- Short-term Bitcoin options show peak open interest around $140,000 strike price calls

- Bitcoin surpassed $125,000 for the first time early Saturday amid low liquidity conditions

- Bitcoin's price rose over 2.8% to $126,251 on Monday, doubling in value over the past year

The sudden push to a fresh all-time high in Bitcoin over the weekend has options traders adding to bets that the largest cryptocurrency will rally to $140,000.

Short-term Bitcoin options contracts that settle toward the end of the year have seen open interest clustered around that strike price for calls, according to data from crypto derivatives exchange Deribit by Coinbase. There has also been a moderate increase in demand for puts, as traders seek downside protection from a pullback after the rally.

“We currently see the largest notional open interest on record for Bitcoin futures and perpetual contracts even after a bunch of ‘buy-to-close' liquidations,” said Greg Magadini, director of derivatives at Amberdata. “The market rally has caught people by surprise, we aren't at the top yet, especially as many traders shorted this market.”

Bitcoin topped $125,000 for the first time just after midnight Saturday in New York, as the around-the-clock nature of the crypto market and decreased liquidity likely allowed bullish traders to push the price through that threshold.

“From here, watch for volatility spikes and any shift in put volume as a red flag for near-term corrections,” said Jean-David Péquignot, chief commercial officer for Deribit by Coinbase. “Bulls have their eyes on $130K+, and bears might find opportunities in overbought squeezes.”

Bitcoin set a another record high on Monday, climbing as much as $2.8% to $126,251, and has now more than doubled in the past year.

Bitcoin's advance coincided with a US government shutdown that began on Oct. 1 and has helped fuel demand for perceived safe-haven assets. The closure scuppered the planned publication of key economic data, including nonfarm payrolls. Gold surged to a record above $3,900 per ounce on Monday, extending a months-long rally.

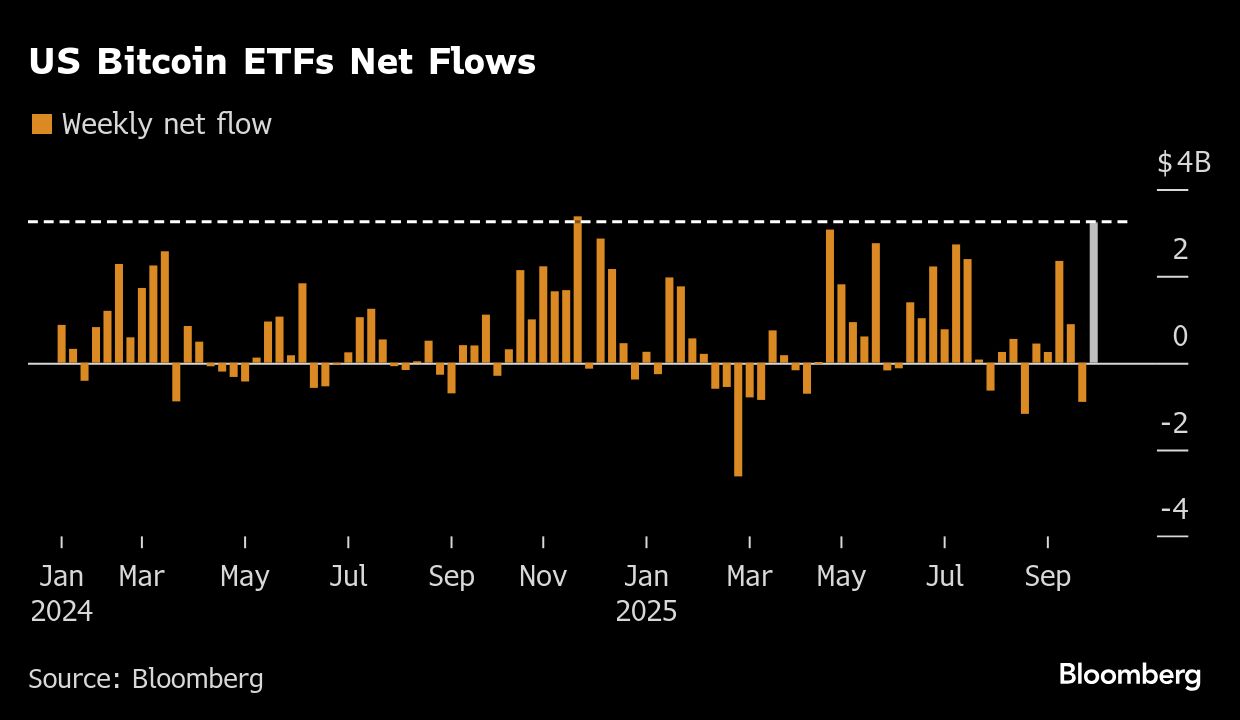

Rising demand in the spot market has been the biggest driver as of late, traders said. Investors poured $3.2 billion into a group of 12 US Bitcoin exchange-traded funds last week, the second-highest haul since they launched in 2024. Meanwhile, the notional open interest on BlackRock's iShares Bitcoin Trust ETF rose to a record $49.8 billion on Friday, data compiled by Bloomberg show.

Bitcoin perpetual futures and termed contracts, which are among the most common ways to add leverage, have climbed in the latest rally and a flurry of traders have closed out short positions as the token started trending higher. Open interest for the derivatives contracts hit $75 billion across crypto exchanges. Futures on offshore exchange Binance and US-based CME have seen some of the largest volumes, according to Amberdata.

Unlike some previous rallies, many of which were driven by the derivatives markets, liquidations in both bullish and short positions have remained subdued. There were around $283 million liquidations of crypto bets in the past 24 hours. Nearly $2 billion was wiped out in late September amid a plummet in Bitcoin prices, posting one of the largest single-day liquidations this year, according to data from Coinglass.

“If all goes well around macro updates and data releases we could see prolonged run into the end of the year,” said Adam McCarthy, a research analyst at Kaiko.

October — often trumpeted as “Uptober” by crypto traders — has historically been Bitcoin's best-performing month. The token has delivered average gains of about 22.5% in October over the past decade, according to data compiled by Bloomberg.

Ether, the second-largest digital asset, rose about 5% to $4,700 on Monday, while XRP was slightly higher at just above $3.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.