- Shares of Samvardhana Motherson and Motherson Sumi Wiring went ex-trade for bonus shares on Friday

- Bonus shares are issued in the ratio of 1:2, one bonus share for every two held

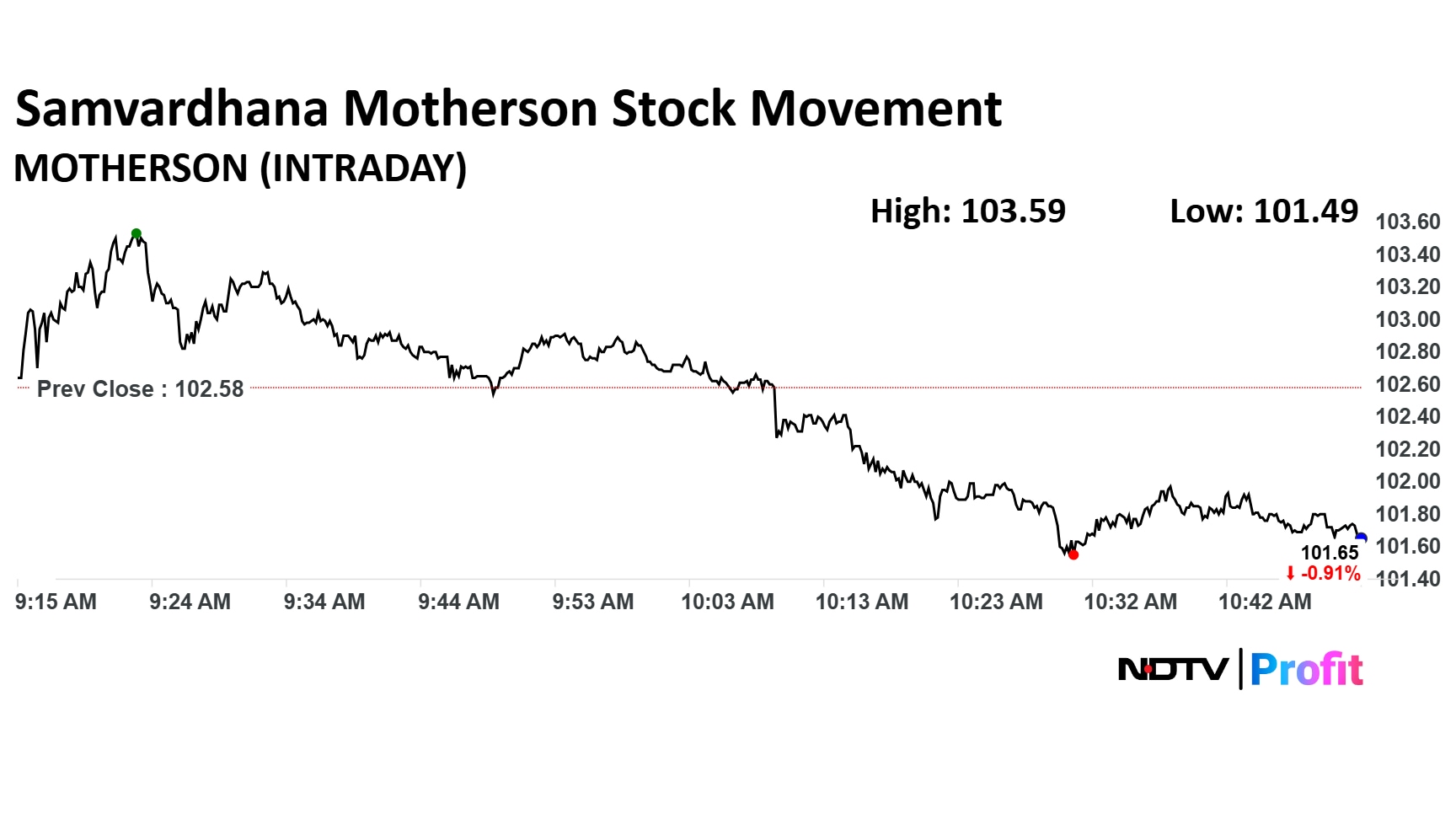

- Samvardhana Motherson shares fell 0.9% to Rs 101.65 with double average trading volume

Shares of Samvardhana Motherson International Ltd. and Motherson Sumi Wiring India Ltd. went ex-trade on Friday for their bonus issue of shares.

The two companies have announced the issue of bonus shares in the ratio of 1:2. This means one bonus equity share will be given for every two equity shares held.

A bonus issue is the distribution of free shares to eligible shareholders. The share price adjusts in the ratio of the bonus allotment on ex-date. However, this does not affect the overall value of holdings.

The company announces the ex/record date in advance, and only those who hold the shares in their demat account as of this record date will be eligible for the bonus allotment.

Shares of Samvardhana Motherson were down 0.9% at Rs 101.65 as of 11:00 a.m.

