- Bharti Airtel promoter Indian Continent Investment sold Rs 9,310 crore stake in a block deal

- Five crore shares, or 0.8% equity, were offloaded at Rs 1,862 per share, a 3.15% discount

- Indian Continent Investment held a 2.47% stake as of June before this sale

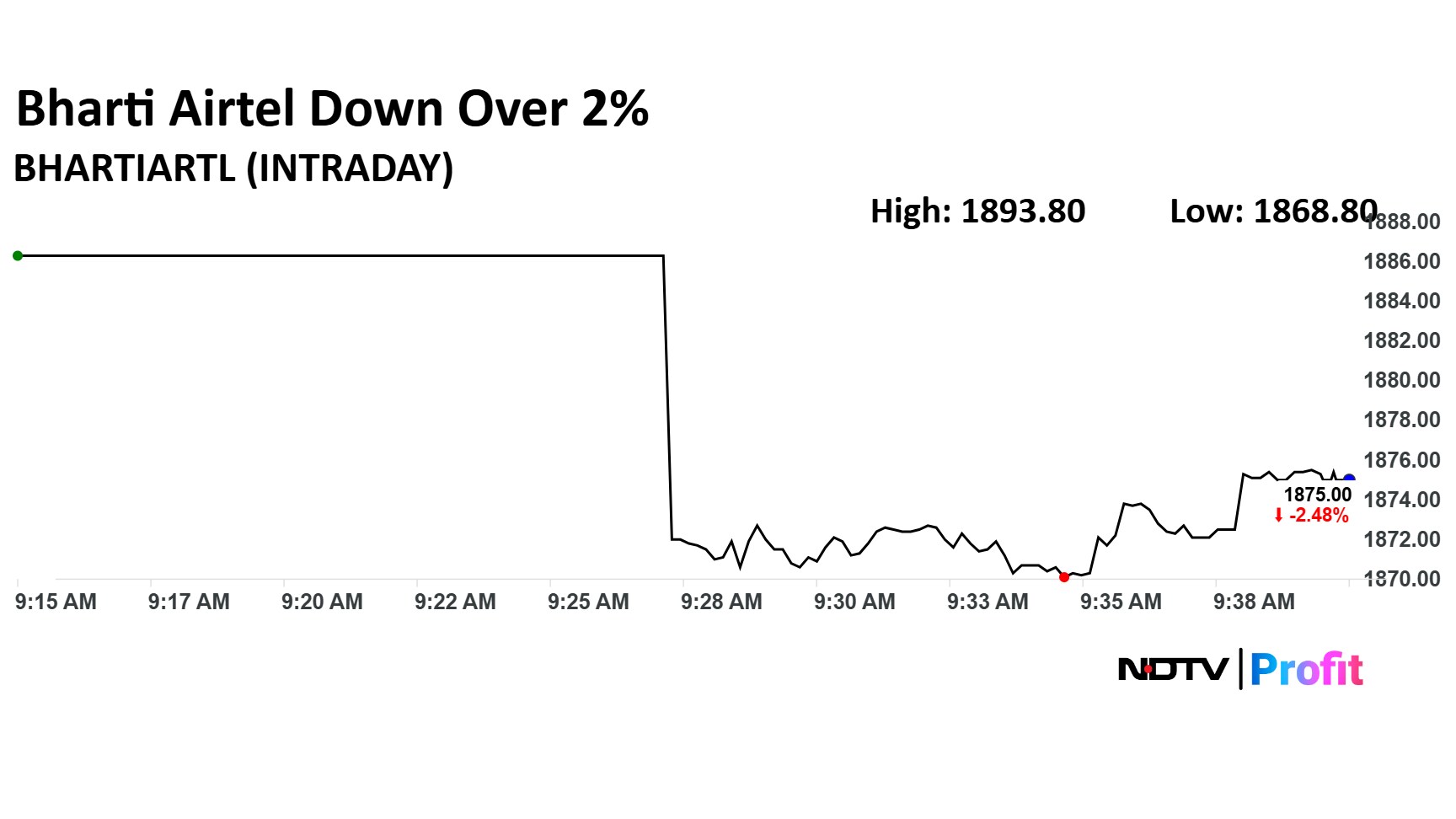

Bharti Airtel Ltd.'s share price slipped by over 2% after its promoter, Indian Continent Investment, offloaded a stake worth Rs 9,310 crore in a block deal in the pre-open session.

Indian Continent Investment offloaded up to five crore shares, representing 0.8% of equity, through the block deal. The offer price for the deal was Rs 1,862 per share, which marks a 3.15% discount to the previous closing price of Rs 1,922.6 per share. Jefferies India and JP Morgan India are the managers for the deal, and the buyers' data will be available post-market hours.

As of June, Indian Continent Investment held a 2.47% stake in the telecom giant. Notably, the telco's major promoter, Bharti Telecom, had acquired a 1.2% stake in the company from Indian Continent Investment on Nov. 7, 2024, according to a PTI report.

Bharti Airtel Share Price

Airtel stock fell as much as 2.80% during the day to Rs 1,868 apiece on the NSE. It was trading 2.46% lower at Rs 1,875 apiece, compared to a 0.47% decline in the benchmark Nifty 50 as of 9:54 a.m.

It has risen 28.98% in the last 12 months and 17.92% on a year-to-date basis. The total traded volume so far in the day stood at 145 times its 30-day average. The relative strength index was at 54.

Twenty-six out of the 33 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold', and four suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,092, implying an upside of 11.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.