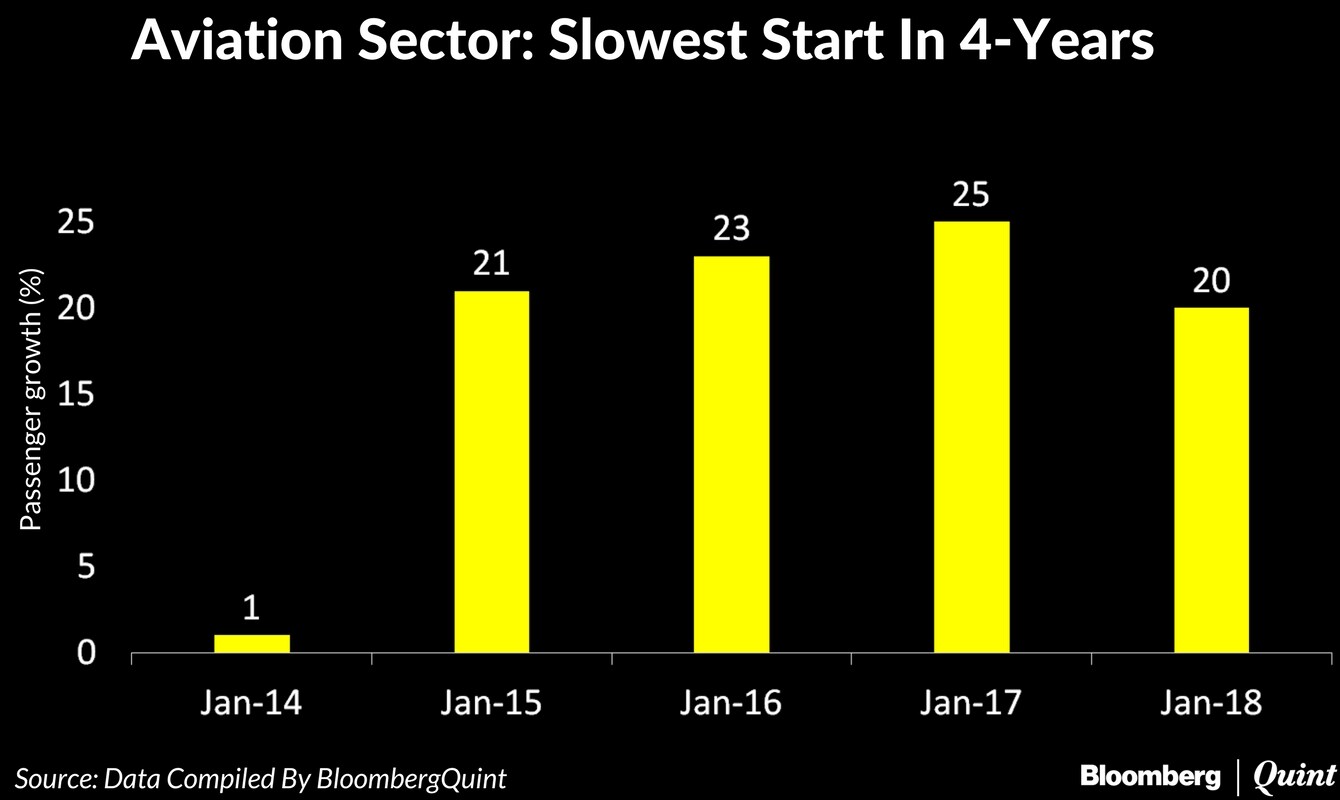

India's aviation market was off to its slowest start in four years.

Airline passenger traffic in the world's fastest-growing market rose at 20 percent in January as 11 million Indians flew in domestic carriers. Yet, that was the slowest pace of growth in the first month since 2014, according to data compiled by BloombergQuint.

The passenger growth for Interglobe Aviation Ltd., the parent of IndiGo, rebounded after six subdued months. For the second half of 2017, IndiGo reported below-industry growth due to a delay in capacity addition.

