Shares of Central Depository Services Ltd. fell to eight-month low on Tuesday as new demat accounts declined in February.

A total of 19.04 crore accounts were registered in February with CDSL and its peer NSDL, while 18.81 crore accounts were registered with them in January. This indicates that 22.61 lakh new accounts were added in the last month. This is 48% lower than the new accounts added in February last year.

The demat account additions had peaked in January last year. The decline comes on the back of a volatile market.

The benchmark NSE Nifty 50 and the BSE Sensex have fallen 16.2% and 15.4%, respectively, from the previous peak, triggering the worst fall since 2020. In February, Nifty also posted its longest monthly losing streak in nearly three decades.

The broader markets also posted their worst decline since March 2020. Nifty Midcap 100 and Nifty Smallcap 100 indices have fallen 15.67% and 20.87%, respectively, this year.

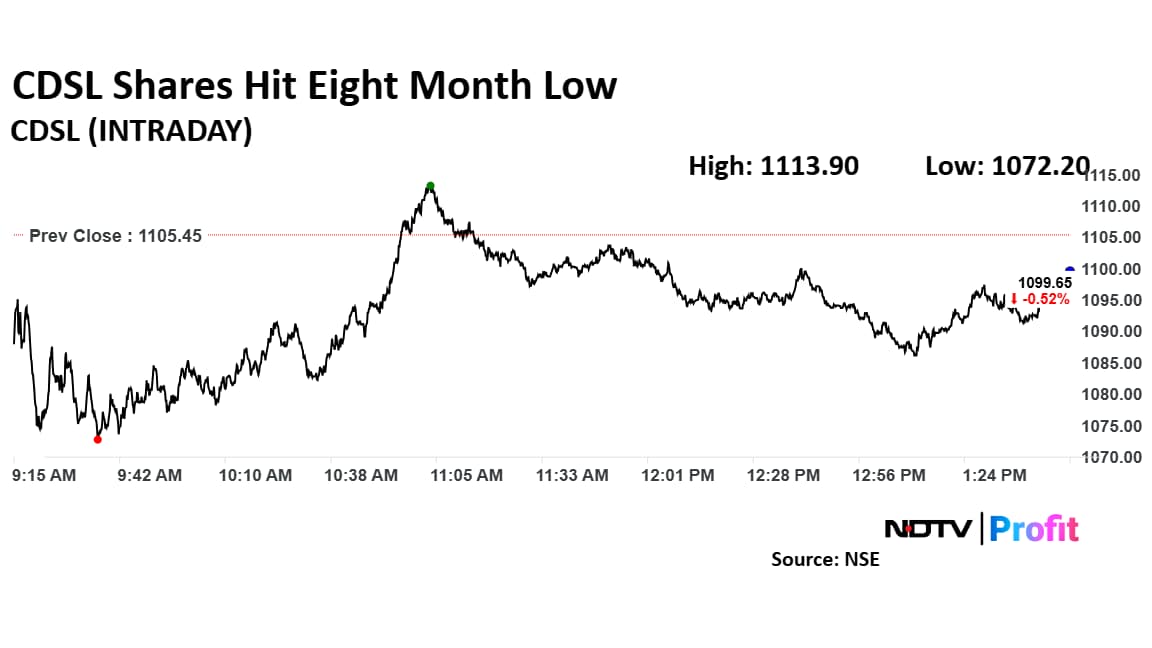

CDSL Shares Decline

The shares of CDSL extended their fall for the third session as they fell as much as 3.17% to Rs 1,072.20 apiece, the lowest level since June 2024. The stock pared losses to trade 1.89% lower at Rs 1,086.40 apiece, as of 1:45 p.m. This compares to a 0.09% advance in the NSE Nifty 50 Index.

It has risen 20% in the last 12 months and 19.46% year-to-date. The relative strength index was at 31.

Out of 10 analysts tracking the company, two maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.