(Bloomberg) -- Bitcoin investors facing pronounced swings in Asia may be grappling with the fallout of automated trading protocols reacting to flows data for US exchange-traded funds holding the cryptocurrency.

Daily figures on the level of demand for these spot-Bitcoin ETFs propagate across the crypto market in Asian hours following the close of US share trading. On Tuesday, the digital asset embarked on its worst drop in a month in the Asian morning as the flows numbers pointed to investors pulling money out.

“From an algorithmic trading perspective, bots can basically auto-scrape this data and buy and sell based on this,” said Shiliang Tang, president of principal trading firm Arbelos Markets. “It seems that's basically what is happening.”

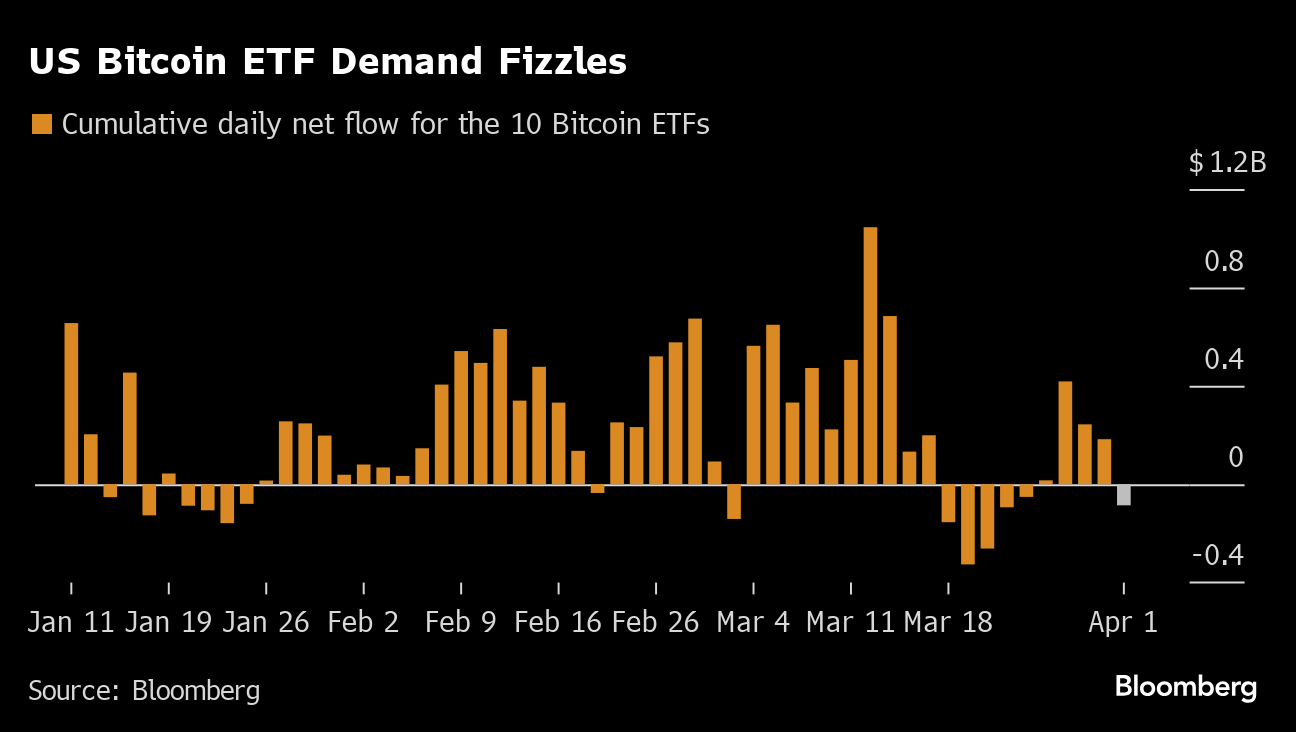

A batch of US Bitcoin ETFs went live on Jan. 11 and has pulled in a net $12 billion so far. The pace of inflows crested in the first half of March, when Bitcoin surged to a record high of $73,798. The sector has suffered bouts of outflows since then and the token is down about 11% from the all-time peak.

This flows pattern helps to explain why Asian-hours market returns were “particularly strong in February and early March, but less so later in March,” Tang said.

As algorithmic protocols dump Bitcoin, that can have a knock-on effect in the derivatives market. Coinglass data show that about $354 million of bullish crypto wagers were liquidated on Tuesday, the most in about two weeks.

Some 5.5% of Bitcoin is held in the overall ETF sector, against 1% for gold, ByteTree Asset Management's Chief Investment Officer Charlie Morris wrote in a note. “ETF flows are, therefore, more important for Bitcoin than gold,” he said.

Bitcoin fell almost 6% on Tuesday and is continuing to struggle for traction, shedding another 0.5% to change hands at $65,400 as of 8:50 a.m. Wednesday in Singapore. Ebbing bets on Federal Reserve interest-rate cuts are another headwind for digital assets.

The original cryptocurrency has jumped roughly fourfold since the start of 2023, when it began a recovery from a bear market. The supply of new Bitcoin tokens is set to halve this month, a four-yearly event some traders view as a prop for prices.

“Typically markets have been taking the cue from the ETF flow number,” said Jakob Kronbichler, co-founder of decentralized credit marketplace Clearpool Finance. “Also, there's been a lot of excitement over past couple of weeks, and the correction is natural for the market to take a bit of a breather.”

--With assistance from Olga Kharif and Emily Graffeo.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.