Stocks in Asia rose after a strong session on Wall Street as a slew of data bolstered confidence in the American economy.

Shares in Hong Kong led the advance, though gains were more modest in Tokyo and Seoul, with the MSCI Asia Pacific Index on course for its biggest weekly rise since June.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, rose 0.35 percent to 10,899.50 as of 7:20 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's a quick look at all that could influence equities today.

- The pound padded Wednesday's surge after the U.K. Parliament blocked a no-deal Brexit and an early election.

- Oil is on track for a second straight weekly gain, buoyed by a big drawdown in U.S. crude stockpiles and reports that the U.S. and China would hold trade negotiations next month.

Get your daily fix of global markets here.

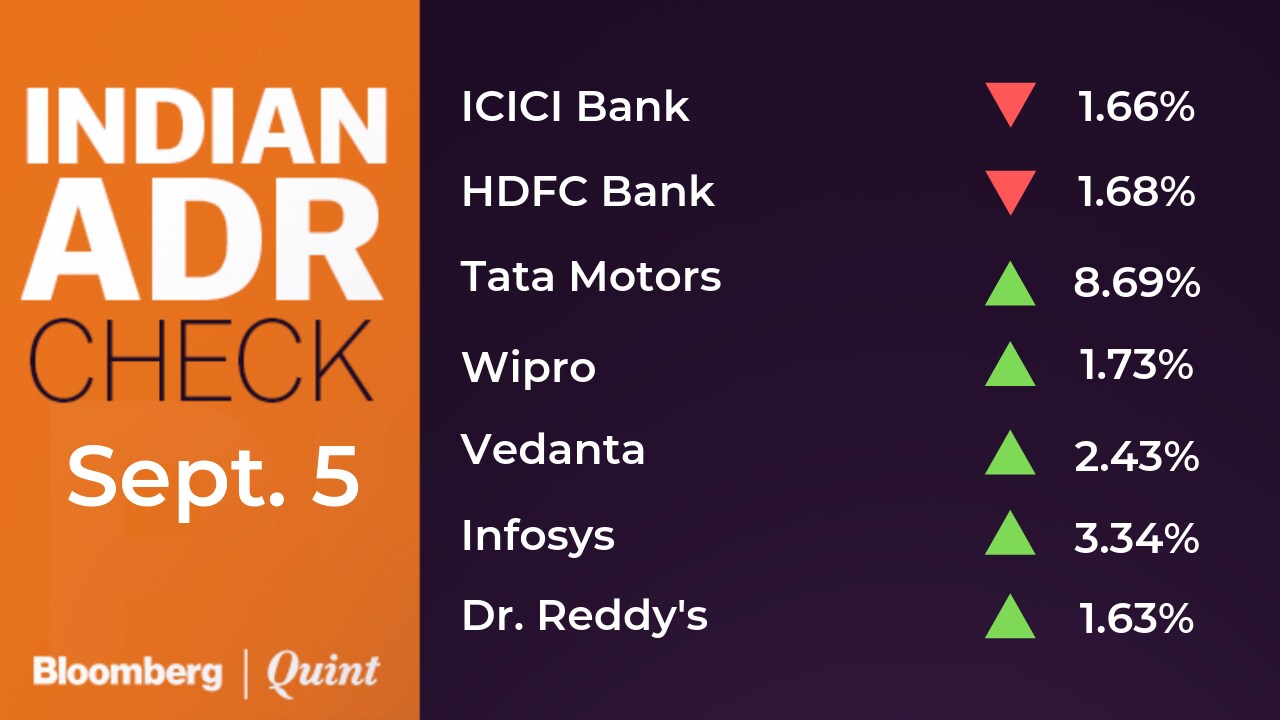

Indian ADRs

Stocks To Watch

- Reliance Industries: Reliance Jio has announced the commencement of JioFiber with effect from Sept. 5. Broadband speed to start from 100 Mbps to 1 Gbps. In the welcome officer a Jio Fiber user gets TV, 4K set top box, OTT app subscription n unlimited data and voice/video calling. Monthly prepaid tariffs start from Rs 699 to Rs 8499. For long term plans users will have access to three, six and 12 months with bank tie-up for EMI.

