The Nifty Auto rose as much as 1.20% intraday, following the Reserve Bank of India's Monetary Policy Committee decision to reduce the key lending rate by 50 basis points to 5.5%. This move is expected to stimulate economic activity by making borrowing cheaper for businesses and consumers.

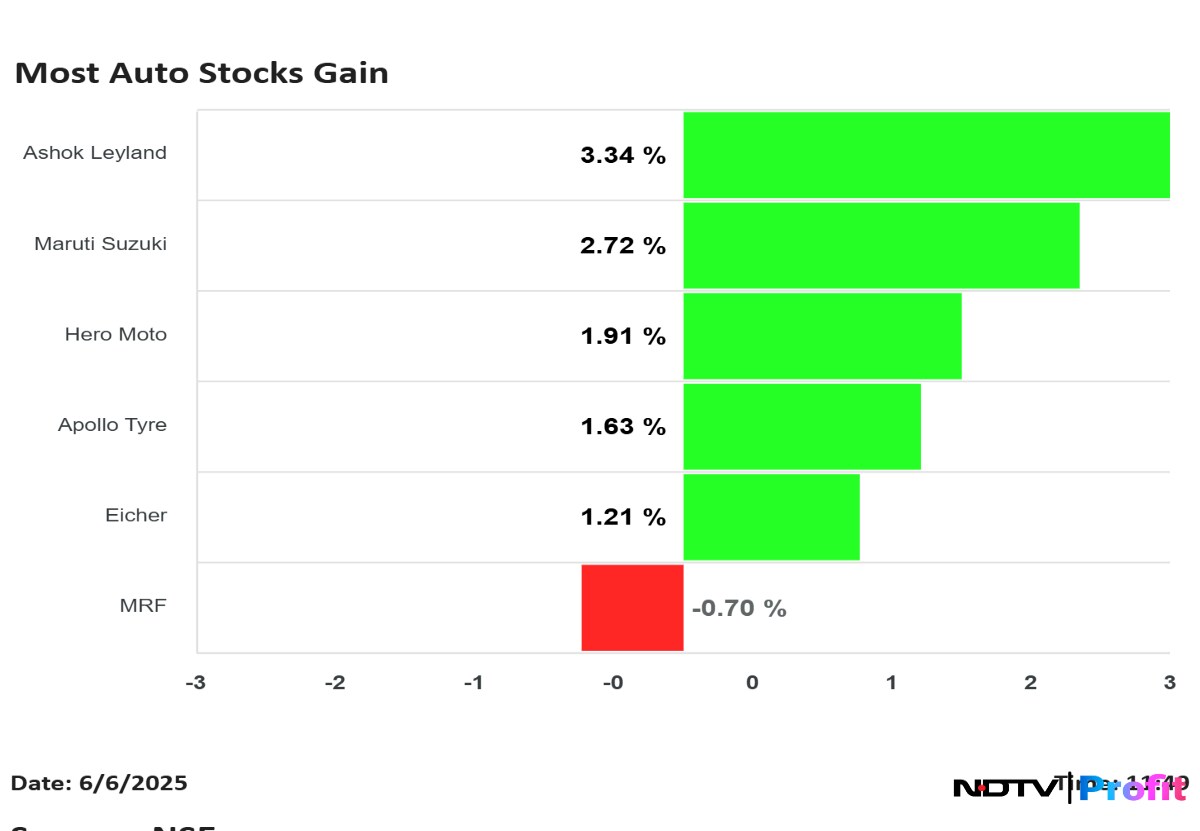

Ashok Leyland Ltd. led the gains, with its share price rising by 3.65% to reach a high of Rs 242.47. Maruti Suzuki India Ltd. followed close, with its share price climbing by 3.11% to a high of Rs 12,503.

The rate cut seems to have anticipated a boost in consumer demand for automobiles, benefiting major players like Maruti Suzuki.

Hero MotoCorp Ltd. experienced a 2.52% increase, with its share price reaching Rs 4,284.2. The move in auto stock could be due to reduction in borrowing costs which is expected to positively impact the company's sales and overall market performance.

The RBI MPC's decision to cut the repo rate by 50 basis points aims to enhance liquidity and reduce the cost of funding for banks. In its previous meeting in April 2025, the MPC, led by RBI Governor Sanjay Malhotra, had reduced the repo rate by 25 basis points from 6.25% to 6%.

Additionally, the RBI announced a reduction in the Cash Reserve Ratio by 100 basis points, lowering it from 4% to 3%. This cut will be implemented in four stages and is expected to release primary liquidity of Rs 2.5 lakh crore into the banking system, further supporting economic growth and stability.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.