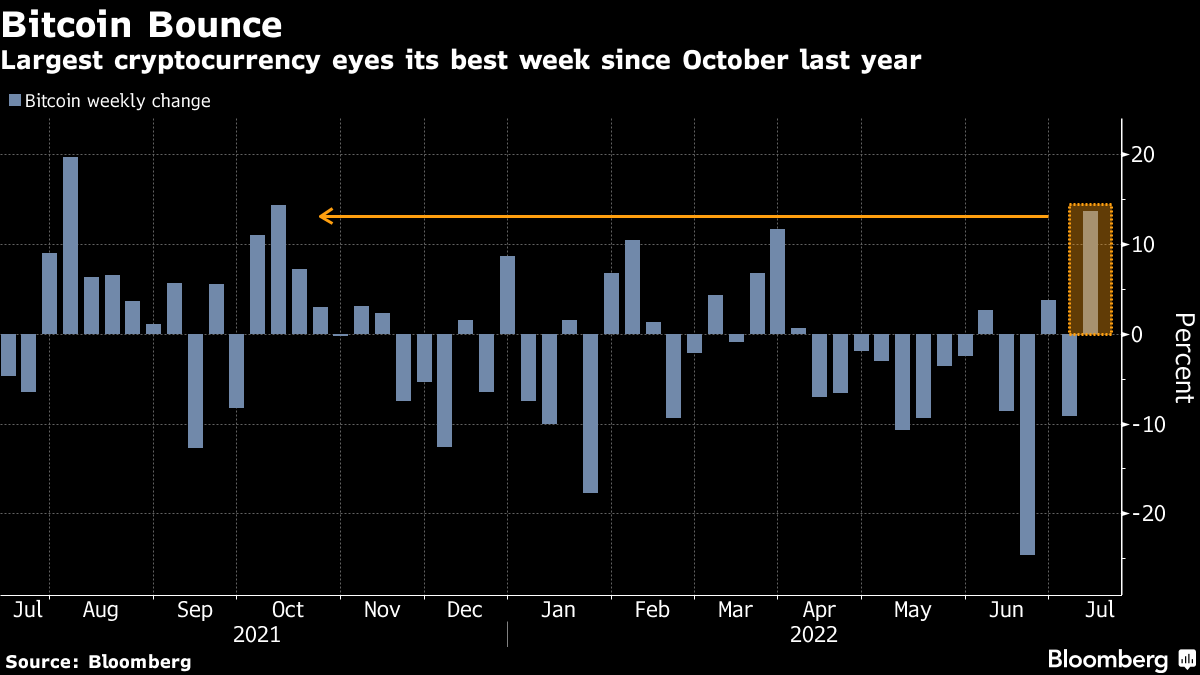

(Bloomberg) -- Bitcoin is on course for its best weekly gain since October last year, helped by a return of risk appetite in global markets more broadly.

The largest cryptocurrency by market capitalization was up more than 13% for the week so far as of 10:33 a.m. on Friday in London. It gave up some gains after briefly trading above $22,000, as news of the killing of former Japanese Prime Minister Shinzo Abe triggered a stock market retreat.

Read more: US Index Futures Slide; Abe's Death Shocks Traders: Markets Wrap

Other tokens like Ether, Avalanche and Solana have also had a strong run in recent days, helping to take the overall market value of cryptocurrencies back close to $1 trillion, according to CoinGecko data.

A stocks rally is providing much-needed relief for battered virtual coins amid the positive correlation between the two asset classes. Bitcoin remains more than 50% lower in 2022, hurt by monetary tightening and a string of blowups in a digital-asset sector that's still sobering up after binging on leverage.

“Risk markets are up across the board” and thus “it's not surprising that crypto is trading higher,” said Ben McMillan, chief investment officer at IDX Digital Assets. “After a cascade of bad news and large liquidations, many crypto investors are still sitting on the sidelines waiting for the next shoe to drop.”

A barrage of economic risks and the threat of more de-leveraging remain a concern in crypto. News that customers of bankrupt broker Voyager Digital Ltd. likely won't get all their money back has struck a new kind of fear into investors who have typically been able to stomach big market downturns.

“A lot of the institutional holders of Bitcoin may be particularly sensitive to the general way that the economy is moving,” said Jared Madfes, partner at Tribe Capital.

If the US jobs report Friday “comes back really weak, inflation comes back even worse, and it looks like a number of the geopolitical issues that are influencing the prices on a number of these core economy assets are not improving, I can't imagine that that is short-term bullish for Bitcoin,” Madfes said.

(Updates with latest Bitcoin move in second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.