The share price of IT firm Cyient Ltd. slipped nearly 10% on Friday despite the company declaring a 39% rise in net profit and a marginal uptick in revenue for the quarter ended March, as brokerages remain bearish.

Emkay Global has a 'reduce' call on the stock, trimming its price target for the company by 7% to Rs 1,270. Cyient's management has attributed a weakness in revenue to increased macro uncertainties impacting the demand environment and has temporarily stopped providing guidance, citing the transition to new leadership, the need for greater clarity on macros, and the ongoing evolution of the newly established semiconductor business.

The brokerage cut earnings per share value for fiscal 2026 and 2027 by 8% and 10%, given the estimates miss for the quarter under question. Emkay valued the DET business at 16 times the March 2027 estimate and the DLM business at a 20% discount to its current market price.

Kotak Securities also maintains a 'reduce' call, also cutting Cyient's price target to Rs 1,150 from Rs 1,300, citing another significant miss in operating performance. The brokerage cut its EPS target for the next two fiscals by 8% to 14%.

The company posted a profit of Rs 170.4 crore in the fourth quarter of the last financial year, according to an exchange filing on Thursday. The consensus estimate of analysts tracked by Bloomberg stood at Rs 172.6 crore.

Cyient Q4 FY25 Earnings Highlights (Consolidated, QoQ)

Revenue down 0.9% to Rs 1,909.2 crore versus Rs 1,926.4 crore (Bloomberg estimate at Rs 18,750.5 crore).

EBIT up 5% to Rs 234.8 crore versus Rs 223.3 crore.

Margin expands to 12.3% versus 11.6%.

Net profit up 39% to Rs 170.4 crore versus Rs 122.3 crore (Estimate at Rs 172.6 crore).

Cyient recommended a final dividend of Rs 14 per share at a face value of Rs 5 each for the financial year 2024–25, aggregating to Rs 155.5 crore.

Other companies, including Hindustan Zinc, Chennai Petroleum Corp., DCB Bank, Force Motors, Kesoram Industries, Dr. Lal PathLabs, Lloyds Metals and Energy, Bank of Maharashtra, Mahindra Lifespace Developers, Mahindra Holidays & Resorts India, Motilal Oswal Financial Services, Orient Electric, Rossari Biotech, Tejas Networks, and VST Industries, are also set to release their fourth-quarter results on Friday.

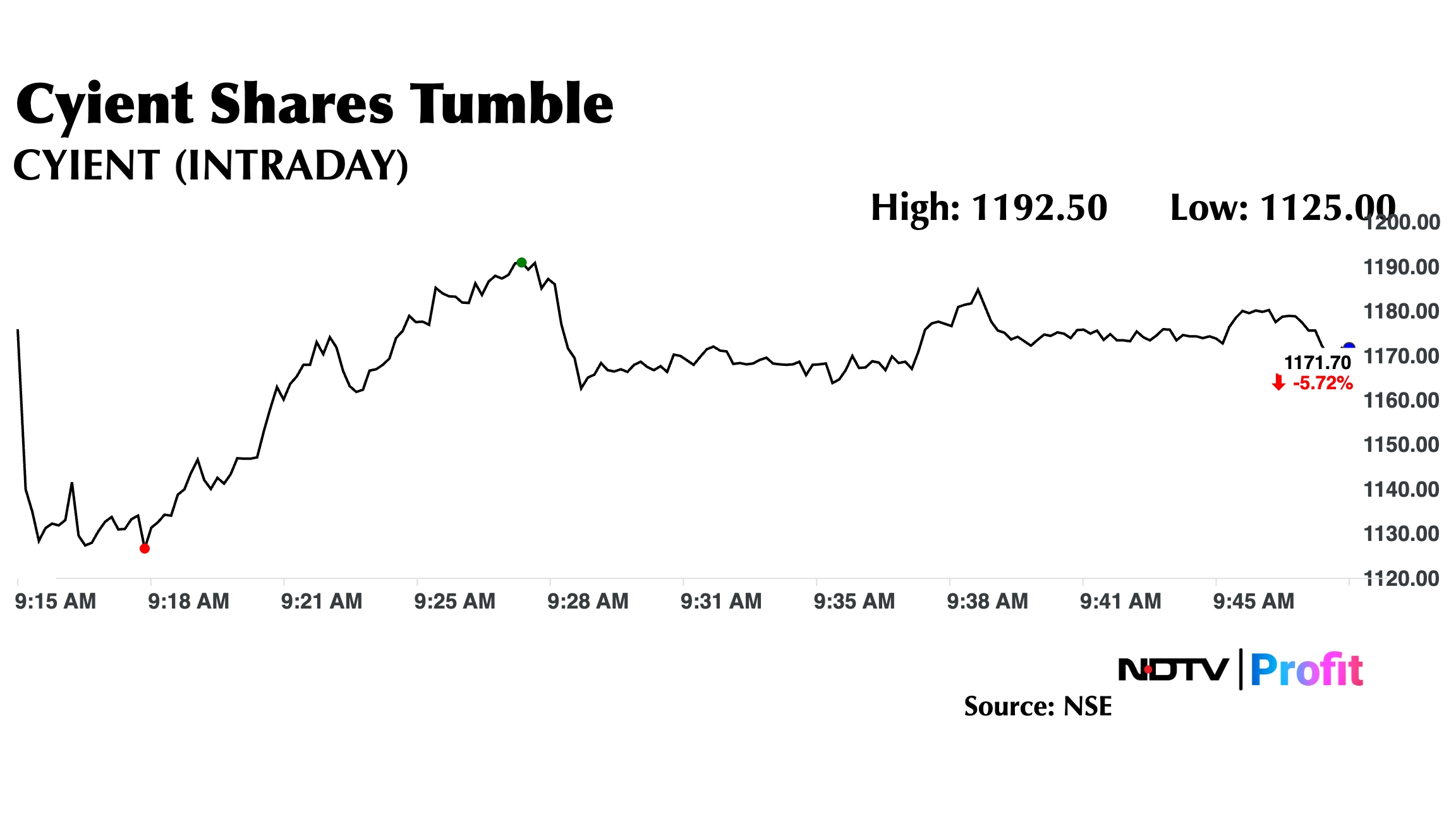

Cyient Share Price Today

The scrip fell as much as 9.48% to Rs 1,125 apiece, the highest level since April 9, 2025. It pared losses to trade 5.40% lower at Rs 1,175.70 apiece, as of 9:47 a.m. This compares to a 0.3% decline in the NSE Nifty 50 Index.

Share price has fallen 36.16% on a year-to-date basis, and is down 38.72% in the last 12 months. Total traded volume so far in the day stood at 4.17 times its 30-day average. The relative strength index was at 58.15.

Out of nine analysts tracking the company, seven maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.