Shares of Bajaj Finance Ltd. rose nearly 2% to touch an over three-month high ahead of its third quarter results.

Bajaj Finance is expected to clock in a net profit of Rs 4,130.4 crore, as per consensus estimates. Analysts also estimate the revenue to come in at Rs 11,567.7 crore.

The non-banking finance company reported a 13% year-on-year increase in profit for the second quarter, reaching Rs 4,014 crore. NII rose 23% to Rs 8,838 crore, while AUM grew 29% to Rs 3.73 lakh crore.

The ratio of gross non-performing assets rose to 1.06%, compared to 0.86% in the previous quarter and 0.91% in the same quarter last year. Net NPA also increased to 0.46%, up from 0.38% last quarter and 0.31% a year ago.

The NBFC earlier this week had received a GST demand worth Rs 863 crore from the Pune tax authorities. The demand was related to the company's collection of upfront interest on loans for consumer durable goods.

The total demand confirmed by the authorities amounts to Rs 341.28 crore in GST dues. Additionally, interest liabilities up to the date of the order totalled Rs 180.59 crore, along with a penalty of Rs 341.28 crore. Bajaj Finance is in the process of filing an appeal before the Commissioner (Appeals-II) of CGST, Pune.

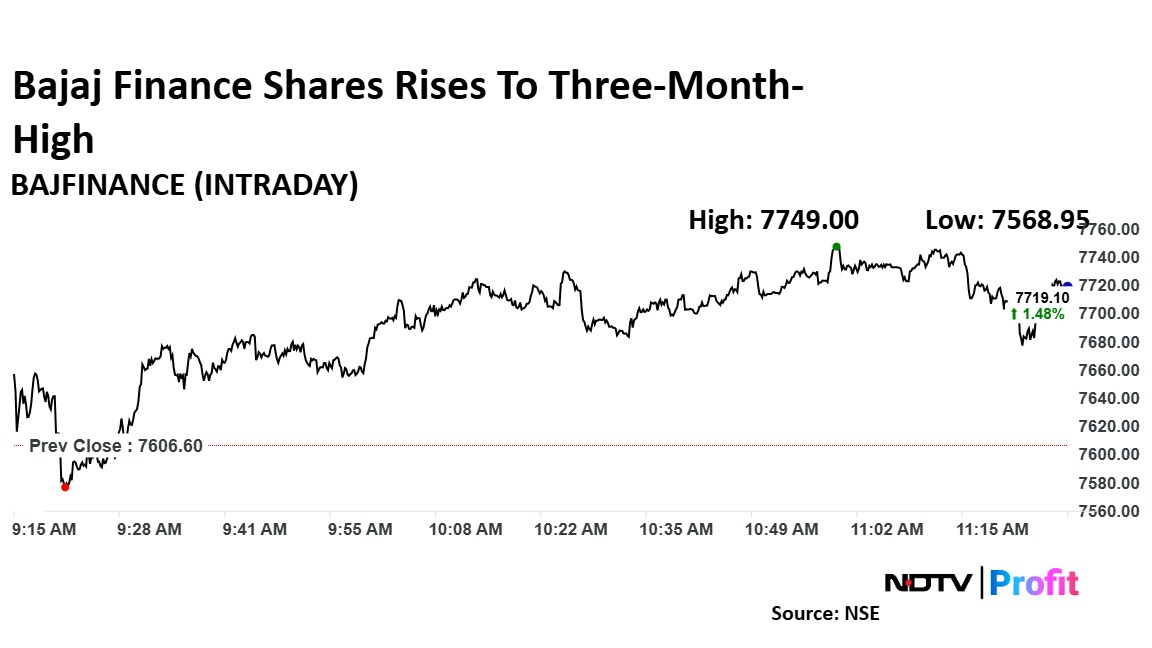

Bajaj Finance Share Price

Shares of Bajaj Finance rose as much as 1.87% to Rs 7,749 apiece, the highest level since Oct. 1, 2024. It pared gains to trade 1.45% higher at Rs 7,716.70 apiece, as of 11:24 a.m. This compares to a 0.20% advance in the NSE Nifty 50.

The stock has risen 7.30% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 65.

Out of 37 analysts tracking the company, 28 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 4.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.