US stocks are in for another drop that will eventually lead to a bear market in the coming months, according to veteran technical strategist Tom DeMark, who accurately called this year's top in February and subsequent April low.

DeMark — a closely-followed analyst who's advised billionaire investors including Paul Tudor Jones, Leon Cooperman and Steve Cohen — uses a system for predicting where markets will move, divined from a half century of chart gazing that's based on mathematical relationships. He focuses on trend exhaustion, with his mantra being markets top on good news and bottom on bad news.

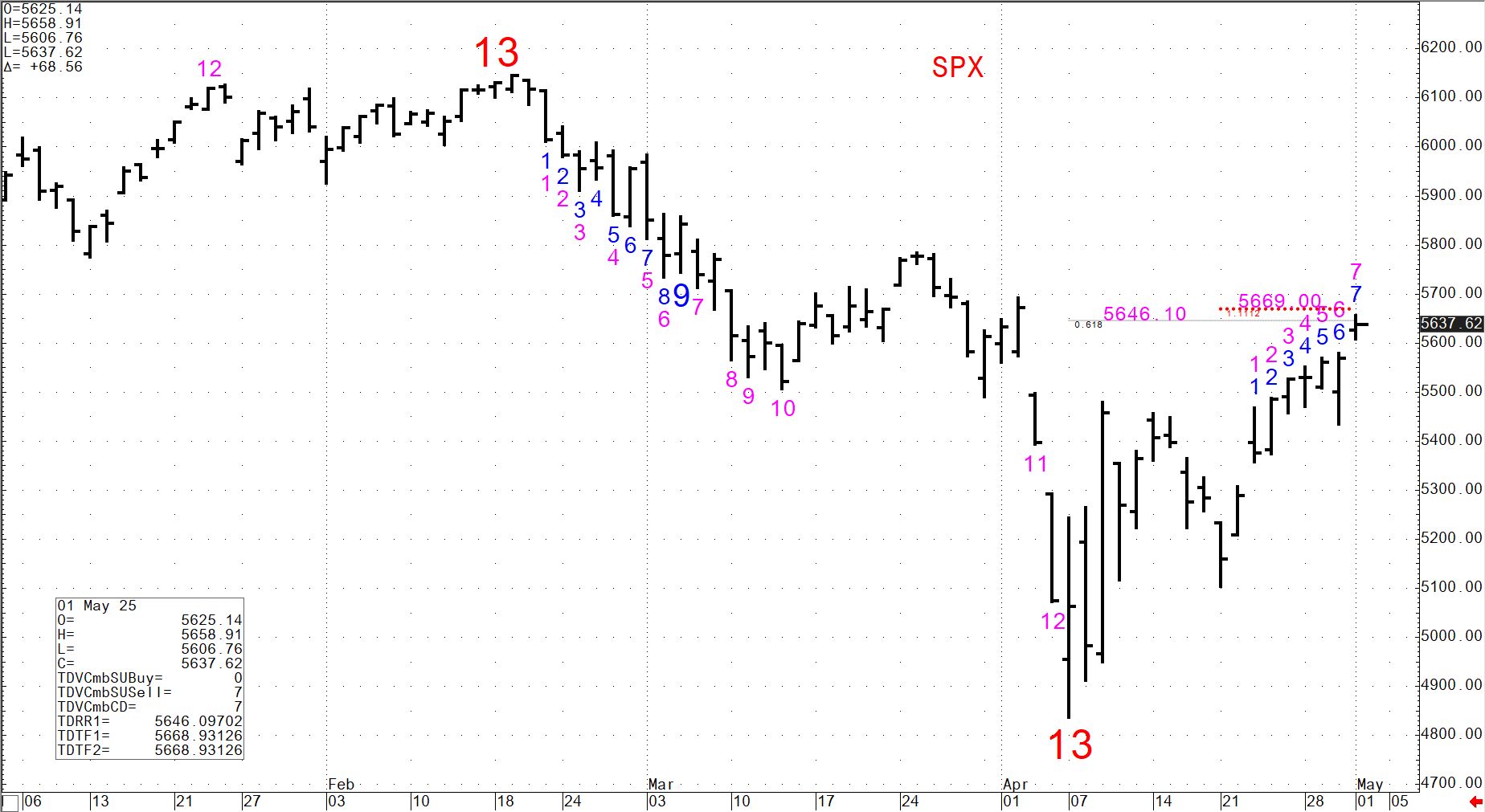

A confluence of technical indicators, sentiment shifts and cyclical timing models are flashing caution signs, suggesting a drop in the S&P 500 below 4,835, this year's intraday low in early April. That would represent a more than 20% drop from the gauge's February peak, pushing the index into a bear market.

“A top is imminent. Too much technical damage has been done,” DeMark said by phone. “Stocks are vulnerable right now and can easily get hit pretty badly if anything quickly changes on the global trade outlook.”

DeMark's warning comes amid a stock-market rebound that's put the S&P 500 Index on track to erase all of its losses suffered after President Donald Trump's tariff announcement last month. The gauge is up for a ninth straight day Friday, which would mark its longest winning streak since 2004.

A near-term top in the market may happen within days, says DeMark, whose firm DeMark Analytics LLC specializes in identifying market turning points. Specifically, the 5,669 level — which is right around where the gauge is currently trading — will likely leave buyers exhausted, said DeMark.

The prediction is based on DeMark's “countdown” study that involves comparing a security's closing price to its highest or lowest levels four days earlier. Cycles of “exhaustion” develop when a pattern continues nine times. The S&P 500 just produced its seventh count on Thursday. DeMark focuses on a string of nine daily moves, which don't have to be consecutive, but do have to be better than four sessions ago.

That means two new closing highs for the S&P 500 would likely trigger sell signals, DeMark said. Once that happens, weak technicals will pressure the index to resume its prior decline and eventually push the S&P 500 below 4,835.

“Historically, markets don't bottom on good news, like last month on positive trade developments,” DeMark said. “Stocks typically bottom when everything is terrible and everyone is forced to throw in the towel — but that hasn't happened yet. Stocks were just way oversold and overdue for a bounce. Ever since then, equities have struggled technically underneath the surface and are in danger of a big drop.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.