- Blue Star shares dropped 5% after lowering full-year growth forecast despite steady Q2 earnings

- Q2 net profit rose 2.8% to Rs 98.8 crore; revenue increased 6.4% to Rs 2,422 crore

- Operating margin improved to 7.6% from 6.6% year-on-year in the September quarter

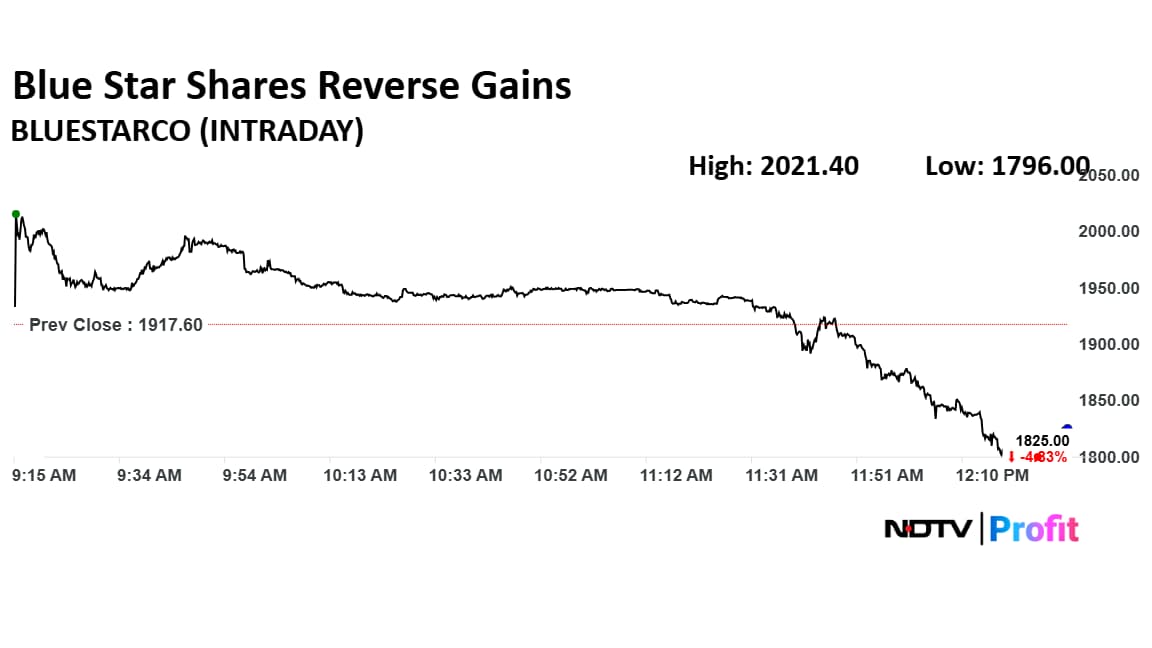

Blue Star shares fell 5% on Tuesday, marking their steepest intraday drop in six months, after the company reduced its full-year growth forecast despite posting steady second-quarter earnings.

The company reported a 2.8% year-on-year increase in consolidated net profit to Rs 98.8 crore in the September quarter, compared with Rs 96.1 crore a year earlier. Revenue rose 6.4% to Rs 2,422 crore from Rs 2,276 crore, while Ebitda grew 22.8% to Rs 183 crore. The operating margin improved to 7.6% from 6.6% in the same period last year.

Managing Director B. Thiagarajan said during the post-results call that the company had lowered its revenue growth outlook for the year from a positive 5% to flat. He cautioned that growth could range between minus 15% and zero, depending on how demand develops during the final quarter.

Thiagarajan attributed the weaker outlook to a drop in festive season sales, extended rainfall, and a rise in channel inventory to about 65 days from 34 days last year. He added that margins in both major segments—commercial air conditioning and unitary cooling products—would likely remain between 7% and 7.5% through the rest of the year.

He said that although this year's performance has been affected by weather-related factors, the company expects long-term growth to remain intact.

Blue Star Share Price

Shares Of Bluestar erased morning gains and fell as much as 4.8% to Rs 1,824. Trading volume was 7.8 times its 20-day average, according to Bloomberg data.

The stock has declined over 8% in the past five days and nearly 5% in the past month.

Among the 25 analysts tracked by Bloomberg, 48% of the the analysts have a 'buy' call, while 32% of the analysts have 'hold' rating on the stock and 20% of them have a 'sell' call.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.