230523 RBI's Rs 2,000 currency exchange facility opens..jpeg?downsize=773:435)

Shares of Bank of Baroda slumped in early trade on Thursday after the lender approved raising up to Rs 10,000 crore through the issuance of long term bonds, as per a disclosure to the exchanges on Wednesday.

The bonds will be utilised for financing infrastructure and affordable housing projects, potentially in one or more tranches throughout the current financial year and beyond, depending on feasibility.

In the current financial year, Bank of Baroda has already raised Rs 10,000 crore through two infrastructure bond issuances. This move reflects the increasing efforts by banks to tap into such funding options due to slower deposit growth in the banking system.

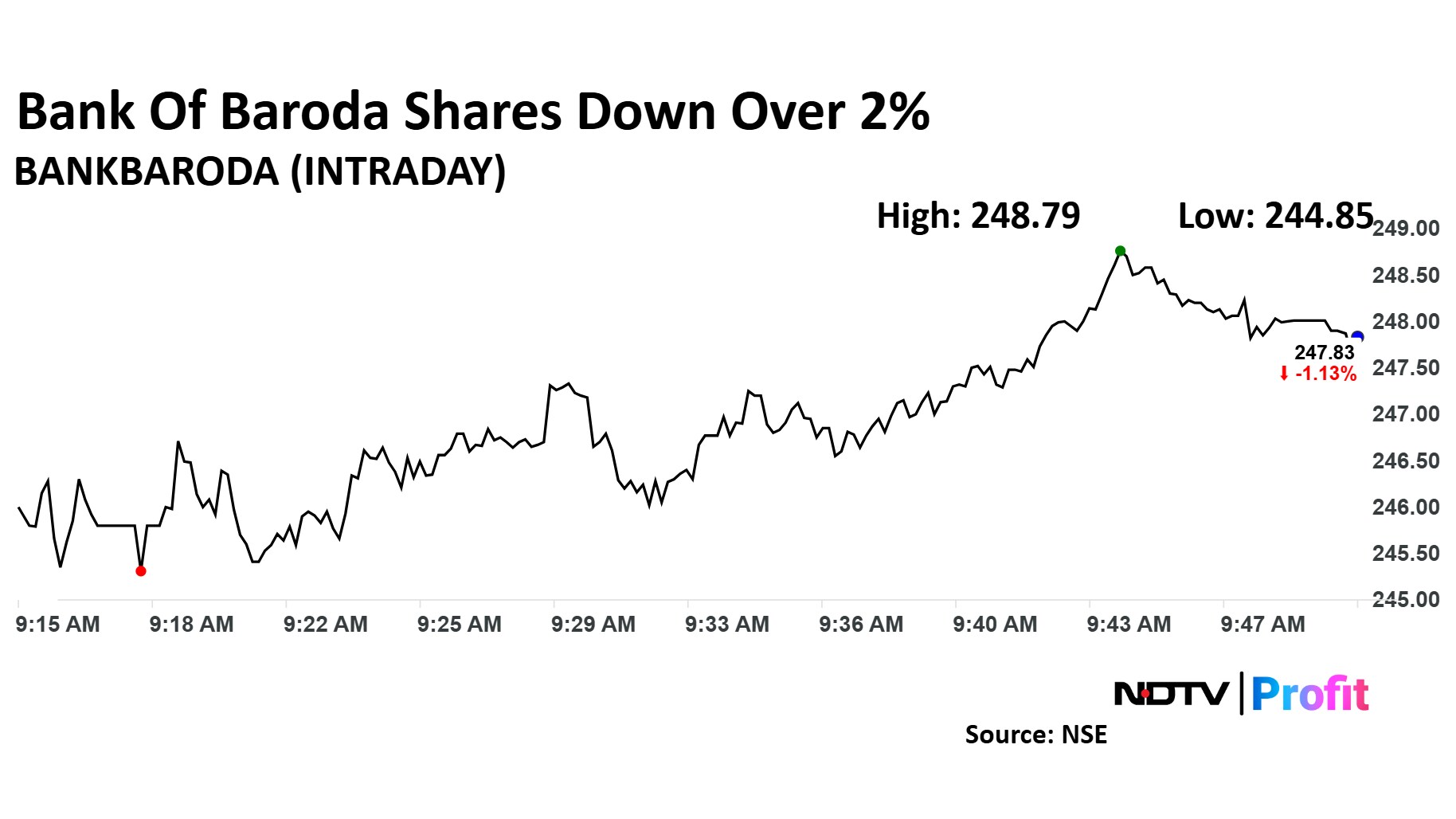

Bank Of Baroda Share Price Today

The scrip fell as much as 2.32% to Rs 244.85 apiece, the lowest level since Dec. 1, 2024. It pared losses to trade 1.66% lower at Rs 246.51 apiece, as of 09:39 a.m. This compares to a 1.13% decline in the NSE Nifty 50 Index.

It has risen 7.47% on a year-to-date basis. The relative strength index was at 43.60.

Out of 36 analysts tracking the company, 29 maintain a 'buy' rating, six recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.