Ashok Leyland Ltd.'s share price jumped over 7%, following the announcement of its third-quarter earnings and bullish outlook from brokerages.

The company's consolidated net profit grew 31% year-on-year to Rs 761.74 crore, up from Rs 580.03 crore in the same period last year.

The commercial vehicle manufacturer reported a 2.2% increase in revenue, reaching Rs 9,436.17 crore, compared to Rs 9,231.06 crore in the previous year. The company's earnings before interest, taxes, depreciation, and amortisation also saw a notable rise of 9%, amounting to Rs 1,168.93 crore, up from Rs 1,071.98 crore. The Ebitda margin improved to 12.4% from 11.6%.

Ashok Leyland, a flagship company of the Hinduja Group, is one of the leading manufacturers of commercial vehicles in India. The company produces a wide range of products, including trucks, buses, light vehicles, and defence vehicles.

Ashok Leyland's third quarter results exceeded PhillipCapital's estimates, driven by better-than-expected realisations and lower other expenses, the brokerage said. Revenue, Ebitda, and adjusted PAT surpassed estimates by approximately 3%, 9%, and 7%, respectively.

"9MFY25 performance is healthy. Despite flattish topline, Ebitda margin improved by 57bps to 11.7% and adjusted PAT increased by 13.5%," it said.

Kotak Securities echoed similar sentiment on Ashok Leyland's third quarter earning and maintained its 'add' rating on the stock. "The company's performance was better than our estimates led by better-than-expected ASPs, possibly due to higher non-auto mix. The company continues to execute well to manage its margins despite decline in volumes in 9MFY25E," the brokerage said.

Profitability trends are expected to improve, driven by pricing discipline in the core business and an increase in the non-auto mix, which is margin accretive, Kotak Securities said.

However, volume trends in the truck and LCV segments continue to remain muted, and these trends are expected to persist over the coming quarters.

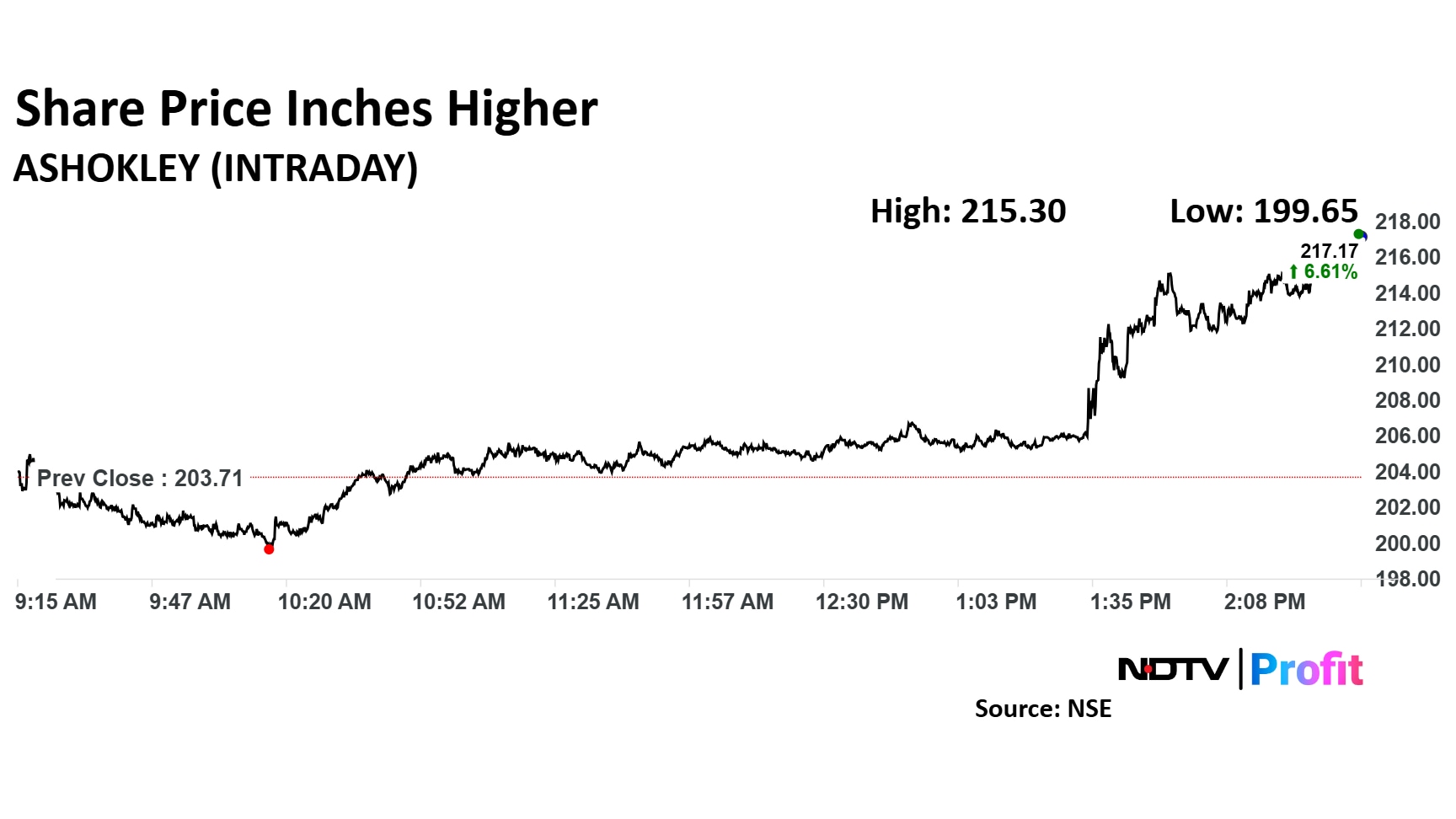

Ashoke Leyland Share Price Today

The scrip rose as much as 7.43% to Rs 218.85 per share. It pared gains to trade 7.08% lower at Rs 218.14 apiece, as of 2:54 p.m. This compares to a 0.43% decline in the NSE Nifty 50.

It has risen 27.31% in the last 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 54.

Out of 42 analysts tracking the company, 32 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.