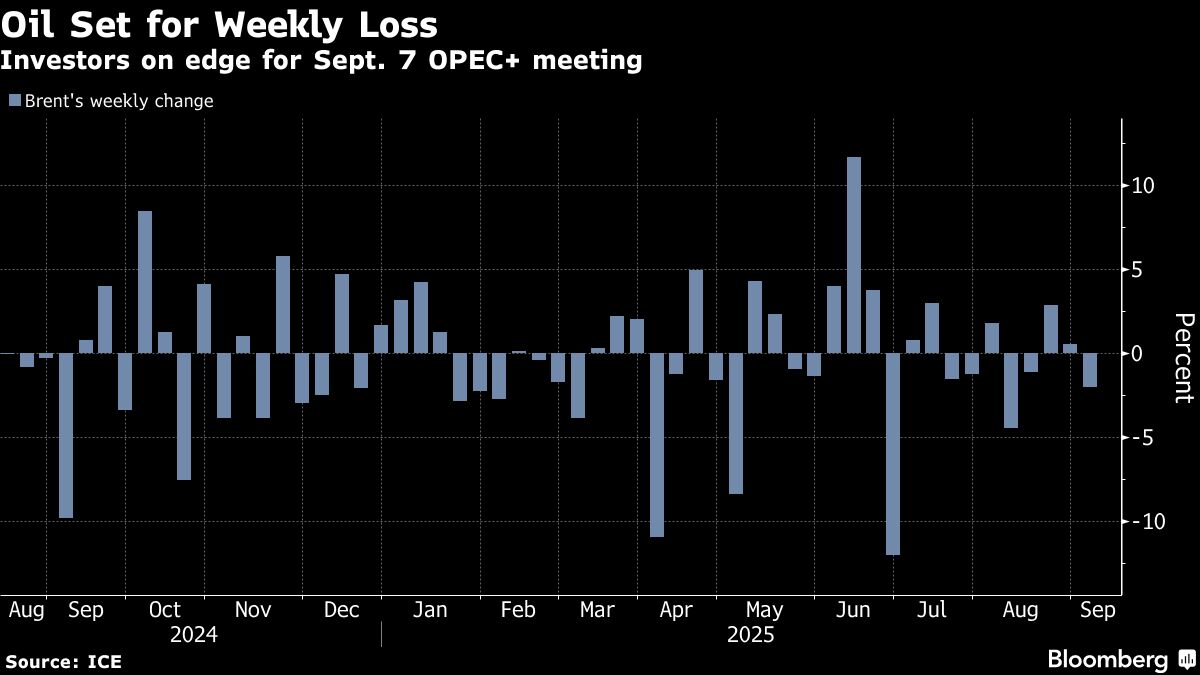

Oil fell for a third day, heading for a weekly decline ahead of an OPEC+ meeting that may see the group sign off on another supply hike.

Brent fell toward $66 a barrel after losing more than 3% over the prior two sessions, while West Texas Intermediate was near $63. The alliance is due to hold a virtual meeting on Sept. 7 to decide the next move after completing the restoration of 2.5 million barrels a day of supply at its previous gathering.

“The oil market will remain on edge,” ANZ Group Holdings Ltd. analysts including Daniel Hynes said in a note. “Expectations are growing that the group will continue to push more barrels into the market in an effort to gain market share lost to US shale producers in recent years.”

Brent crude futures have retreated by 11% this year after the shift by OPEC+ — coupled with supply increases by drillers outside the group — exacerbated concerns about a global glut. Market sentiment has also been weighed down by growing worries over energy demand, driven in part by the impact of trade tariffs introduced by the Trump administration.

Oil ended lower on Thursday after a US government report showed a build in nationwide crude stockpiles, including a rise of 1.6 million barrels at the key storage hub at Cushing, Oklahoma, that was the biggest increase since March. Refinery runs, meanwhile, held at the lowest level since July.

Prices:

Brent for November settlement fell 0.3% to $66.79 a barrel at 8:28 a.m. in Singapore. Prices are 2% lower this week.

WTI for October delivery slipped 0.3% to $63.29 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.