.jpg)

The company continued to lose market share, albeit at a slower rate in January, for the seventh straight month. Its share was still the highest at 39.7 percent, while the passenger load factor or capacity utilisation stood at 89.7 percent for the month.

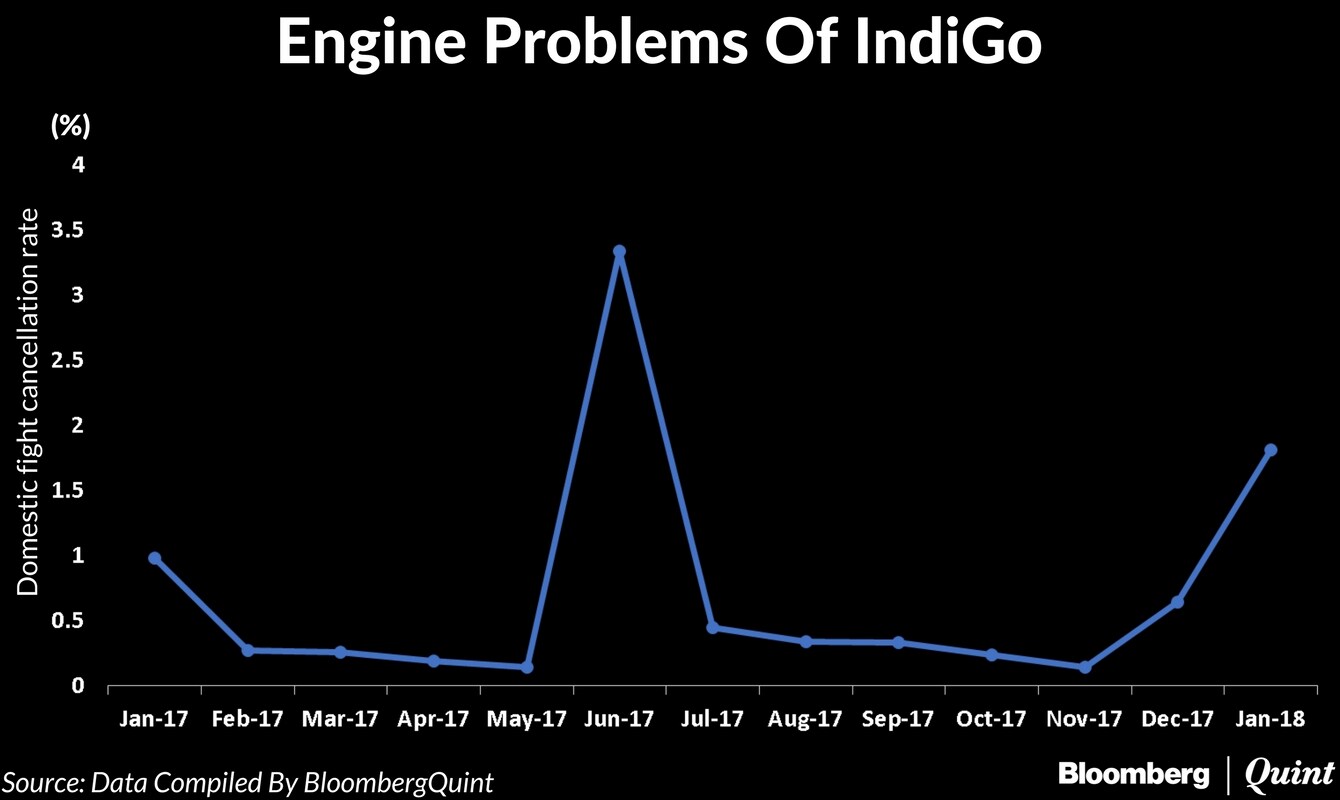

IndiGo's domestic flight cancellation rate spiked due to engine problems. This is expected to persist in February as the company grounded three aircraft, resulting in cancelled flights. In June 2017, cancellations had spiked due to engine problems in its Airbus A320 Neo planes.

