Cipla Ltd.'s third-quarter profit missed estimates as its depreciation costs doubled.

Net profit rose 6.9 percent year-on-year to Rs 400 crore for the quarter ended December, according to the company's exchange filing. That compares with the Rs 460 crore estimated by analysts tracked by Bloomberg.

Cipla received a tax credit of Rs 64.2 crore compared to a tax expense of Rs 128.3 crore in the year-ago quarter. The company's bottom line was impacted by a 103 percent surge in depreciation costs, which stood at Rs 522 crore.

Revenue rose 11 percent to Rs 3,914 crore. That compares with the estimate of Rs 4,116 crore.

Earnings before interest, tax, depreciation and amortisation rose 20.9 percent to Rs 818.6 crore, marginally below the estimates of Rs 836 crore. Ebitda margin expanded 230 basis points to 20.9 percent, indicating improved operational performance. It was ahead of the estimated 20.3 percent.

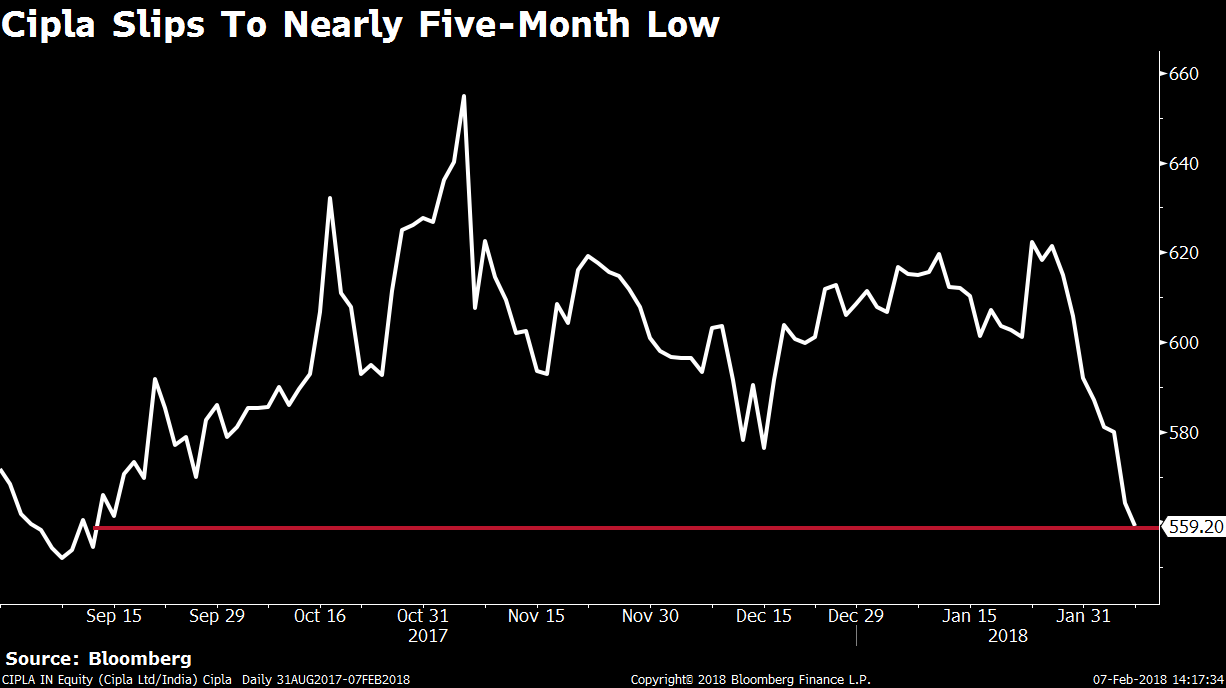

Shares of Cipla fell as much as 1.78 percent to a five-month-low of Rs 554.2 after the results were announced. That compared with a 0.6 percent rise in the Nifty Pharma Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.