Shares of Anand Rathi Wealth Ltd. listed at a premium on market debut after its Rs 660-crore initial public offer saw healthy investor demand.

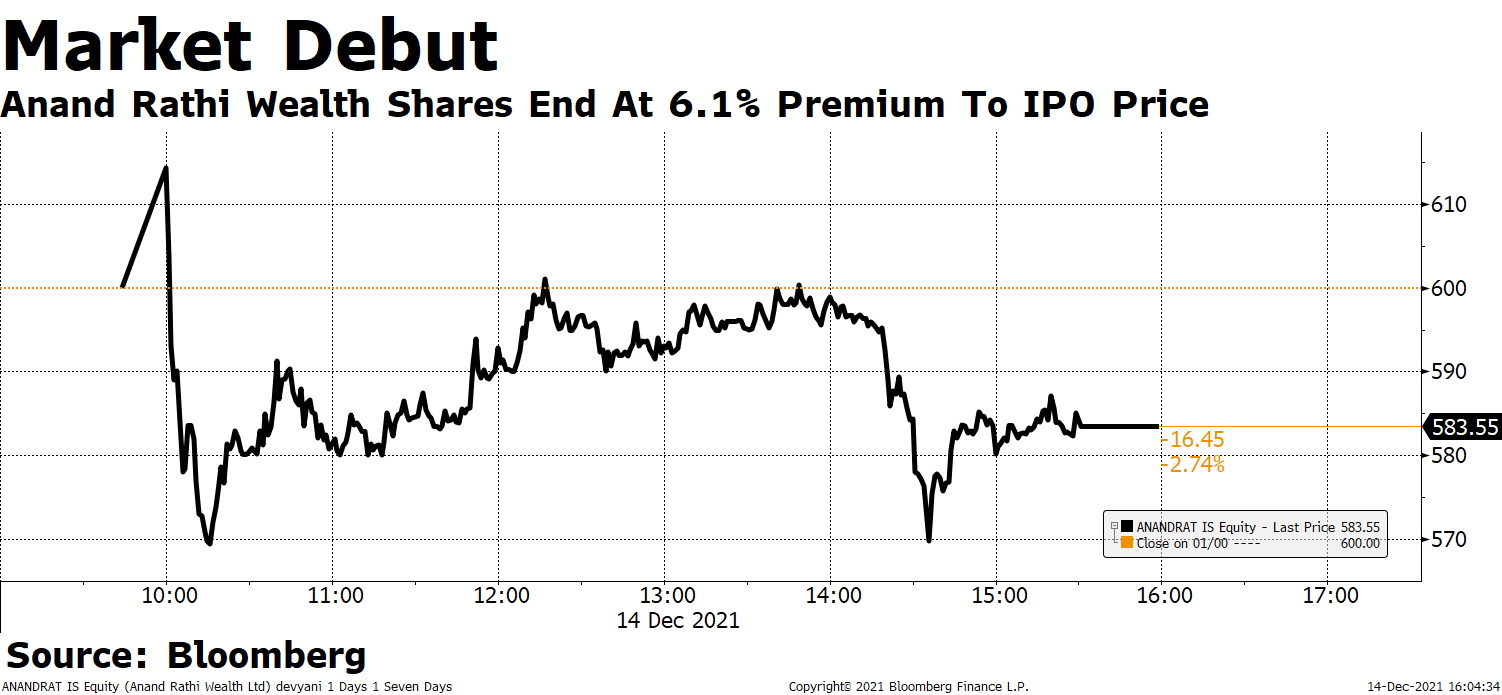

The stock listed at Rs 600 apiece, a nearly 9.1% premium over the issue price of Rs 550 apiece, on the National Stock Exchange. The stock hit an intraday high of Rs 615 apiece. It ended at Rs 583.55 apiece, a 6.1% premium to IPO price.

Anand Rathi Wealth's IPO—a pure offer for sale by promoter shareholders and investors—was subscribed 9.78 times.

The company is into distribution of mutual fund products to clients and structured products, including market-linked debentures to high net worth investors. The total assets under management of its clients was Rs 30,209 crore as of August.

Research Reports On Anand Rathi Wealth

Anand Rathi Wealth IPO - A Play On Structural Wealth Management Business: ICICI Direct

Anand Rathi Wealth IPO - Healthy Prospects; Valuations Look Pricey: Reliance Securities

Watch the full interview with the company's management here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.