Shares of Bajaj Finserv slipped in trade after Allianz SE signed binding agreements to sell 26% of its stake in Bajaj Allianz General Insurance Co. and Bajaj Allianz Life Insurance Co. The sale will be to Bajaj Group for approximately 2.6 billion euros.

Bajaj Group will now hold 75.01% of the total equity share capital in Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance.

The company will acquire 11,13,295 equity shares of Rs 10 each in Bajaj Allianz General Insurance at a price of Rs 4,808.24 per share. The group is also set to acquire 15,22,161 equity shares of Rs 10 each in Bajaj Allianz Life Insurance at a price of Rs 2,654.12 per share.

These shares amount to 1.01% equity stake in each of the companies, together with all rights, title, and benefits. The board has also approved acquisition of the entire equity stake held by Allianz in Bajaj Allianz Financial Distributors Ltd., which is a 50:50 joint venture with the company.

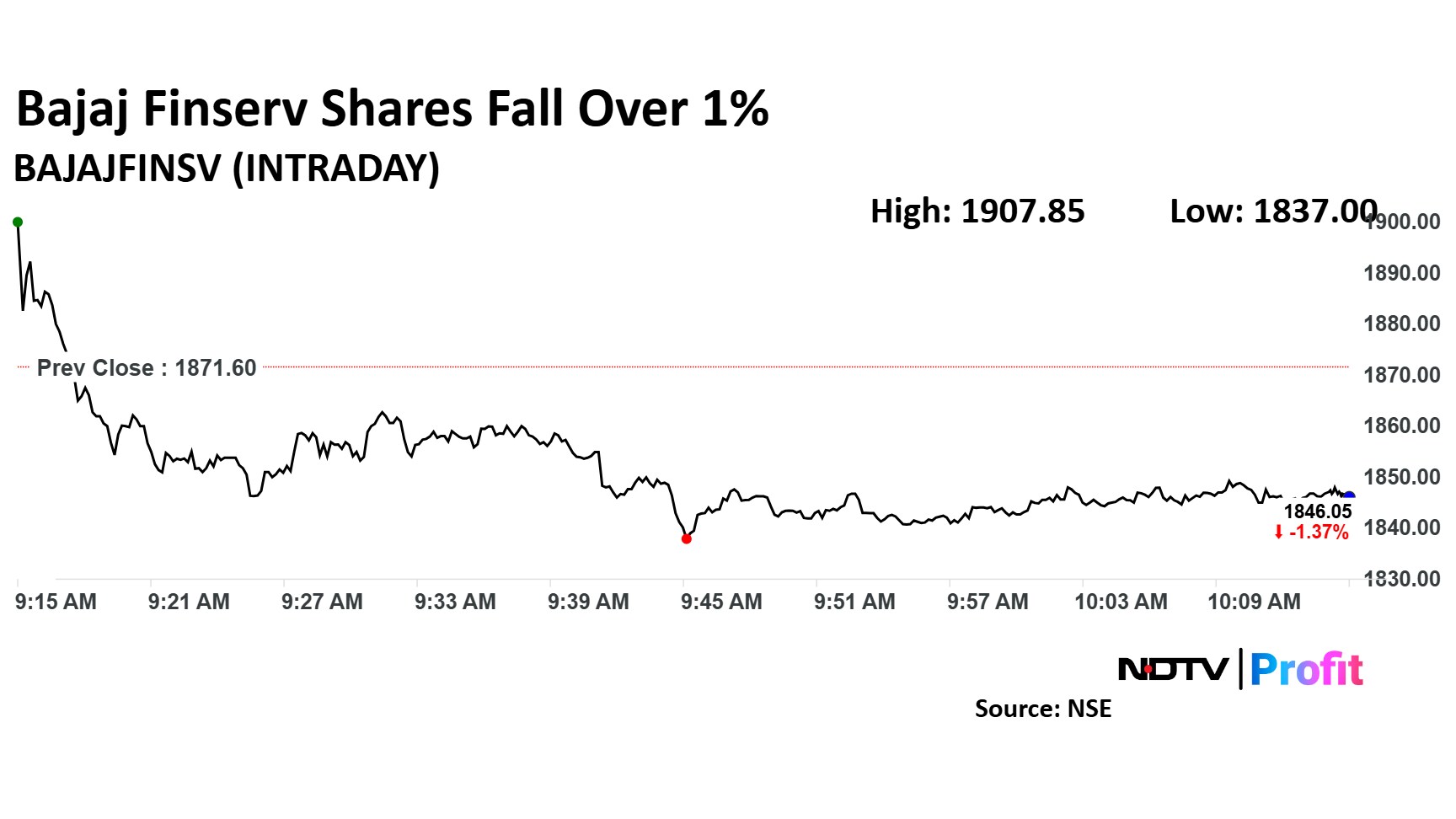

Bajaj Finserv Share Price

Bajaj Finserv stock fell as much as 1.85% during the day to Rs 1,837 apiece on the NSE. It was trading 1.12% lower at Rs 1,848 apiece, compared to a 1.05% advance in the benchmark Nifty 50 as of 10:10 a.m.

It has risen 17.4% in the last 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. Relative strength index was at 56.21.

Nine out of 12 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,915, implying an upside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.