patterns received orders worth Rs 40.21 crore and is awaiting order worth Rs 91.69 crore.

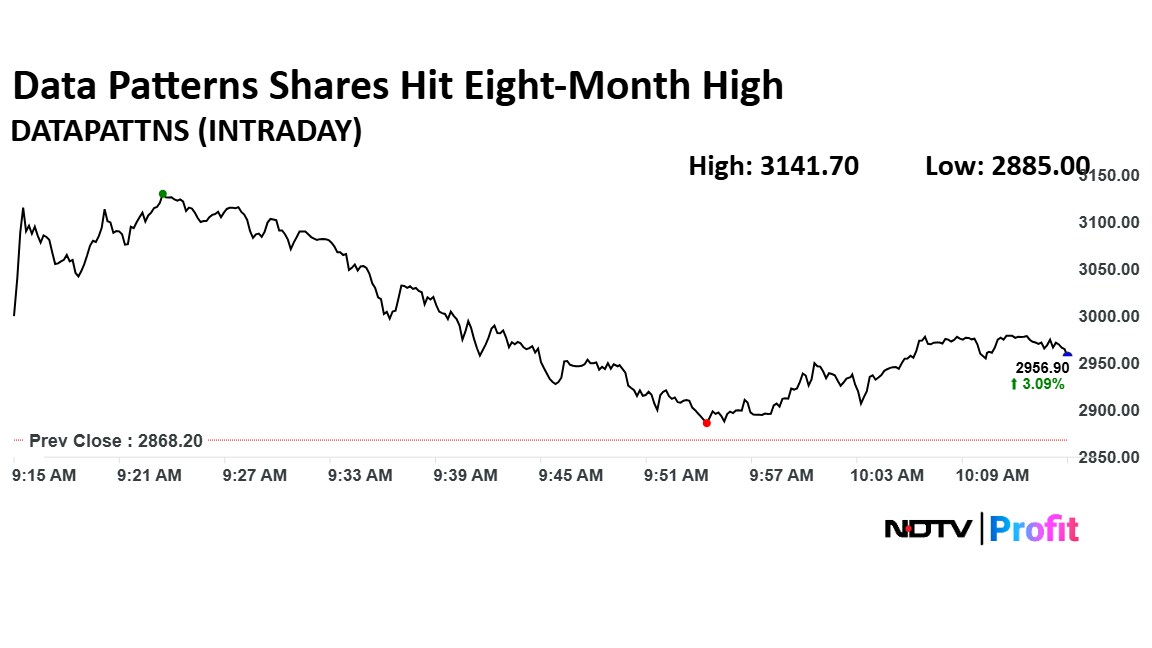

Data Patterns Share Price Advance

The shares of Data Patterns rose as much as 9.54% to Rs 3,141.70 apiece, the highest level since Aug. 2. They pared gains to trade 2.80% higher at Rs 2,948.60 apiece, as of 10:08 a.m. This compares to a 0.07% advance in the NSE Nifty 50.

It has fallen 5.94% in the last 12 months and risen 20.37% year-to-date. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 62.19.

Out of 12 analysts tracking the company, 11 maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 24.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.