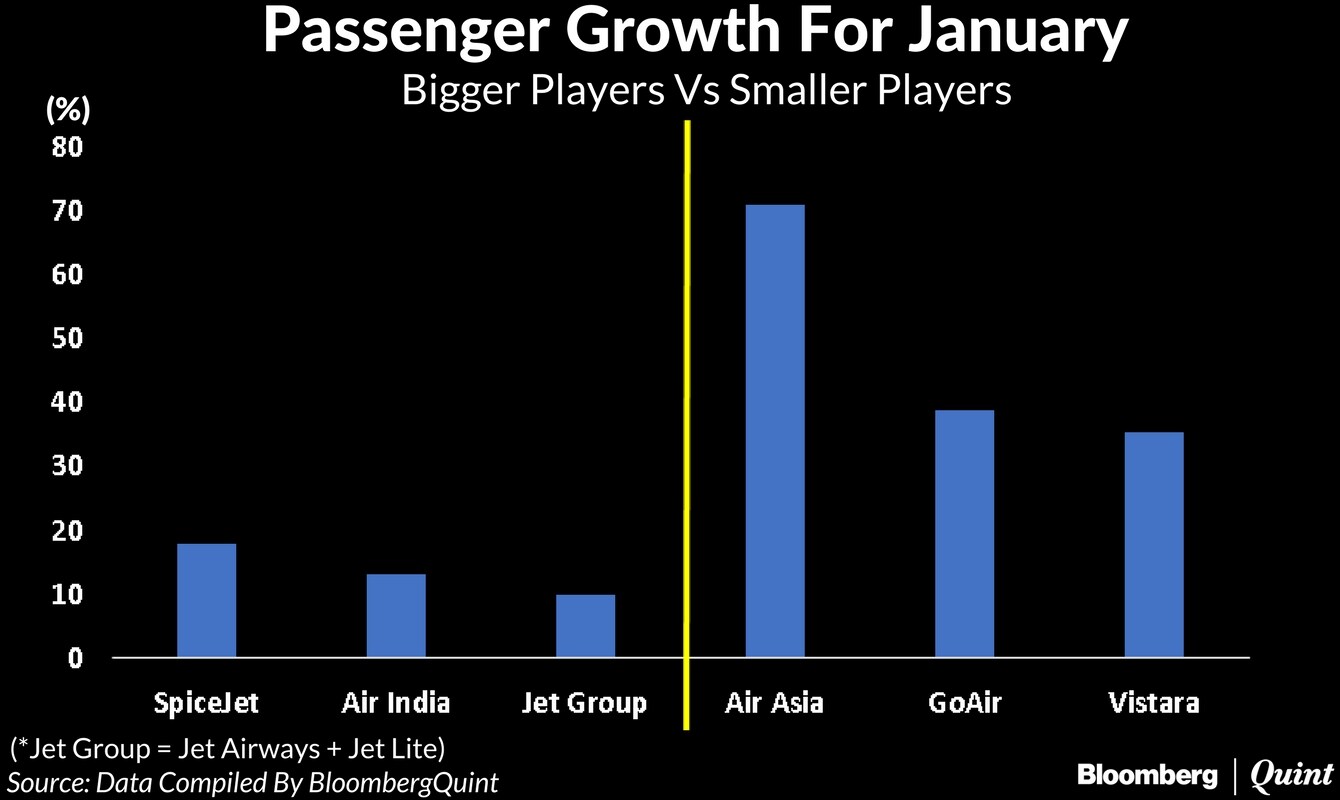

While passenger traffic for other bigger carriers like—Air India Ltd., Jet Airways Ltd. and Spicejet Ltd.—rose below the industry average, it was higher for smaller airlines like GoAir, Air Asia and Vistara.

