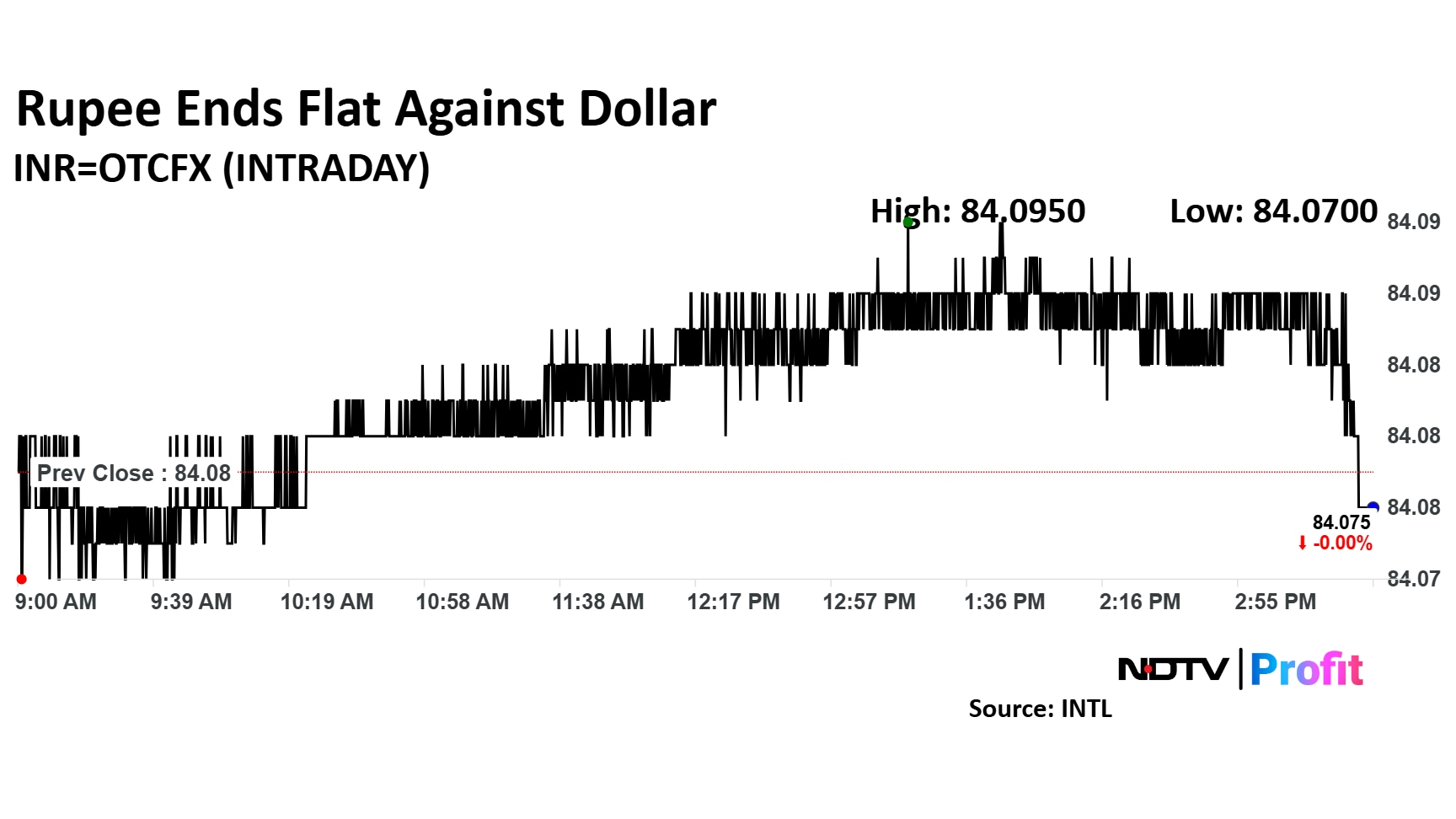

The Indian rupee closed little changed against the US dollar on Thursday, recovering from an all-time low it hit during the day.

The local currency ended the trading session at Rs 84.0837 per dollar, compared to the previous close of Rs 84.086, as per Bloomberg data. Intraday, it hit a record low of 84.1.

The relief to the domestic currency came after intervention by the central bank. Public sector banks have been selling dollars on behalf of the Reserve Bank of India to support it near the 84.09 level, Informist reported citing forex dealers.

"The rupee has been trading below Rs 84 for the majority of October, but the recent pressure is primarily due to domestic factors, notably the month-end dollar demand from oil importers," said Amit Pabari, managing director of CR Forex Advisors.

"However, upcoming IPO inflows may offer the domestic currency some relief as companies like Swiggy Ltd., Acme Solar Holdings Ltd., and Sagility Ltd. prepare to raise funds next week," he said.

As a result, Pabari anticipates the dollar-rupee pair to trade in a tight, narrow range of Rs 83.80-84.20, with RBI interventions offering critical support to prevent any significant downside.

The dollar index, which gauges the relative performance against a basket of six currencies, fell below 104 level. Yield on the US 10-year bond rose 2 bps to 4.28%.

A weaker-than-expected outcome in US employment data could exert downward pressure on the dollar, Pabari said. The dollar index could trend towards 102 in the medium term, with a long-term target around 100.

Meanwhile, growing optimism over US fuel demand following an unexpected drop in inventories and reports that OPEC+ may delay a planned output increase in December by a month or so led to a 0.5% increase in Brent crude prices to $72.9 per barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.