Bharat Electronics Ltd. saw its share price rise by over 2.8% during the trading session on Wednesday, following the announcement of a contract with the Ministry of Defence. The contract, worth Rs 1,220.12 crore, involves the procurement of 149 software defined radios for the Indian Coast Guard.

The radios will enable secure and reliable information sharing, collaboration, and situational awareness through high-speed data and secure voice communication. This enhancement will bolster the Indian Coast Guard's capabilities in maritime law enforcement, search and rescue operations, fisheries protection, and marine environment protection, according to a release issued by the defence ministry.

Additionally, the SDRs will improve interoperability for joint operations with the Indian Navy, it added.

The project is a step toward strengthening the coast guard's operational capabilities and supporting the Indian government's "blue economy" objectives by reinforcing maritime security, the release said.

"Aligning with the Atmanirbhar Bharat initiative, the contract will enhance the country's manufacturing capabilities for advanced military-grade communication systems, generating employment opportunities and fostering expertise development," it further noted.

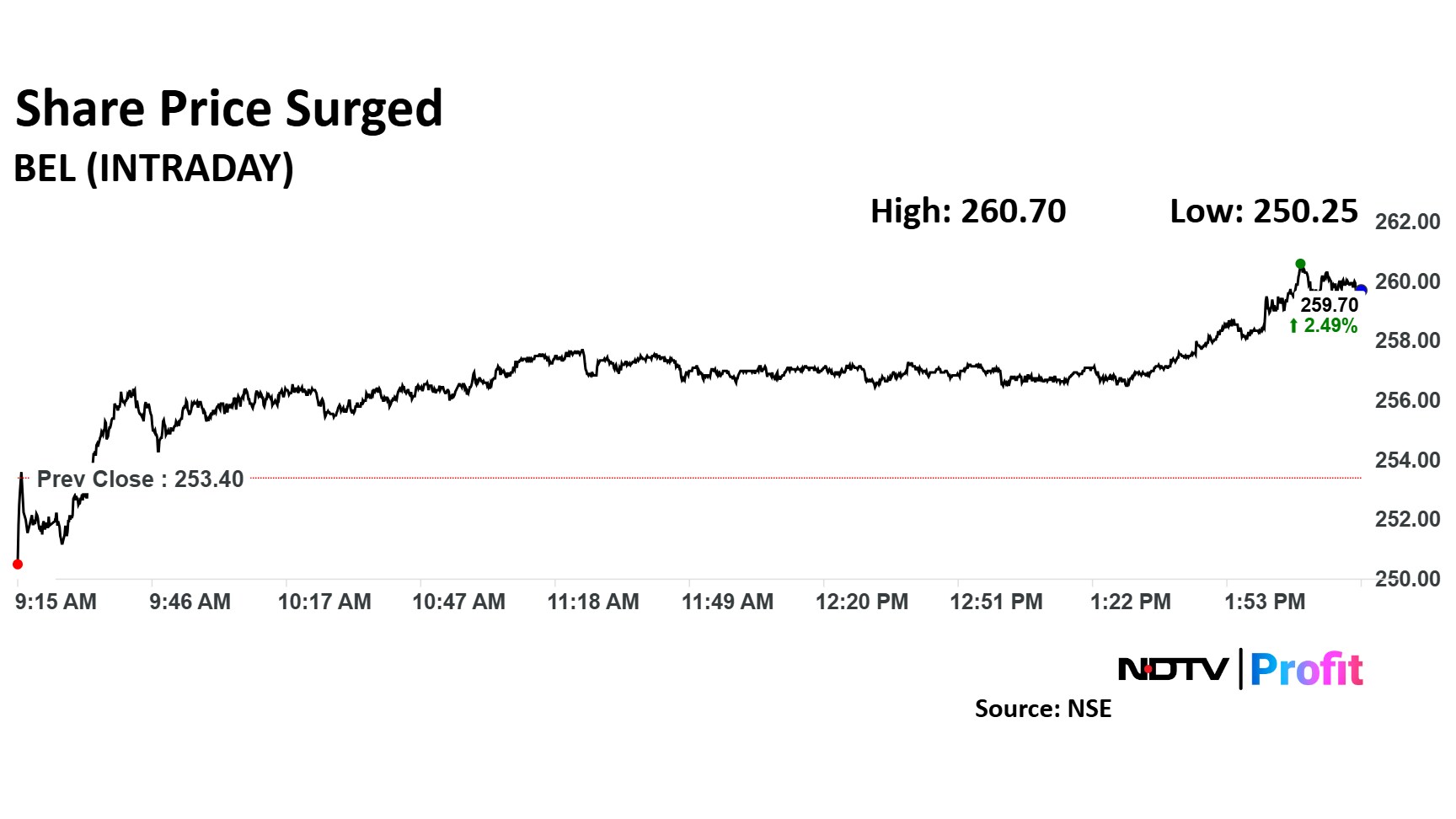

Bharat Electronics' scrip rose as much as 2.88% to Rs 260.7 apiece on the NSE, after the contract with the defence ministry was announced. The shares pared a fraction of the gains to trade 2.49% higher at Rs 259.7, as compared to 0.12% decline in the benchmark Nifty 50.

Notably, the stock has risen by 36.38% in the last 12 months. The total traded volume so far in the day stood at 0.6 times its 30-day average, whereas the relative strength index was at 44.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average of 12-month analysts' price target implies an upside of 31.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.