- Shares of Clean Science hit a 52-week low after a broker sold twice the offered equity

- Promoter sold shares via large trades with Avendus Spark selling extra shares in market

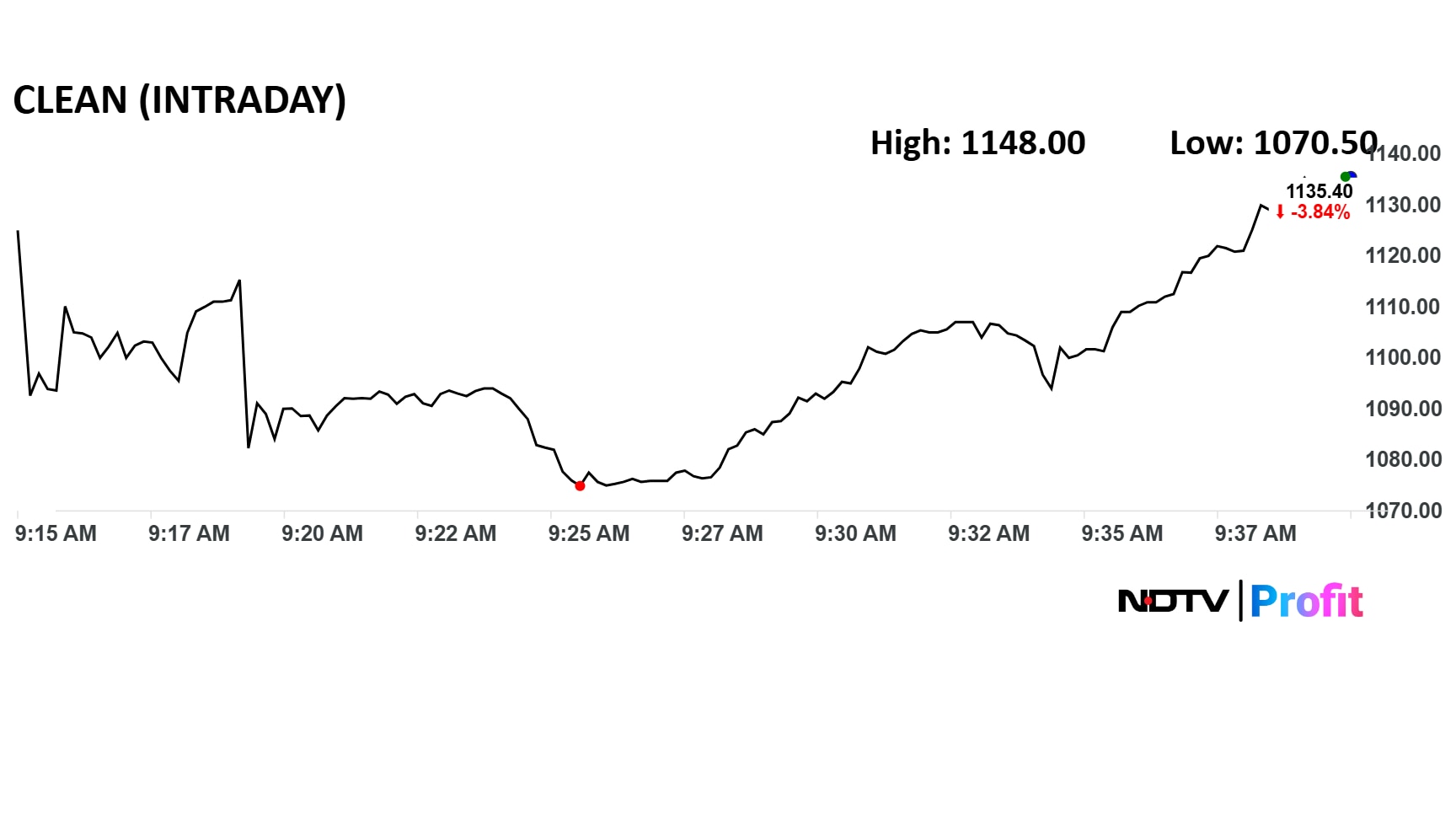

- Share price declined 9.3% intraday to Rs 1,070.5 on NSE with high trading volume

Shares of Clean Science and Technology Ltd. hit a 52-week low on Thursday after a broker to a block deal erroneously sold twice the equity on offer. The promoter sold equity via large trades.

The dealer to the transaction, Avendus Spark sold extra shares in the open market. Sources told NDTV Profit that the broker will compensate for the extra shares sold in the trade.

Around 90 million shares were traded in block deals compared to 25.5 million (24% equity) planned.

The floor price of the offer was Rs 1,030 apiece, a nearly 13% discount to Wednesday's closing price, according to Bloomberg. The promoter stake is 74.97% as of June.

Clean Science share price declined 9.3% intraday to Rs 1,070.5 apiece on the NSE. The benchmark Nifty 50 was up 0.07%.

Avendus Spark said in a statement that they are "reviewing the facts with utmost priority and remain fully committed to addressing this matter responsibly and in line with the highest standards of governance".

Clean Science share price declined 9.3% intraday to Rs 1,070.5 apiece on the NSE.

The total traded volume so far in the day stood at 6,343 times its 30-day average. The relative strength index was at 31.

On the BSE, the total traded value was Rs 6,953 crore.

The stock has fallen 19% in the last 12 months and 26% on a year-to-date basis.

Eight out of the 14 analysts tracking Clean Science have a 'buy' rating on the stock, two recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside/downside of 35%.

Company Issues Clarification

The company in an exchange filing near market close posted that:

Significantly Higher Sell Orders Were Placed Due To Error From Spark Institutional's End

Promoters Sought To Sell Up To 24% Stake Via Certain Brokers Including Spark Institutional

Promoters Confirm Actual Sale Of Nearly 24% Stake

Promoters Awaiting Detailed Explanation From Broker Spark Institutional

Clean Science pays the price for Avendus Spark's mistake

August 21, 2025

A double block deal from #CleanScience rattled investors, pushing the stock down. It later turned out to be a mistake by broker #AvendusSpark.@_nirajshah explains the costly mistake.

Read: https://t.co/ePBSIxn1AM pic.twitter.com/iaxtCBXbL6Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.