Shares of Apollo Hospitals Enterprises Ltd. fell over 4% on Tuesday even as the firm posted a 52% net profit growth in the third quarter of the current financial year, beating analysts' estimates.

Apollo Hospitals' counter plunged as the Adani Group announced the launch of Adani Health City integrated health campuses, to be implemented through the Group's not-for-profit healthcare arm.

The Adani Group has engaged the USA's Mayo Clinic Global Consulting (Mayo Clinic) to provide strategic advice on organisational objectives and clinical practices at these establishments.

The company posted a profit of Rs 372.3 crore in the quarter ended Dec. 31, 2024, according to an exchange filing on Monday. Analysts tracked by Bloomberg had estimated a profit of Rs 347 crore.

In the healthcare services segment, the company recorded revenue of Rs 2,785 crore, up 13% year-over-year; Ebitda of Rs 670.6 crore, a 14% year-over-year increase, with a margin of 24.1% and a profit of Rs 348 crore, representing 21% year-over-year growth.

The company has also declared an interim dividend of Rs 9 per share.

Morgan Stanley maintained its 'overweight' rating, with a target price of Rs 1,859 per share.

The third quarter earnings were in line with estimates, and the hospital firm has 7,996 operating beds and plans 3,512 bed addition across 11 locations over three to four years starting next fiscal, the brokerage said. "Apollo is building a unique healthcare platform and has scope for consolidated return on capital employed expansion."

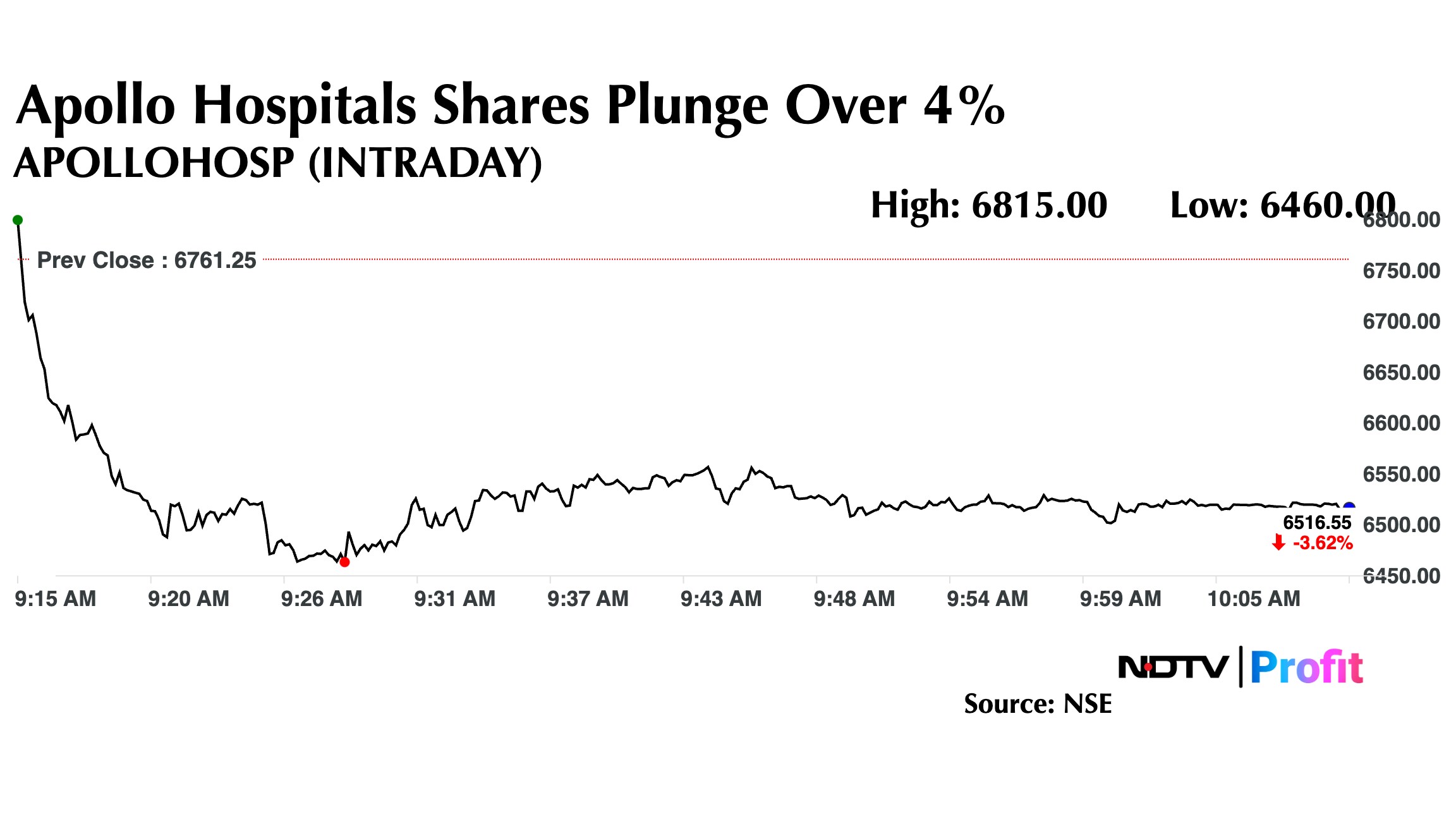

Apollo Hospitals Share Price Today

Apollo Hospitals' share price fell as much as 4.46% intraday to Rs 6,460 apiece. The scrip was trading 3.61% lower at Rs 6,516 per share as of 10:00 a.m., compared to a 0.36% decline in the Nifty 50.

The stock has risen 1.24% in the last 12 months and has fallen 10.66% on a year-to-date basis. Total traded volume so far in the day stood at 0.31 times its 30-day average. The relative strength index was at 49.28.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.