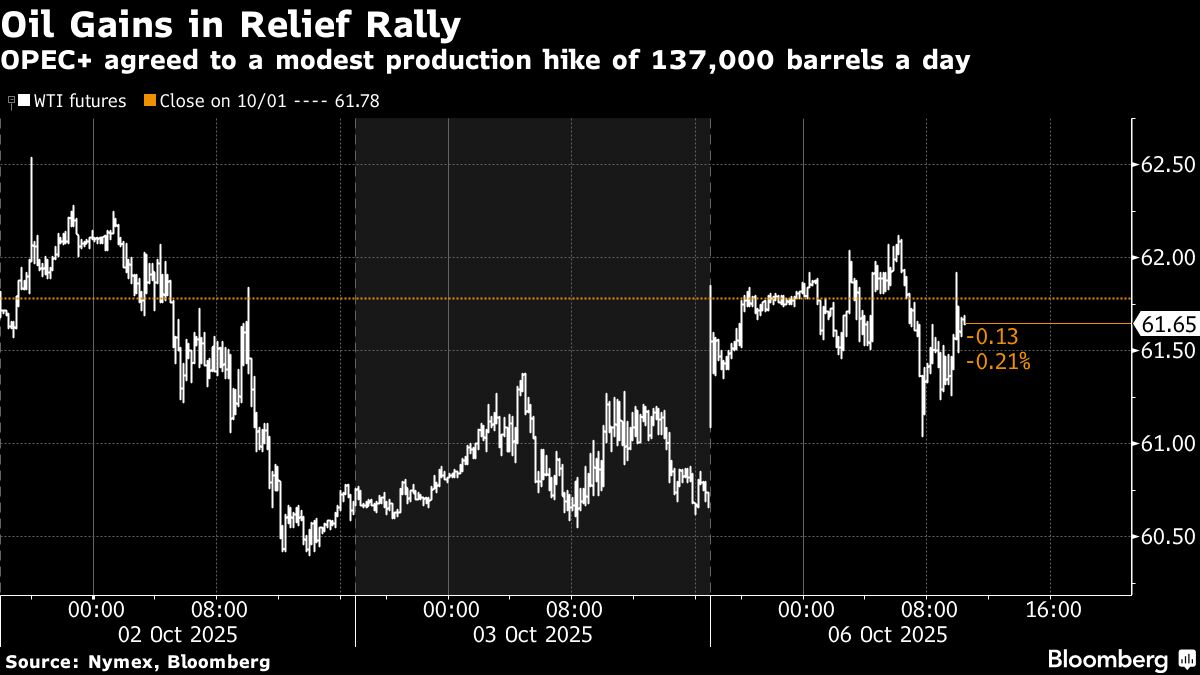

Oil gained after OPEC+ agreed to raise production by a modest amount, staving off traders' fears of a super-sized increase.

West Texas Intermediate topped $61 a barrel, following a 7.4% slump last week. On Sunday, the Organization of the Petroleum Exporting Countries and partners including Russia backed a 137,000-barrel-a-day increment, well below some of the possible figures reported before the decision.

Prices also got a boost after Reuters reported that Russia's Kirishi oil refinery halted its most productive unit, CDU-6, following a drone attack and fire on Oct. 4. Traders have honed in on Russian flows over recent weeks amid intensifying Ukrainian attacks on the country's energy infrastructure.

“Crude futures could be solidifying a low near the $60 a barrel area for WTI,” said Dennis Kissler, senior vice president for trading at BOK Financial. Kissler cited strikes from Ukraine against Russian oil infrastructure and the modest OPEC increase.

On Monday, Saudi Arabia kept the price for its main crude oil grade to Asia unchanged. While that was lower than the 30-cents-a-barrel hike expected in a Bloomberg survey of refiners and traders, a collapse in Middle Eastern oil prices last week had some market participants expecting a cut as supplies swell.

Crude has fallen this year on concern global output will top demand over the next few months. The International Energy Agency has forecast a record annual surplus for 2026, and many Wall Street banks have predicted lower prices.

The latest decision from OPEC+ came despite an earlier difference of position between co-leaders Saudi Arabia and Russia. Ahead of the session, which lasted just nine minutes, Moscow had favored an adjustment that would help to defend prices, according to two people. Still, Riyadh — more mindful of market share — indicated it supported a larger rise, one of the people said.

OPEC+ has been progressively unwinding supply restraints over recent quarters in a bid to reclaim market share from drillers outside the alliance. The group initially agreed to bring back a 2.2-million-barrel-a-day tranche of halted output in stages, and then followed up by tackling another layer of curbed production. Still, actual increases in output have lagged behind headline figures.

“Balances have shifted decisively into surplus after a period of tightness that began in mid-2024 through 2025,” said Susan Bell, an analyst at Rystad Energy AS. “Supply is only moving in one direction, and with demand weakening, the remainder of 2025 will be a one-two punch for crude prices.”

Prices:

WTI for November delivery gained 0.8% to $61.39 a barrel at 11:12 a.m. in New York.

Brent for December settlement added 1% to $65.19 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.