Bandhan Bank Ltd.'s stock came under pressure on Monday, falling 4.45% in early trade, after the lender reported lackluster first-quarter results for FY26.

The Kolkata-based private sector bank posted a 65% year-on-year drop in the net profit to Rs 372 crore for the June quarter, down from Rs 1,063 crore in the same period last year. The steep fall was attributed to rising bad loans and a decline in net interest income, which slipped to Rs 2,757 crore from Rs 2,987 crore a year ago. Interest earned declined marginally to Rs 5,476 crore, while operating profit fell to Rs 1,668 crore from Rs 1,941 crore.

Despite a slight increase in total income to Rs 6,201 crore, the bank's asset quality deterioration raised red flags. Gross non-performing assets rose to 4.96% of gross advances, up from 4.23% a year earlier. Net NPAs also increased to 1.36%, compared to 1.15% in the corresponding quarter last year.

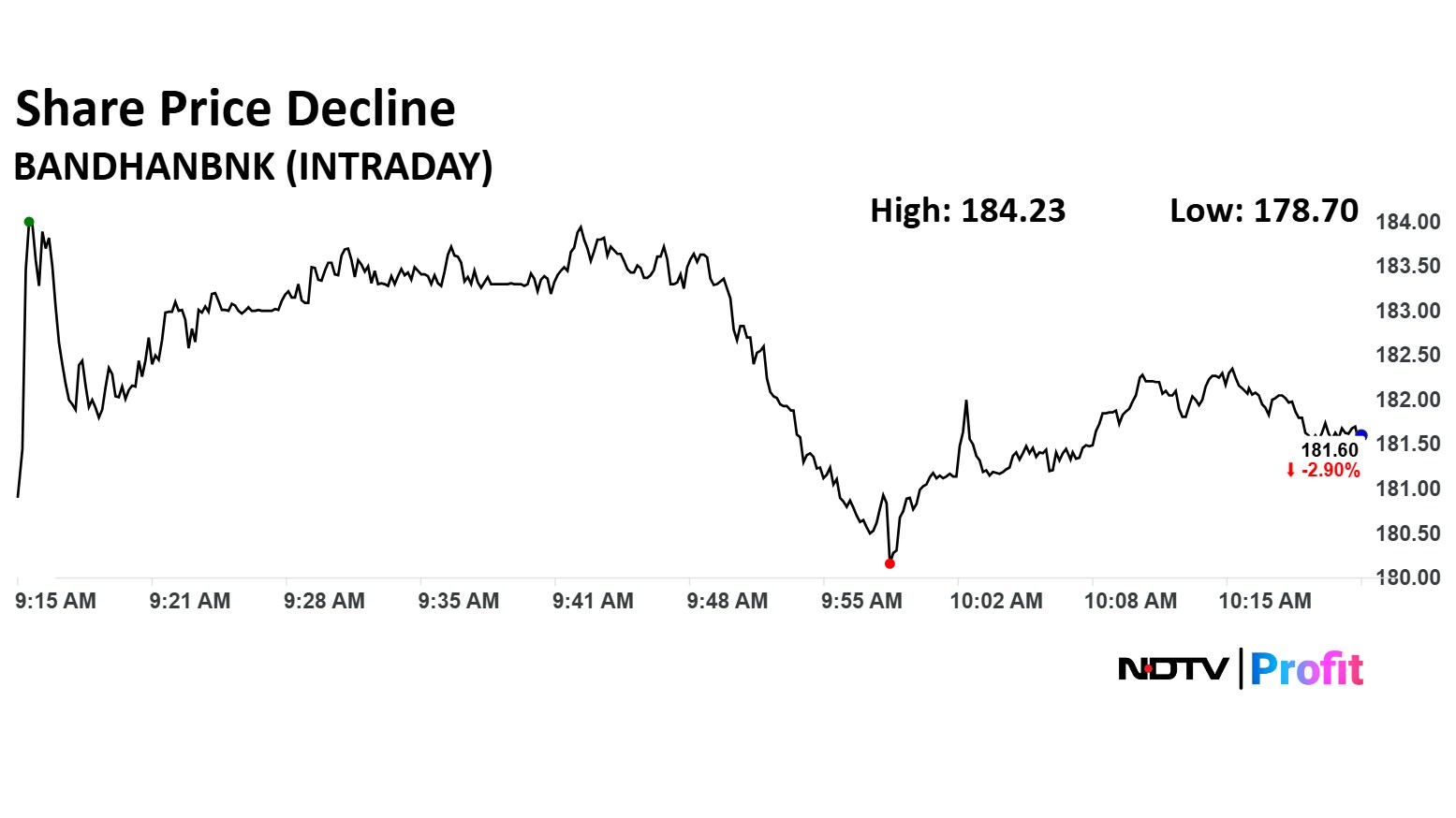

The scrip fell as much as 4.45% to Rs 178.70 apiece. It pared losses to trade 2.90% lower at Rs 181.60 apiece, as of 10:20 a.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has fallen 8% in the last 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 52.

Out of 29 analysts tracking the company, 15 maintain a 'buy' rating, 12 recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.