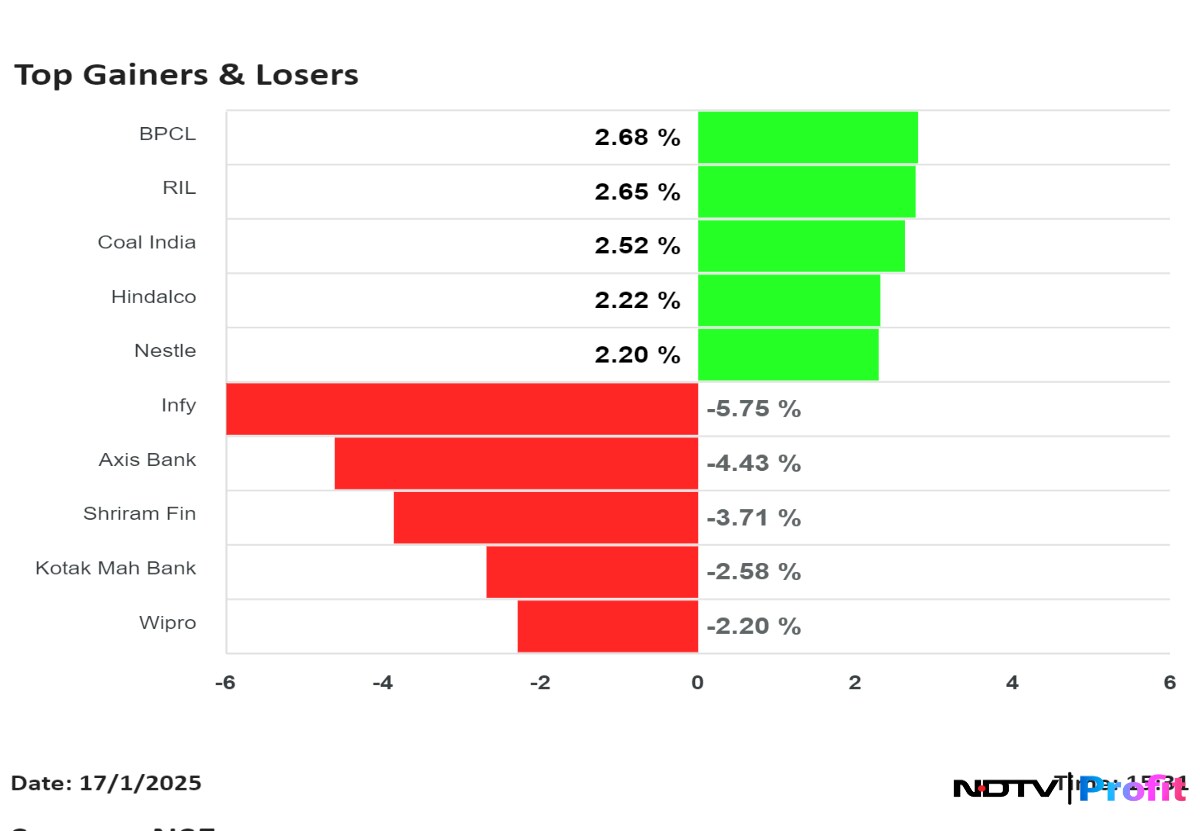

Share prices of Reliance Industries Ltd., Bharat Petroleum Corp., Coal India Ltd., Hindalco Industries Ltd., and Nestle India Ltd. were the top gainers among the NSE Nifty 50 stocks.

Among the losers were shares of Infosys Ltd., Axis Bank Ltd., Shriram Finance Ltd., Kotak Mahindra Bank Ltd., and Mahindra & Mahindra Ltd.

The Nifty and Sensex logged a second week of fall as investors assess more corporate earnings. On Friday, Nifty ended 0.47%, or 108.60 points down at 23,203.20. Sensex closed 0.55%, or 423.49 points lower at 76,619.33.

Top Gainers

Reliance Industries was the top gainer among Nifty stocks after it reported its third quarter results. Friday's rally came as a rebound in retail sales in the quarter, along with net subscriber additions for Jio Infocomm and a strong outlook on new energy business provide a strong earnings-growth visibility in the near future, according to analysts.

The stock hit Rs 1,326 per share intraday, its highest level since Dec. 5.

This was followed by Bharat Petroleum Corp., which rose after a two-session fall. Coal India, Hindalco Industries, and Nestle India were also among the top gainers and closed 2% higher.

Top Losers

Infosys fell the most among Nifty stocks on Friday. Intraday, it hit a low of Rs 1,812 apiece, its lowest since Nov. 18. The fall came even as the company raised its revenue guidance for a third consecutive time following an in-line third-quarter profit growth. Analysts also shared bullish calls on the stock.

The technology giant upped its revenue forecast in constant-currency terms for the financial year ending March 2025 to 4.5–5.0% from its earlier projection of 3.75–4.5%.

Axis Bank closed over 4% lower following its Q3 result. The stock hit its lowest level in over one year, as analysts and brokerages cut earnings estimates. The near-term growth outlook looks bleak after a rise in slippages and rising credit cost weighed on the private lender's third-quarter performance.

Shriram Finance lost around 4%, while Kotak Mahindra Bank and Wipro ended 2% lower.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.