Borosil Renewables Ltd.'s share price jumped for a fourth consecutive session to hit its highest level since Aug. 2, following Finance Ministry's decision to impose provisional anti-dumping duty on imports of the textured tempered coated and uncoated glass from China and Vietnam.

"The provisional anti-dumping duty imposed by the Ministry of Finance shall be effective for a period of six months with effect from Dec 04, 2024," the Indian solar glass product manufacturer said in an exchange filing.

Despite the presence of the domestic industry and other producers, the imports have dominated the entire market, a Ministry of Commerce and Industry report said on Nov. 5.

This clearly shows that the exporters are flooding the Indian market to drive out the domestic industry and the dumped imports are undercutting the prices of the domestic industry, and the undercutting is significantly positive during the period of investigation, the report stated.

"The subject imports have continuously caused strain on the prices of the domestic industry, as they were priced lower than the selling price of the domestic industry throughout the injury period," it said.

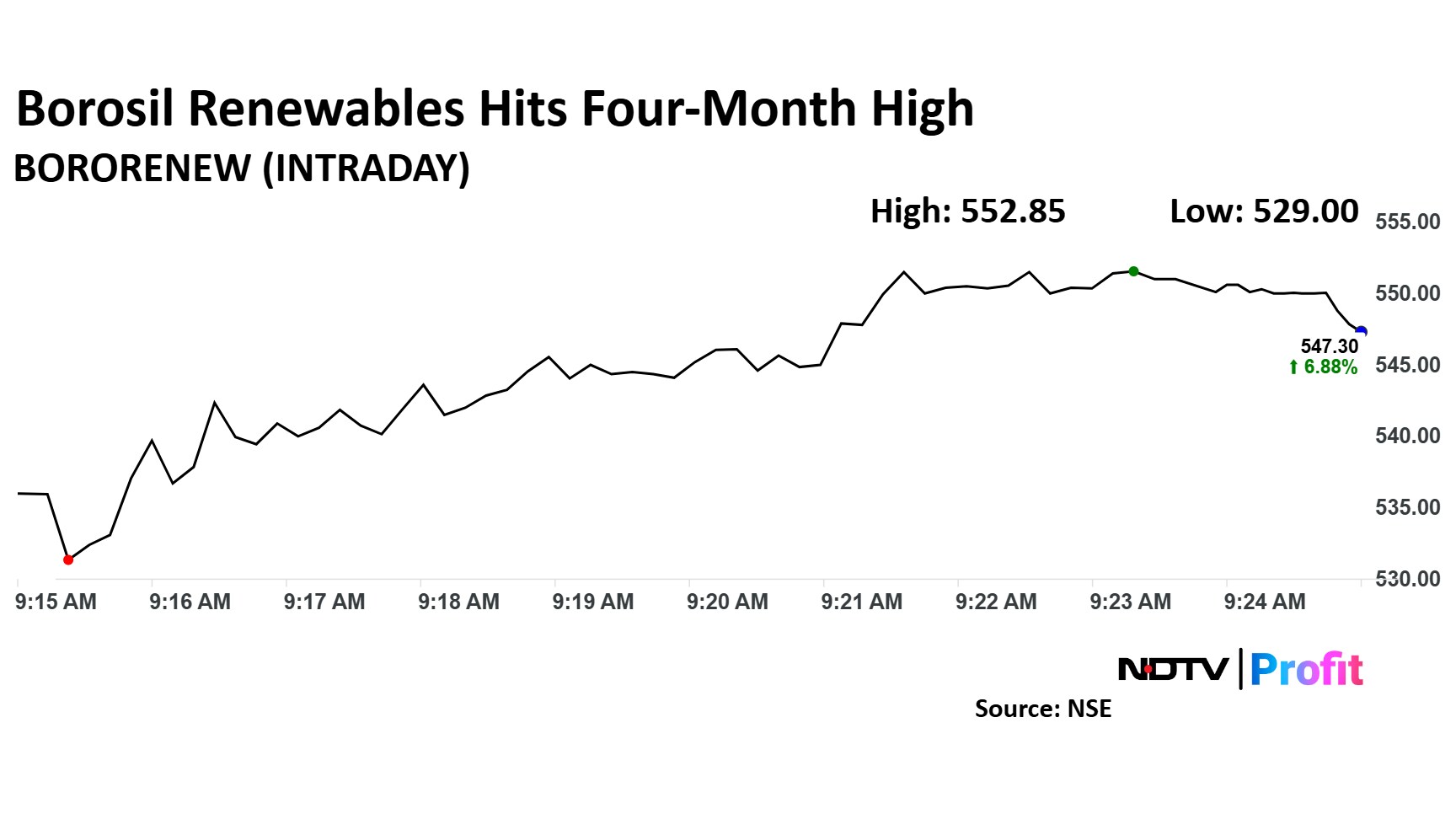

Borosil Renewables Share Price Today

Share price of Borosil Renewables rose as much as 7.97% to Rs 552.85 apiece, the highest level since Aug. 2. It pared gains to trade 5.2% higher at Rs 538.65 apiece, as of 9:46 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 22.7% on a year-to-date basis. Total traded volume so far in the day stood at 4.55 times its 30-day average. The relative strength index was at 73.44, indicating that the stock may be overbought.

Three analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.