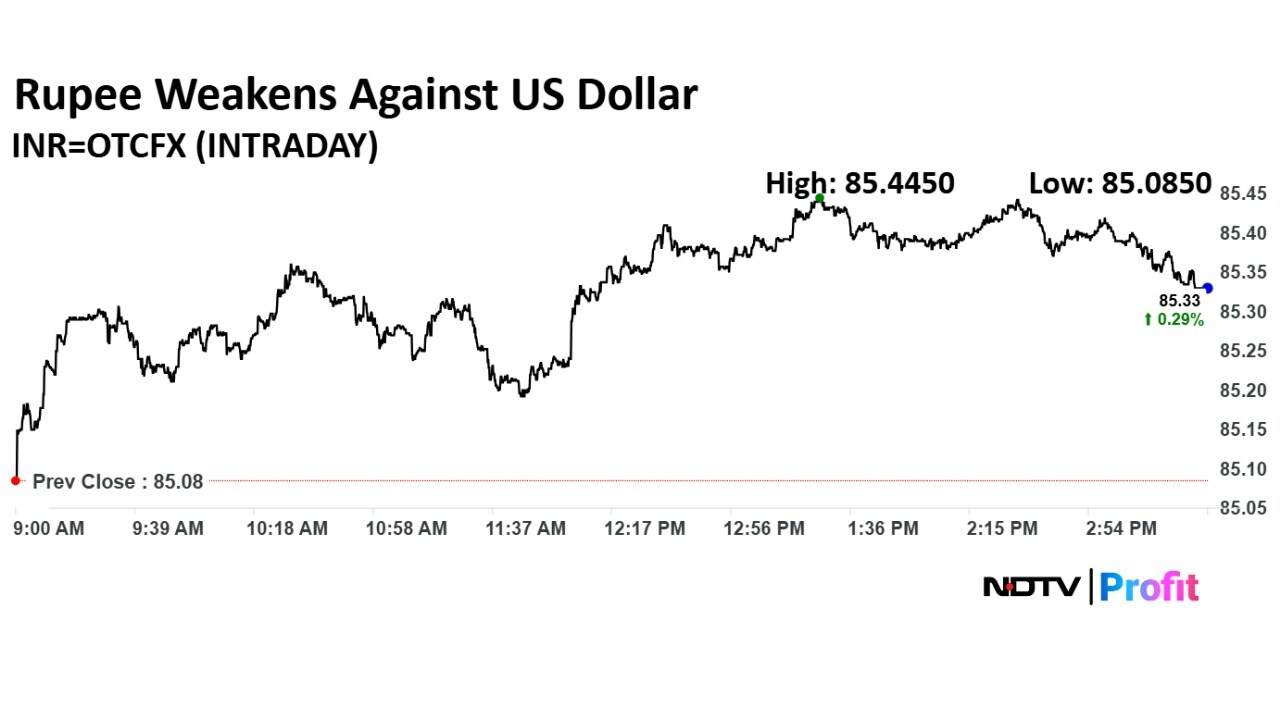

The Indian rupee weakened by 25 paise to close at 85.34 against the US dollar on Tuesday, in comparison to its previous close of 85.09 on Monday. This significant depreciation comes amid various global and domestic economic factors influencing the currency markets.

The domestic currency opened five paise weaker at 85.14 against the US dollar but fell 30 paise during the afternoon trade on the back of decline in Indian equities and strong dollar index.

The dollar index was facing pressure after US President Donald Trump gave the European Union an extension for the tariffs until July 9. However, the dollar index was up to 99.359 during afternoon trade in comparison to 98.934 at previous close.

"The Dollar Index continues to trade below 99.00 level and is acting as a tailwind for the Rupee," said Amit Pabari, managing director at CR Forex Advisors. "However, speculation of an RBI rate cut in the upcoming MPC meeting, fuelled by softening food and energy prices, is also weighing on short-term rupee sentiment as the bond yields are trending on a downtrend causing the yield differential to narrow down."

Additionally, Brent oil prices rose to $65.12 in early Asia trade as market participants weighed the possibility of an OPEC+ decision to further increase its crude oil output at a meeting later this week.

According to him, the rupee will face a strong resistance near 85.50 levels, while the immediate support would be 84.80-84.90. "A breach below this support could pave the rupee's path towards 84.50 levels," he added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.