- Sun Pharma clarified that SEBI had ordered forensic audit with respect to financial statements for financial years 2016, 2017 and 2018, which are presently underway. The company said that it has always sought to comply with regulatory obligations.

- Bajaj Finance to consider raising funds via QIP issue on Sept. 17.

- NDTV: Bombay High Court has set aside SEBI's orders which were passed in August 2017. The company's writ petition challenged order passed by SEBI in which the authority it rejected settlement applications filed by the company in the alleged delayed disclosure of Rs 450 crore disputed tax demand and other alleged non-disclosures. High Court has condoned delay in filing of the settlement applications and has directed SEBI to decide the said applications on merits.

- Prabhat Dairy: Board of directors to consider delisting of shares from the bourses on Sept. 10. The promoters intent to acquire 49.9 percent stake from the public shareholders and then go for voluntary delisting. At present, they hold 50.1 percent stake in the company.

- Videocon Industries: The National Company Law Tribunal has directed State Bank of India to maintain status quo on its plan to sell upstream oil and gas assets of the Group located in Brazil and Indonesia.

- L&T Finance Holdings: Board to consider raising up to Rs 100 crore via non-convertible preference shares on Sept. 11.

- Bank of Baroda reduced MCLR across various tenors by five basis points with effect from Sept. 7. One Month MCLR at 8.1 percent and One Year MCLR at 8.4 percent.

- TCS has expanded its strategic partnership with Posten Norges AS for solutions in areas of mail, communications and logistics.

- Tech Mahindra has announced a multi-year agreement with AT&T Network.

- Hinduja Global Solutions stated that it has recovered $1 billion in denied insurance payments on behalf of healthcare systems. The company has collected more than $3 billion in accounts receivables so far on behalf of healthcare systems.

- Karur Vyasa Bank revised its MCLR across various tenors with effect from Sept. 7. Base Rate at 9.7 percent, one-month MCLR at 8.35 percent and one-year MCLR at 9.45 percent. Bank has also executed an agreement with ICICI Lombard General Insurance to sell non-life insurance products.

- DHFL defaulted in payment of non-convertible debentures interest worth Rs 1.4 crore which were due between Sept. 3-4.

- NCC: Sundaram Group decreased stake from 5.16 percent to 2.77 percent in the company.

- Datamatics Global Services entered in a strategic partnership with Bangalore International Airport for digital services.

- Maruti Suzuki: European Commission cleared the acquisition of joint control over a newly created plant, by Toyota Tsusho India Pvt. Ltd., its parent Toyota Tsusho Corporation, and Maruti Suzuki India Ltd., according to European Commission's statement.

Indiabulls Housing Finance clarifies on the PIL against the company and its promoter saying that it will fight out the petitioners in the court.

September 6, 2019

Catch all the market stories here: https://t.co/qabQTwOlPa pic.twitter.com/tWvEuGSHJqBrokerage Radar

On Reliance Industries' JioFiber Plans

CLSA

- JioFiber plans are 13-23 percent cheaper, data allowances are lower.

- JioFiber is unlikely to expand the broadband market as pricing has not been lowered meaningfully.

- See limited impact on Bharti Airtel and Dish TV.

Macquarie

- Plans are lucrative, but not lucrative enough.

- Getting TV subscribers not having broadband connectivity on board will be challenging.

- Expect churn in DTH to be much lower than street expectation.

- Do not impact much impact on PVR/Inox as movie premiere available on selected plans.

Credit Suisse

- Jio's entry level broadband pricing competitive.

- No combo plans announced with cable and mobile.

