Shares of Aster DM Healthcare Ltd. rose over 5% on Wednesday after it decided to acquire the remaining 13% stake in its subsidiary Prerana Hospital Ltd.

Aster DM entered into an agreement with the key promoters and minority shareholders of its arm Prerana Hospital (Aster Aadhar), to acquire an additional stake in Prerana Hospital.

Post this, the healthcare company will own 100% of the Prerana Hospital, from the 87% stake earlier, it said in its exchange filing on Tuesday. The transaction is expected to be completed in two tranches before 2025-end.

The complete acquisition of Prerana Hospital "marks a significant milestone for Aster DM Healthcare in its continued growth and diversification strategy", it said in the statement.

Aster DM is "well-positioned" to meet the increasing demand for advanced healthcare in India and the operating Ebitda margin is expected to reach 23% to 25% over the next four to five years.

The subsidiary will operate and leverage the parent company's strengths, including its established market presence and financial stability, it said.

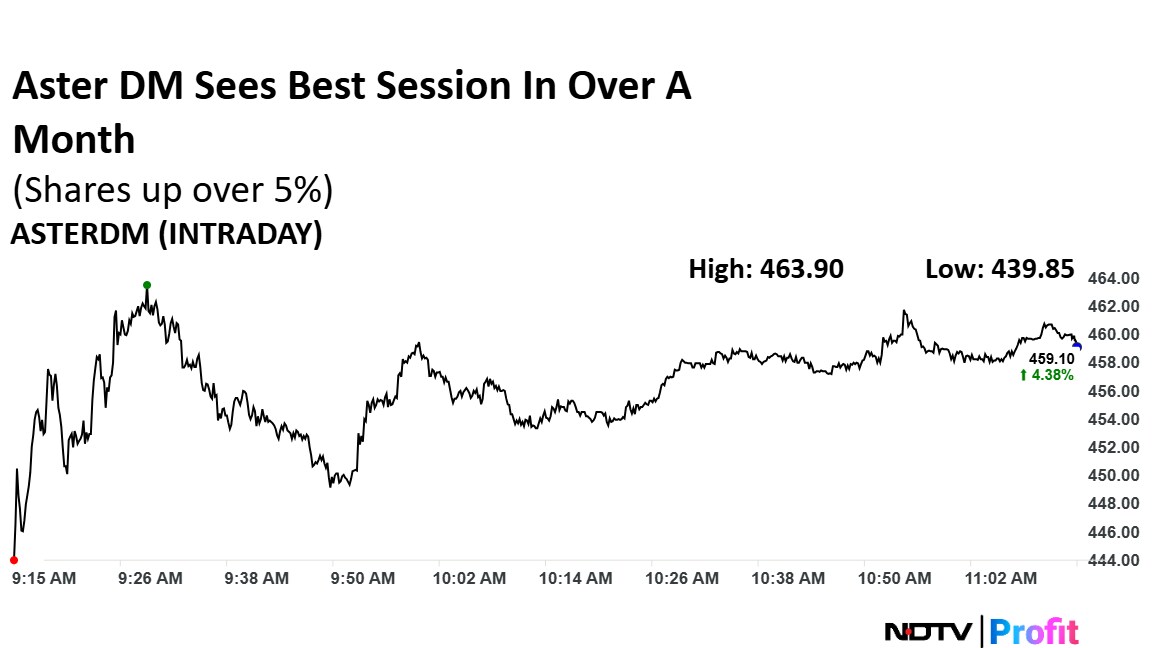

Aster DM Share Price Today

Aster DM stock rose as much as 5.47% during the day, before paring gains to trade 4.68% higher at Rs 460.4 apiece as of 11:11 a.m. This compares to a 0.05% advance in the benchmark Nifty 50.

It has risen 38% during the last 12 months and has advanced by 45% on a year-to-date basis. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 67.

Of the eight analysts tracking the company, seven have a 'buy' rating on the stock, and one has a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.