Shares of Container Corporation of India Ltd. fell over 4% on Friday after its fourth quarter margins contracted.

The logistics service provider posted a 3% rise in standalone net profit to Rs 302.1 crore in the fourth quarter in comparison to Rs 294.54 crore reported in the same quarter of the previous fiscal. However, Concor's revenue fell 1.6% to Rs 2,281.4 crore in the fourth quarter, according to an exchange filing on Thursday.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 11% year-on-year to Rs 433.46 crore. The Ebitda margin narrowed 110 points to 19% from the earlier 21.1%.

The 'Navratna' company also approved issuance of bonus equity shares in the ratio 1:4.

Container Corp. Announces Dividend

The company's board has also declared a final dividend of Rs 2 per equity share of face value of Rs 5 each for the year. The final dividend adds to the first interim dividend of Rs 2 per share, the second interim dividend of Rs 3.25 per share and the third interim dividend of Rs 4.25 per share already paid during the year.

The final dividend is subject to approval of shareholders at the ensuing 37th Annual General Meeting. The record date to determine the shareholders who will be eligible to receive the final dividend is June 6.

The payment of final dividend, if approved by the shareholders will be completed with 30 days from the AGM.

Container Corp. Announces Bonus Shares

The issuance of bonus shares is subject to the approval of shareholders through postal ballot and other approvals as applicable. The company will inform the record date for determining the entitlement of the shareholders to receive bonus shares in due course.

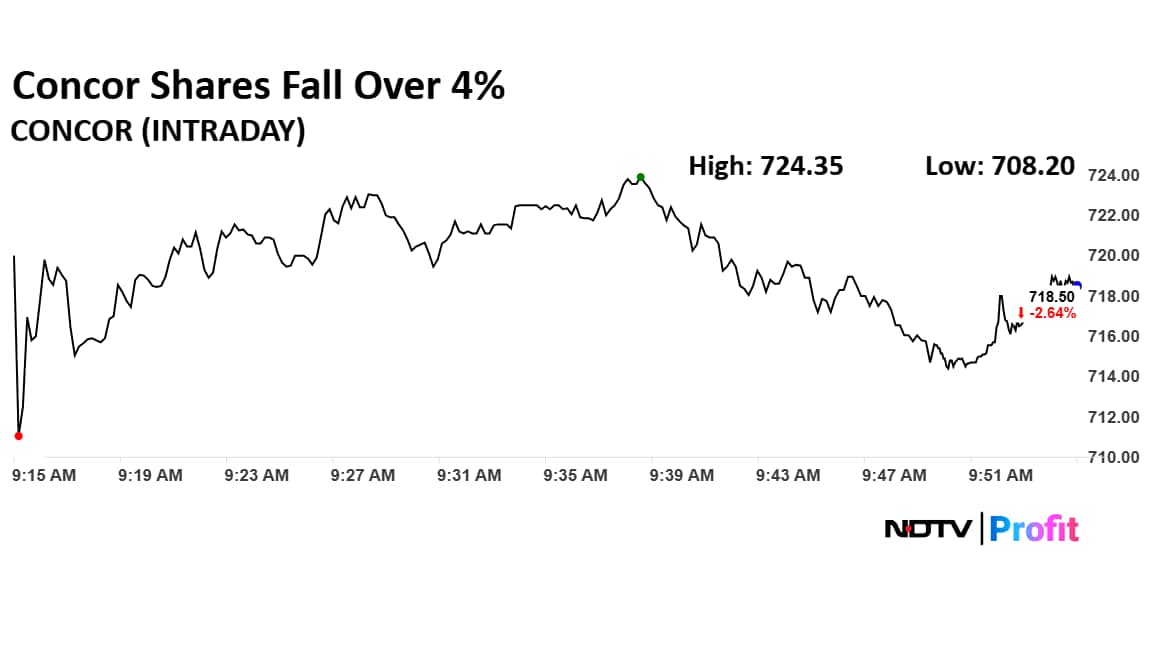

Concor Shares Decline

Shares of Container Corp. fell as much as 4.03% to Rs 708.20 apiece, the lowest level since May 16. It pared losses to trade 3% lower at Rs 715.75 apiece, as of 9:50 a.m. This compares to a 0.71% advance in the NSE Nifty 50.

The stock has fallen 35.29% in the last 12 months and 9.19% year-to-date. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 50.33.

Out of 21 analysts tracking the company, 11 maintain a 'buy' rating, three recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.