(Bloomberg) -- Brevan Howard Asset Management has grounded some of its traders to stem losses after the collapse of Silicon Valley Bank triggered wild moves in the bond market.

The macro hedge fund firm curtailed the betting of at least three money managers after they hit maximum loss levels, according to people with knowledge of the matter. The traders all specialized in rates trading, the people said, asking not to be identified because it's private.

Large hedge funds like Brevan Howard spread their money across many managers and use the loss limits to help ensure the overall performance can't be sunk by a few losing bets. The grounding of money managers is a risk management move that some firms have used in previous volatile times so they can analyze trades or unwind them.

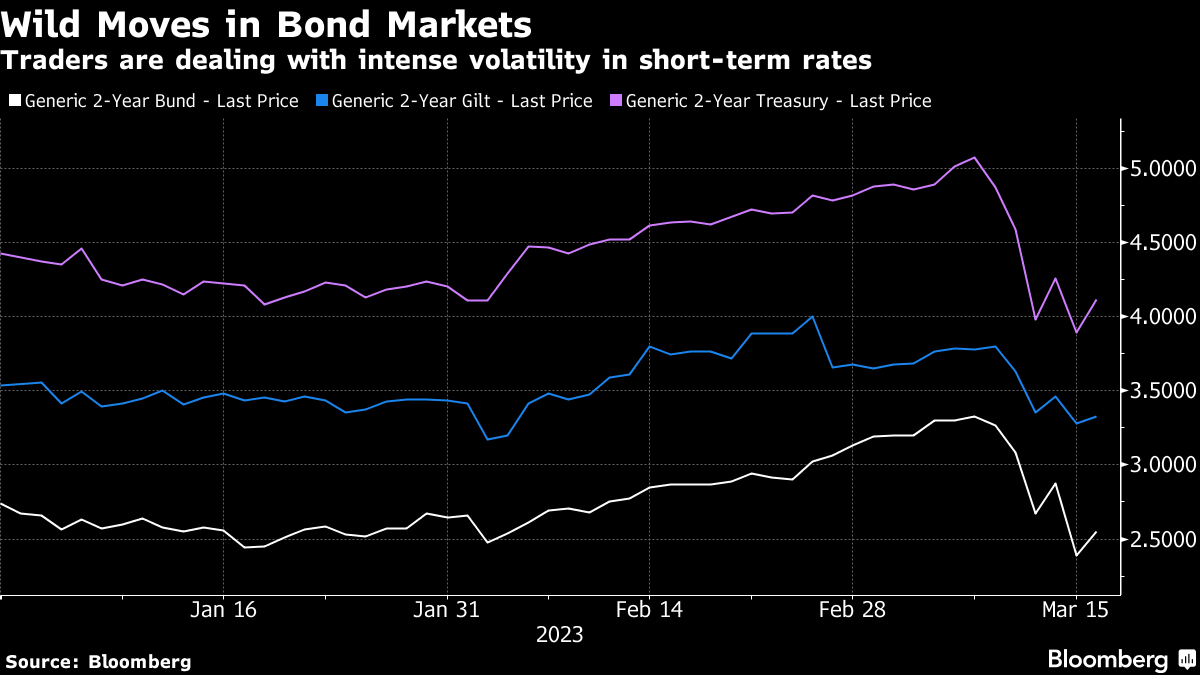

Volatility in government bond yields have been especially hurting trades tied to short-dated rates after the collapse of SVB prompted market participants to reassess whether central banks will change or stick to their current monetary policy strategies.

Read more: Rate-Hike Bets Evaporate as Global Bonds Surge Amid Bank Turmoil

A representative for the Jersey, Channel Islands-based Brevan Howard, which manages more than $30 billion, declined to comment.

In a similar move in late 2021, Balyasny Asset Management, BlueCrest Capital Management and ExodusPoint Capital Management each grounded two to four traders after they suffered losses when government bond yields abruptly moved against them.

Brevan Howard is among macro hedge funds that have given up earlier gains this year. Its flagship Master Fund lost 1.2% during the first 10 days of March, bringing the fund to a year-to-date loss of 0.4%, according to an investor document seen by Bloomberg.

Energy hedge fund Westbeck Capital Management has also cut the amount of risk it is taking after hitting the strategy's maximum loss limit on Wednesday, according to an investor document seen by Bloomberg.

The hedge fund has lost 8.9% this month and is down 9.9% this year, according to the letter.

“The extraordinary volatility in the fixed income markets has triggered a severe oil market correction,” Westbeck told clients in the letter. “We understand the collapse in treasury yields over the recent days has translated into large losses for a number of macro players, creating a VAR shock, forcing widespread risk liquidation including large oil positions.”

A spokesman for London-based Westbeck declined to comment.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.