BNP Paribas sees India's information technology service sector as one bright spot in the backdrop of the US monetary and fiscal easing cycle. The brokerage believes that dollar strength, inventory restocking, and retail consumer-friendly themes will help India's IT industry growth.

According to BNP Paribas, there are enough reasons to find comfort in Indian IT's valuation. The macroeconomic environment is far better placed in 2025. A rate cut from the US Federal Reserve is likely underway. The current administration in the US appears to be business friendly.

However, an inflationary impact of Donald Trump's tariff is a risk this calendar year. After noting the limited impact of the tariff hike on China to 20% in 2018, given the strengthening dollar index at that time. Hence BNP Paribas's Exane global equity strategy team notes that observing the pace of tariffs on China and the offsetting Chinese yuan depreciation will be key.

Positive real wage growth, housing and construction bottoming, potential China stimulus, potential peace in Ukraine and fiscal easing in Germany are going to support Indian IT services' growth, BNP Paribas said in a note.

BNP Paribas picks Infosys Ltd. and Tata Consultancy Services Ltd. in the Indian IT sector. Infosys will have support for its growth from discretionary demand recovery and generative artificial intelligence enhancement. Infosys is expected to offer one of the highest earnings estimate upgrade potentials.

Tata Consultancy Services Ltd. is trading close to the last five-year average price-to-equity ratio and near-term client-specific challenges seem to be more than priced in.

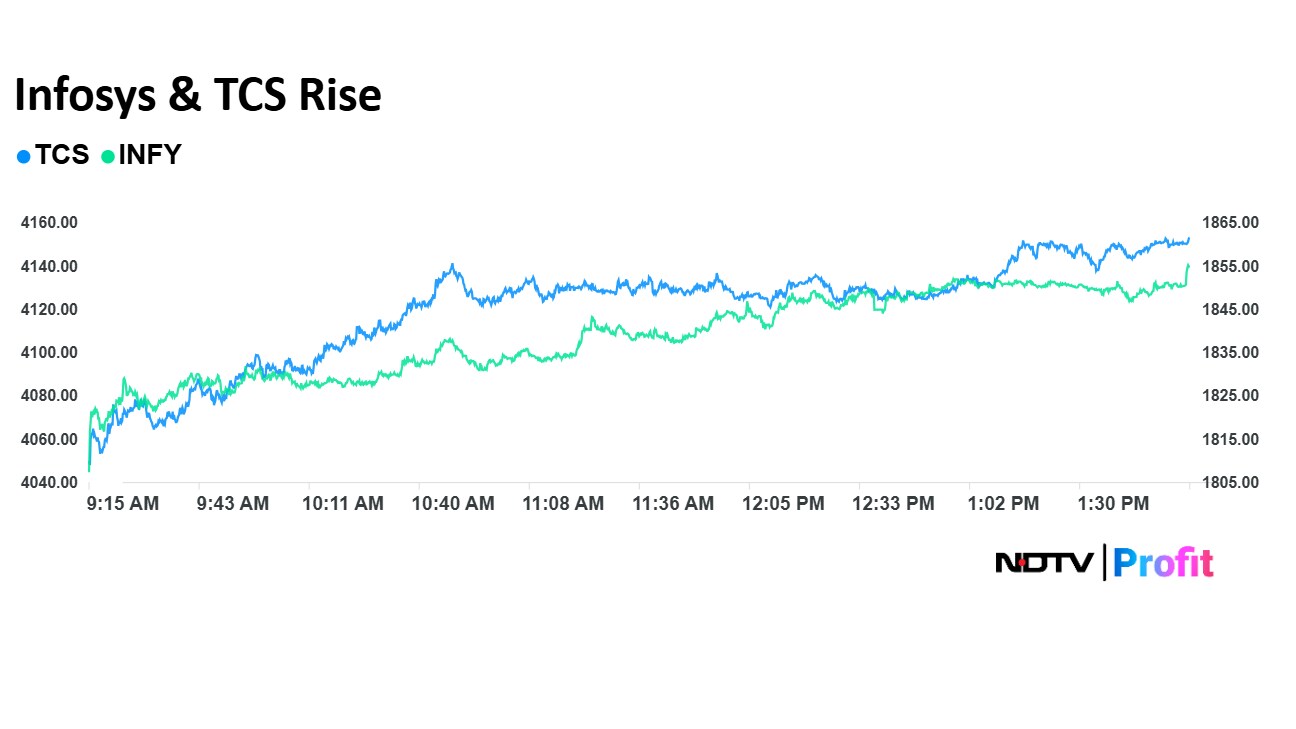

Both Infosys Ltd. and Tata Consultancy Service Ltd. share prices rose in Wednesday's session. Tata Consultancy Services share price rose 2.97% to Rs 4,155.55 apiece.

Infosys Ltd. share price rose 3.07% to Rs 1,855.90 so far today. Both Infosys and Tata Consultancy Services were trading 2.96% and 2.83% higher, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.