Ashok Leyland Ltd.'s board approved a bonus issue of equity shares in 1:1 ratio on Friday.

The issuance of bonus shares is subject to approval of shareholders through postal ballot and other approvals as applicable. The company will inform the record date for determining the entitlement of the shareholders to receive bonus shares in due course.

The board has also recently recommended a dividend of Rs 4.25 per share with a face value of Re 1 each for financial year 2025, according to a separate exchange filing. The second interim dividend will be paid on or before June 14. The record date for the same was May 22.

The total amount to be disbursed as dividend is Rs 1,248 crore. Retail investors who own up to 9.56% stake will receive a sum total of up to Rs 118 crore.

This comes as the company announced its fourth quarter results on Friday.

Ashok Leyland Q4 Highlights (Standalone, YoY)

Revenue up 5.7% to Rs 11,906.71 crore versus Rs 11,266.69 crore.

Net profit up 38% to Rs 1,245.87 crore versus Rs 900.41 crore.

Ebitda up 12% to Rs 1,790.96 crore versus Rs 1,592.11 crore.

Margin at 15.0% versus 14.1%.

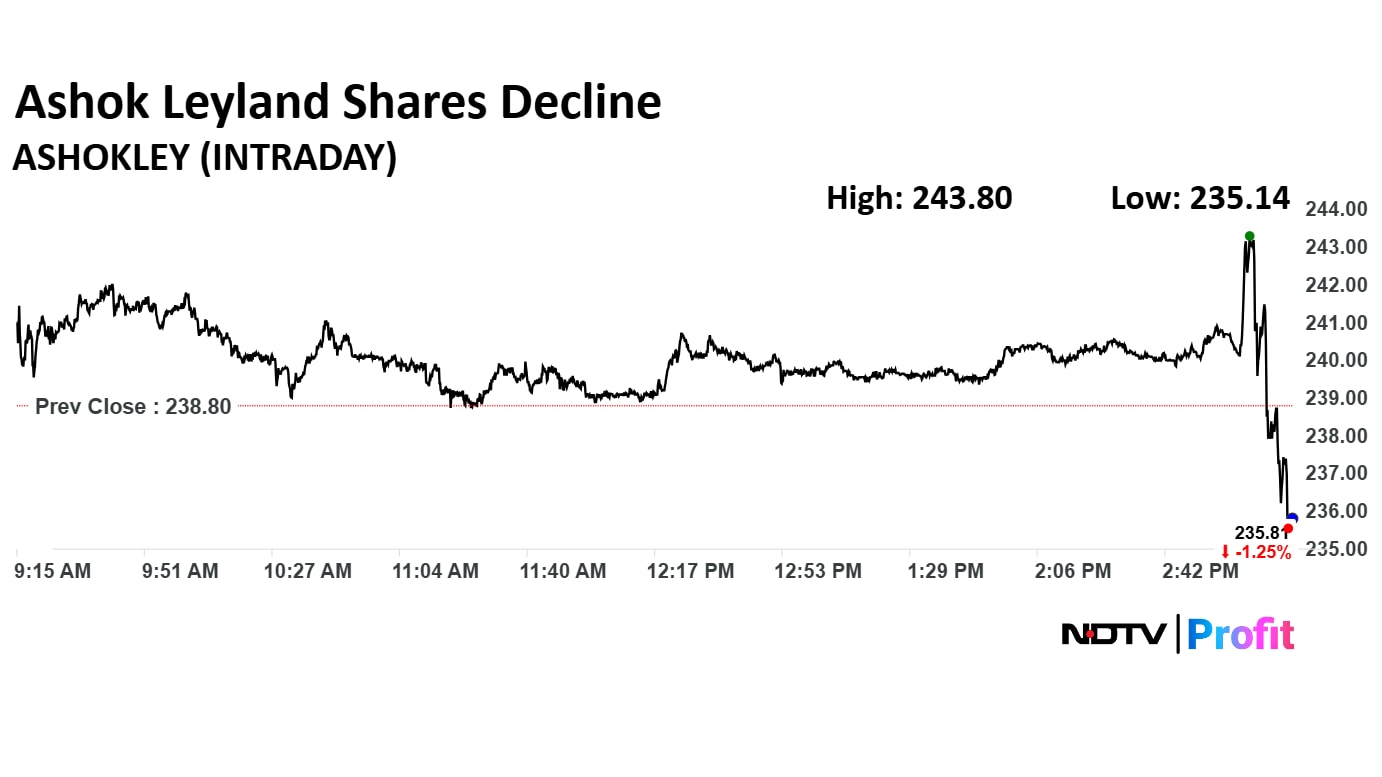

Ashok Leyland Share Price Today

The scrip rose as much as 2.09% to Rs 243.80 apiece. It pared gains to trade 0.80% lower at Rs 236.90 apiece, as of 03:15 p.m. This compares to a 0.99% advance in the NSE Nifty 50.

Out of 44 analysts tracking the company, 36 maintain a 'buy' rating, four recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.