After initially rising, shares of Samvardhana Motherson dipped 0.9% at Rs 101.65 as of 11:00 a.m. The total traded volume stood at two times the 30-day average with a turnover of Rs 64 crore, as per NSE data. The relative strength index was 48.

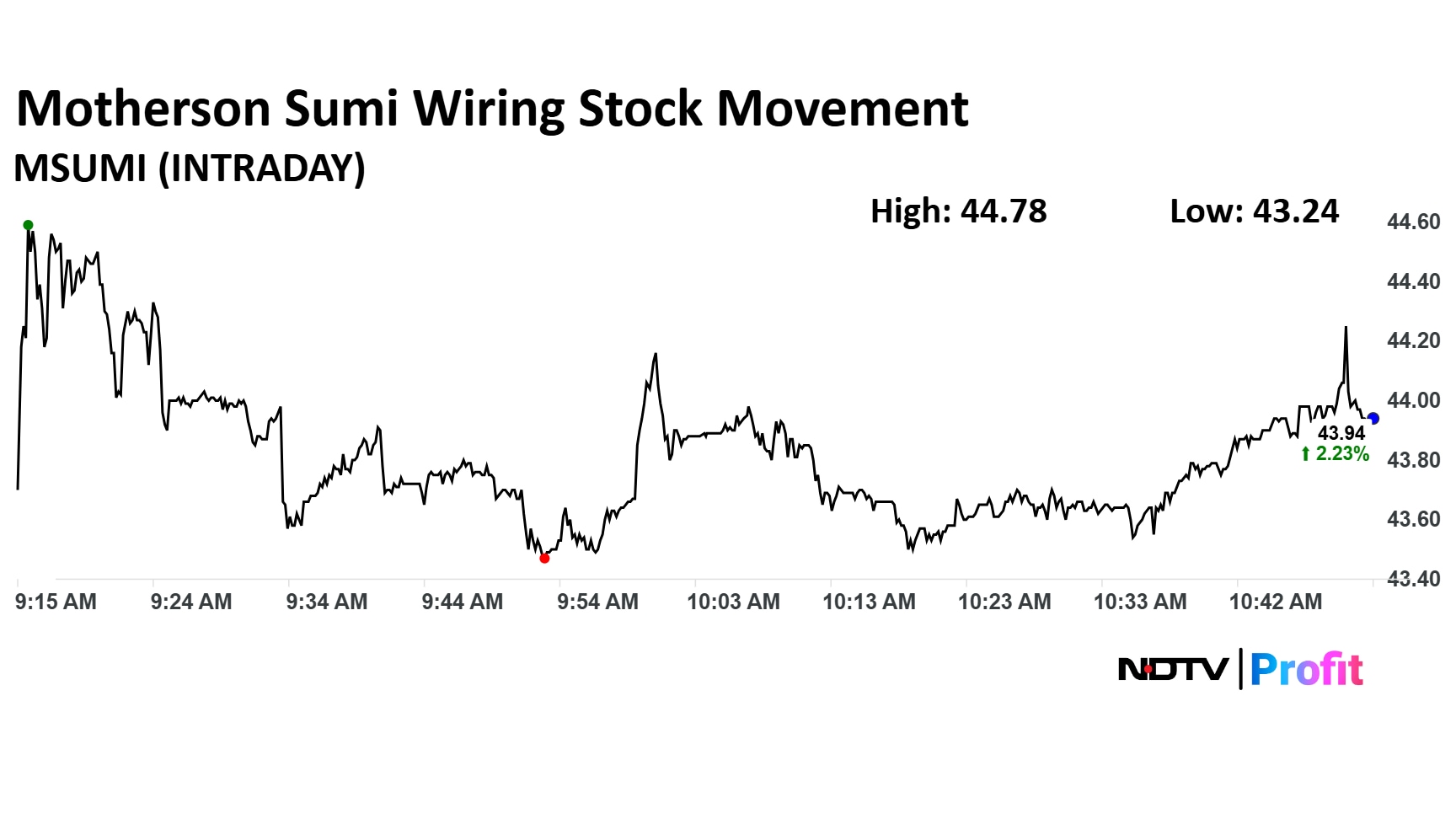

Motherson Sumi Wiring was up 2.3% at Rs 43.94. The total traded volume stood at 3.5 times the 30-day average with a turnover of Rs 28 crore. The relative strength index was 73, indicating the stock is overbought.

Motherson Sumi Wiring was up 2.3% at Rs 43.94.

Under India's T+1 settlement cycle, investors must buy the shares at least one trading day before the record date to be eligible. This means that purchases made on the record date itself will not reflect in the demat account in time.

The deemed date of allotment of bonus shares for Samvardhana Motherson and Motherson Sumi Wiring will be Monday, July 21, 2025, and these bonus shares will be made available for trading on the next working day i.e., Tuesday, July 22, 2025.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.