- CarTrade called off its proposed deal with Girnar Software for automotive classifieds consolidation

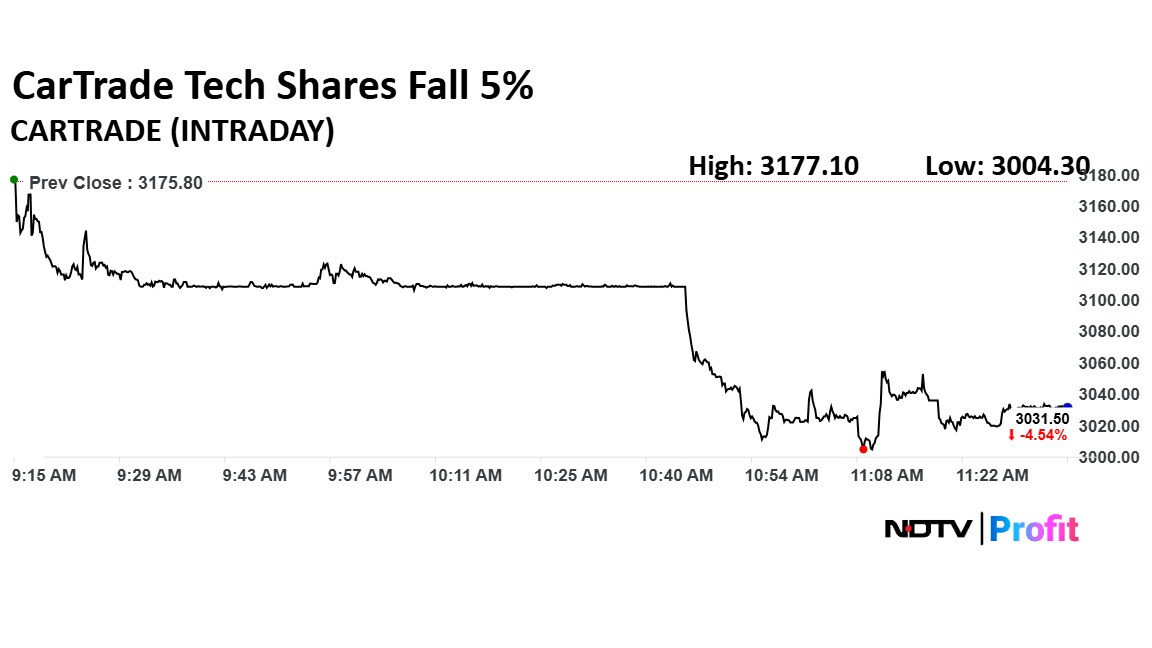

- Shares of CarTrade fell over 5% following the announcement of the deal cancellation

- The deal focused only on new and used vehicle classifieds, excluding financing and insurance

CarTrade Tech Ltd. shares fell over 5% on Thursday after it called off its proposed deal with Girnar Software, the parent company of CarDekho and BikeDekho. The deal was for potential consolidation in their automotive classifieds businesses in India.

According to an exchange filing by CarTrade, both the parties have decided mutually to not proceed with the transaction at this stage.

"The Company will continue to pursue its strategic roadmap, drive product and technology innovation, and enhance value across its diversified ecosystem," CarTrade said in an exchange filing.

The talks between the companies were focused solely on the new and used automotive classifieds segments and did not include Girnar's financing, insurance, or other non-automotive businesses.

The discussions were expected to bring together two of India's leading digital automotive platforms, potentially creating a stronger presence in the online vehicle marketplace. Both companies operate in highly competitive segments, offering listings and services for buying and selling cars and two-wheelers.

CarTrade Share Price Today

The scrip fell as much as 5.40% to Rs 3,004.30 apiece on Thursday, highest since Nov. 24. It pared gains to trade 4.68% higher at Rs 3,027.20 apiece, as of 11:34 a.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has risen 134.74% in the last 12 months and 104% year-to-date. Total traded volume so far in the day stood at 0.58 times its 30-day average. The relative strength index was at 51.19.

Out of nine analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 3,071.70 implies an upside of 1.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.