.png?downsize=773:435)

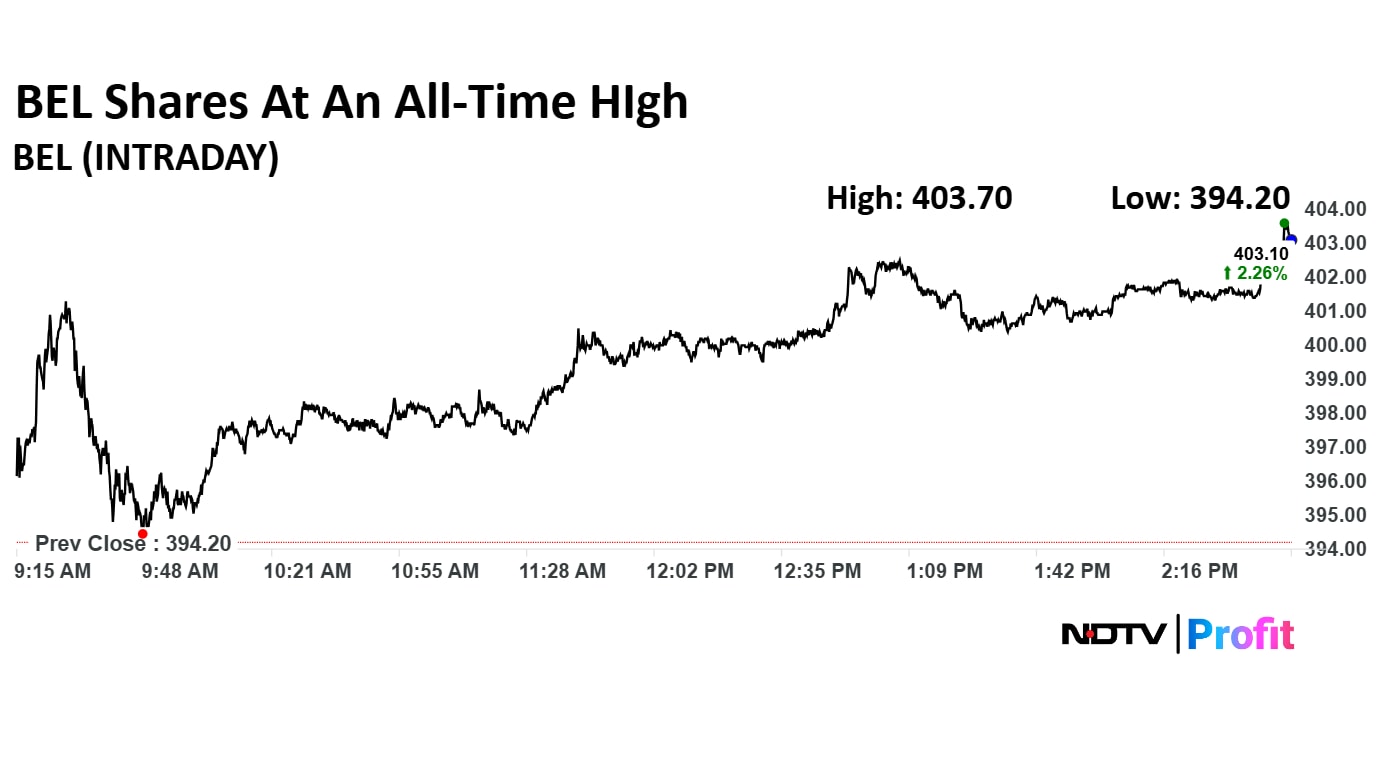

Share price of Bharat Electronics Ltd. hit an all-time high on Monday, reaching Rs 402.50 apiece, at an advance of 2.11%.

This rally comes amid a run up in all sectors, with the Nifty India Defence index rallying 0.62% as of 2:38 p.m., as compared to the benchmark NSE Nifty 50 at 0.86%.

Defence stocks, though in a sectoral rally, were trading mixed during the session, with Dynamatic Technologies and BEL leading the rally while Data Patterns (India) and DCX Systems weighed the index.

The stock had recently been in the limelight with brokerage firm Antique reiterating its bullish stance, in regards to India targeting defence capital outlay worth Rs 16 lakh crore through domestic procurement by 2030.

Bharat Electronics, a 'Navratna' Defence PSU established in 1954, is a leading Indian government-owned company under the Ministry of Defence. It specialises in producing advanced electronic products and systems for the Indian armed forces, covering domains such as radars, missile systems, communication technologies, electronic warfare systems, avionics for aircraft, naval systems, and tank electronics.

Bharat Electronics Share Price Today

The scrip rose as much as 2.22% to Rs 402.95 apiece, hitting a fresh record high. It pared gains to trade 2.17% higher at Rs 402.75 apiece, as of 02:47 p.m. This compares to a 0.88% advance in the NSE Nifty 50.

It has risen 37.68% on a year-to-date basis, and 30.36% in the last 12 months. The relative strength index was at 52.59.

Out of 28 analysts tracking the company, 24 maintain a 'buy' rating, one recommends a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.