Shares of BSE Ltd. fell over 9% on Wednesday to hit a four-month low after the National Stock Exchange of India shifted the monthly and quarterly expiry days of futures and options contracts of Nifty, Bank Nifty, FinNifty, Nifty Midcap Select, and Nifty Next 50 to the last Monday of the expiry month.

The changes will take effect from April 4, according to a circular released by the NSE on Tuesday. Currently, the F&O expiry day falls on the last Thursday of the expiry month.

NSE has also shifted the expiry days of Nifty weekly contracts to Monday from Thursday. In addition, the exchange has also moved the expiry days of Nifty half-yearly contracts to Monday from Thursday.

"There is no other change in the contract specifications of index and stock derivatives," NSE said, adding the settlement schedule will be intimated separately by Clearing Corporations.

The move by NSE could have an impact on the volumes on BSE on the trading days of Monday and Friday.

The rejig in the F&O contract expiry days comes after the NSE had, with effect from Jan. 1, aligned the expiry days of various contracts to Thursday.

Till last year, the expiry day of Bank Nifty's monthly and quarterly contracts was Wednesday, and for FinNifty, it was Tuesday. For Nifty Midcap Select and Nifty Next 50, the contracts used to expire on Mondays and Fridays, respectively.

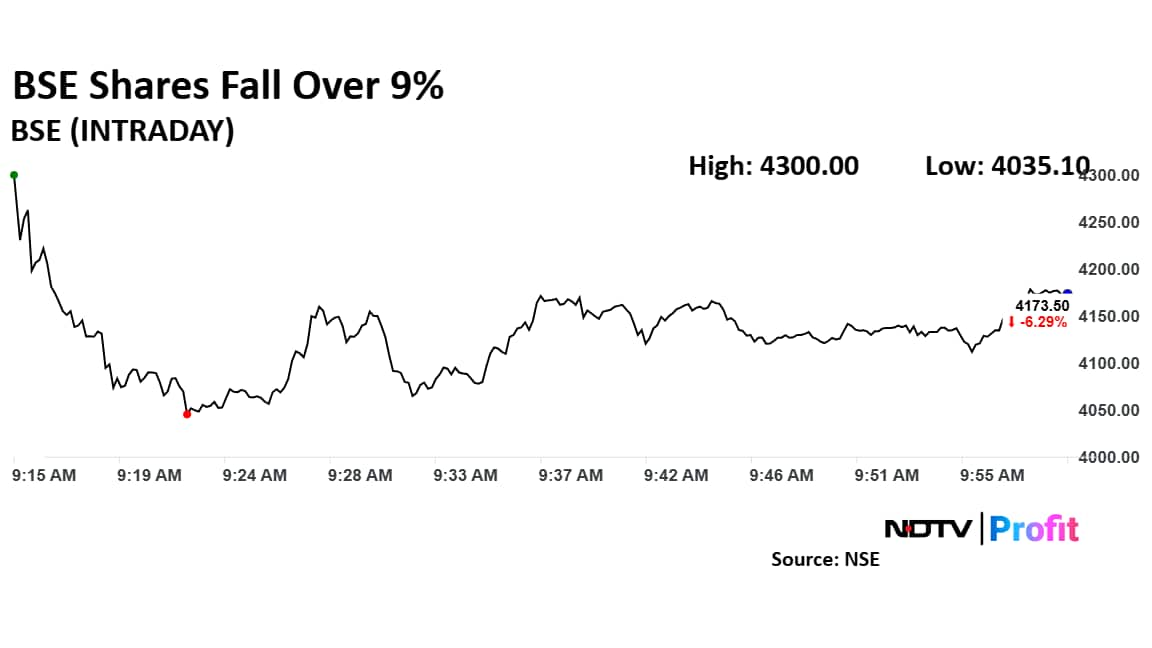

BSE Share Price Declines

BSE shares fell as much as 9.40% to Rs 4,035.10 apiece, the lowest level since Oct. 23, 2024. It pared losses to trade 5.16% lower at Rs 4,231 apiece, as of 10:12 a.m. This compares to a 0.71% advance in the NSE Nifty 50.

The stock has risen 84.28% in the last 12 months. Total traded volume so far in the day stood at 5.6 times its 30-day average. Relative strength index was at 32.

Out of 11 analysts tracking the company, eight maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 48.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.