Brainbees Solutions, the parent company of FirstCry, saw its stock price surge by over 9% following the announcement of its third-quarter earnings on Saturday. The company reported significant year-on-year growth in revenue and Ebitda, alongside a substantial reduction in net loss.

Revenue for the third quarter increased by 14.3%, reaching Rs 2,172 crore compared to Rs 1,900 crore in the same period last year.

Ebitda saw a significant jump of 84.4%, rising to Rs 108 crore from Rs 59 crore. Meanwhile the Ebitda margin also showed improvement, climbing to 4.9% from 3.1%.

Meanwhile, net loss narrowed considerably to Rs 8 crore, a marked improvement from a loss of Rs 31.5 crore.

On Jan. 24, a JM Financial note pointed the stock had underperformed after giving strong listing gains post its IPO in Aug. 2024. The brokerage noted the scrip had underperformed markets and the decline had been exacerbated by the impeding pre-IPO shareholders' lock-in expiry on Feb. 13, 2025.

Brainbees Solution is a leading player in the online retail space for baby and kids' products. Founded in 2010, the company has grown rapidly, offering a wide range of products, including clothing, toys, and accessories.

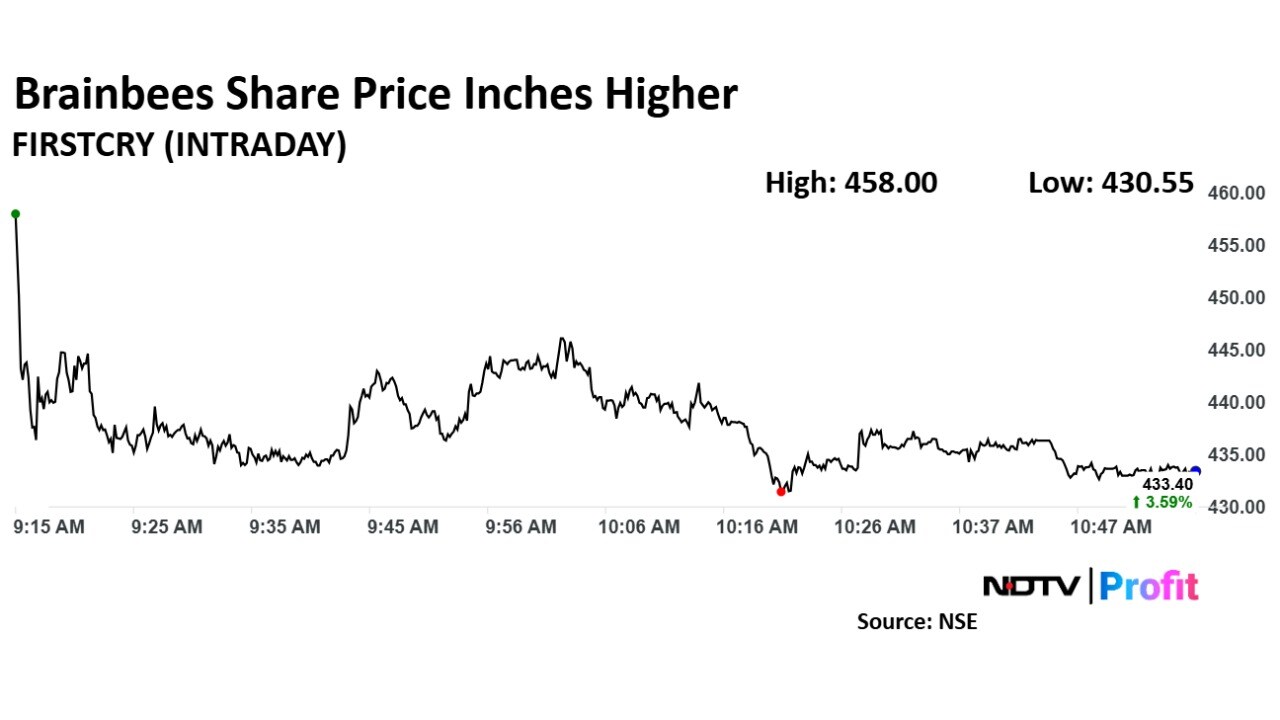

The scrip rose as much as 9.46% to Rs 458 apiece. It pared gains to trade 3.64% higher at Rs 433.65 apiece, as of 10:50 a.m. This compares to a 0.72% decline in the NSE Nifty 50 Index.

It has fallen 36.14% in the last 12 months. Total traded volume so far in the day stood at 9.7 times its 30-day average. The relative strength index was at 35.

Out of seven analysts tracking the company, six maintain a 'buy' rating and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 32.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.