- If Jio achieves target of 20 million subscribers, then broadband service could contribute $1.2 billion to Ebitda.

- Higher speed should help in faster content downloads, multiplayer gaming, etc.

Goldman Sachs

- JioFiber plans in-line with expectations; Free TV may not be a big draw

- Bharti could continue to see ARPU pressure; Impact on PayTV and movie exhibitors low

- Low possibility of churn as customer is quite sticky

- Tariff hike in wireless segment towards end of 2019-20.

More Calls

CLSA on India Steel

- Falling cost curve weakens the case for steel price rally.

- Indian steel prices under pressure too.

- Tata Steel: Maintained ‘Sell'; cut price target to Rs 275 from Rs 320

- JSW Steel: Maintained ‘Sell'; cut price target to Rs 170 from Rs 200

JPMorgan on InterGlobe Aviation

- Upgraded to ‘Overweight' from ‘Neutral'; hiked price target to Rs 2,080 from Rs 1,630.

- Structural cost advantage in a highly competitive industry.

- Revenue growth to be driven by internals.

- Expect September quarter to be seasonally weak, providing an opportunity to buy.

Nomura on Axis Bank

- Maintained ‘Buy'; cut price target to Rs 875 from Rs 900.

- Retail growth has been high but prudent with focus on growth from liability customers.

- Profitability to normalize in FY21; market expectation from new mgmt. look more reasonable now.

- Valuations not demanding anymore; cut price target to adjust for moderate growth.

HSBC on Life Insurance

- Robust sales and improving product mix.

- Non-par and annuity offerings and competition in protection need to be monitored.

- Expect sales of HDFC Life's non-par product to moderate.

- HDFC Life: Maintained ‘Hold'; hiked price target to Rs 510 from Rs 484.

- ICICI Prudential: Maintained ‘Buy'; hiked price target to Rs 470 from Rs 460.

- SBI Life: Maintained ‘Buy'; hiked price target to Rs 870 from Rs 826.

Trading Tweaks

- Reliance Communications to move into short term ASM Framework.

Who's Meeting Whom

- Deepak Fertliser & Petrochemicals to meet Bellwether Capital on Sept. 6.

- Eris Lifesciences to meet DSP, Reliance MF and other investors on Sept. 6.

- GSK Pharma to meet Matthews International Capital Management on Sept. 12.

- Shriram City Union Finance to meet Enam Holdings on Sept. 6.

- Sundram Fasteners to meet SBI Cap Securities on Sept. 6.

Insider Trading

- Rico Auto Industries promoters acquired 50,000 shares from Sept. 3-4.

- Anant Raj promoter Anil Sarin acquired 1.3 lakh shares on Aug. 30.

- Tourism Finance Corporation promoter India Opportunities acquired 99,000 shares on Sept. 3.

Money Market Update

- The rupee strengthened for the second straight session to close at 71.84/$ versus 72.12/$ on Wednesday.

F&O Cues

September Futures

- Nifty Sep futures closed at 10,881.6, premium of 33.7 points versus 41.7 points.

- Nifty futures open interest up 2 percent, adds 2.9 lakh shares in open interest.

- Bank Nifty Sep futures closed at 26,994, premium of 74 points versus 95 points.

- Bank Nifty futures open interest up 6 percent, adds 90,000 shares in open interest.

Options

- Nifty PCR at 1.24 versus 1.08 (across all series).

Nifty Weekly Expiry: Sept. 12

- Max open interest on call side at 11,000 (15.5 lakh shares).

- Max open interest on put side at 10,800 (11.7 lakh shares).

- open interest addition seen at 11,200C (+8.1 lakh shares), 10,800P (+7.6 lakh shares), 11,000C (+7.3 lakh shares).

Nifty Monthly Expiry: Sept. 26

- Max open interest on call side at 11,000 (23.4 lakh shares).

- Max open interest on put side at 10,800 (31.8 lakh shares).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.