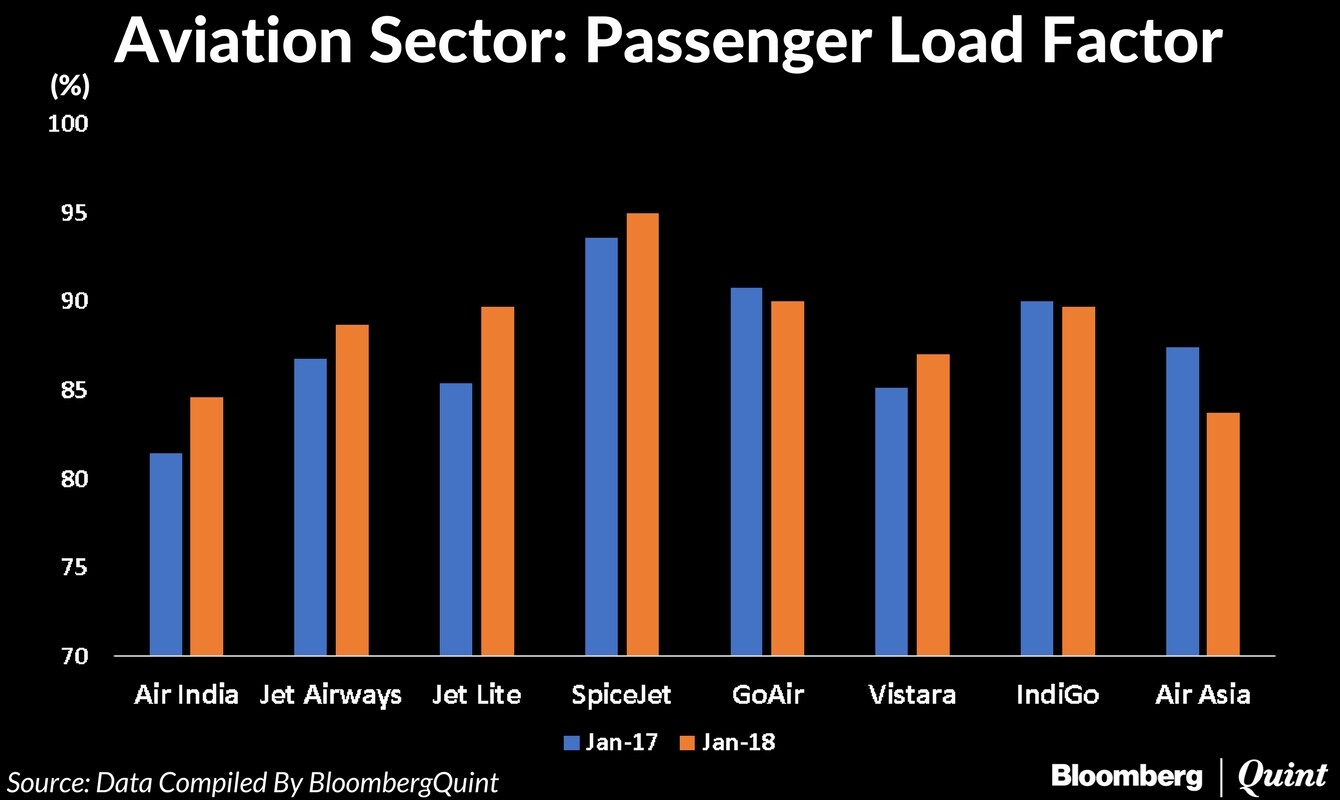

Passenger load factor, a measure of capacity utilisation, grew for only four carrier among the top seven—Air India, Jet Group, SpiceJet and Vistara. It fell for IndiGo, GoAir and Air Asia over a year ago. SpiceJet has clocked a 90 percent-plus passenger load since May 2015.

Also Read: Davos WEF 2018: Ajay Singh Says UDAN Helped SpiceJet Maximise Profit

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.