The rupee opened stronger on Friday as the inclusion of Indian government bonds in the JPMorgan emerging markets index began.

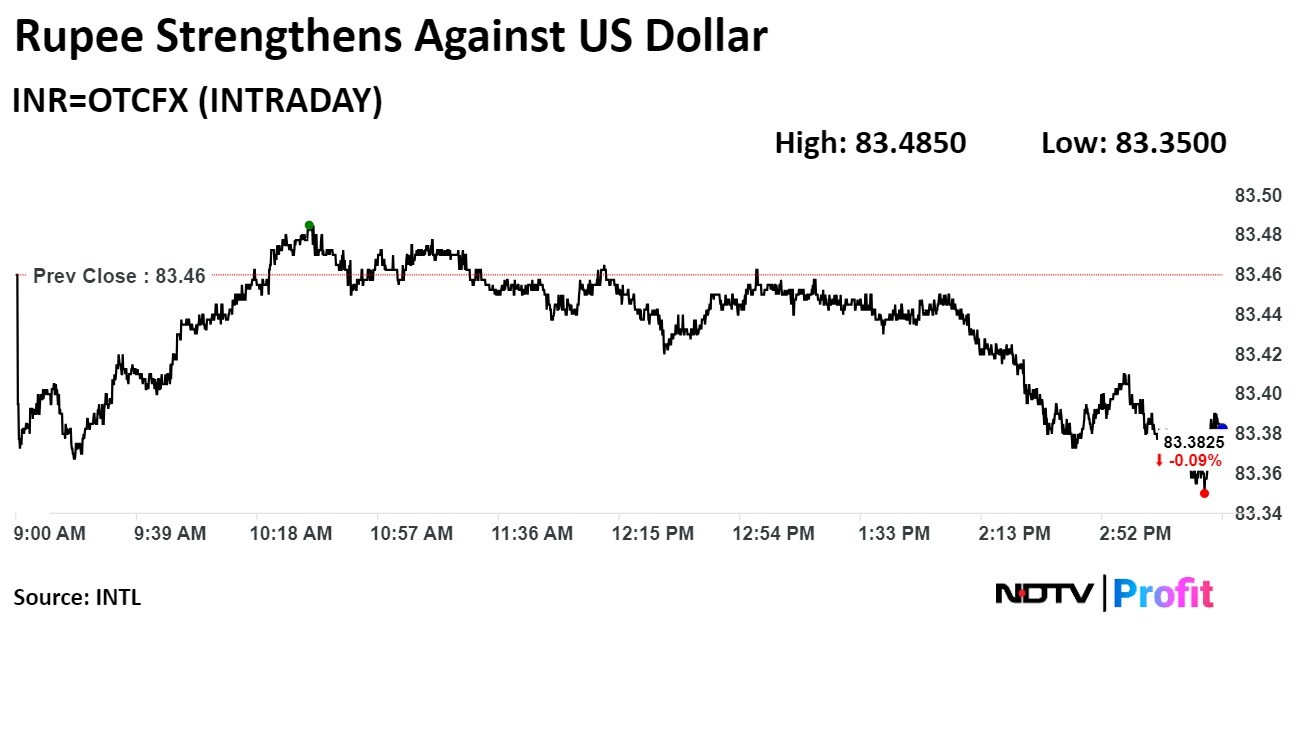

The local currency appreciated by 7 paise to close at Rs 83.39 against the greenback. It opened at Rs 83.40, according to Bloomberg. It had closed at Rs 83.46 on Thursday.

JPMorgan Chase & Co. had announced a landmark decision to include the domestic gilts in its benchmark emerging market index on June 28. Since then, global funds have poured $11 billion into the domestic debt market.

India is predicted to have the maximum weight of 10% in the index. With an inclusion of 1% weight per month, the addition of the gilts will be staggered over a 10-month period, starting June 28 through March 31, 2025. The inclusion is expected to bring in upwards of $20 billion of foreign investments over the next few months. Currently, 23 Indian government bonds with a total nominal value of $330 billion are index-qualified.

Calling it a "golden day for India", Anil Bhansali, executive director at Finrex Treasury Advisors LLP, expects that exporters would wait to sell dollars, while importers would buy dollars at the dips.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.