Asian stocks fell after renewed concern about an interim U.S.-China trade deal curbed sentiment.

Japan's Topix index opened lower, with shares down more modestly in Sydney. Equities in Seoul shrugged off the latest plunge in South Korean exports. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.23 percent to 11,900.50 as of 6:50 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's a quick look at all that could influence equities today.

- U.S. stocks fell as weak manufacturing data and renewed concern on trade rattled markets adjusting to the Federal Reserve's signal that it's done easing.

- Oil fell for a third day as a U.S. government report showed a bigger-than-expected build in domestic crude supplies and Chile cancelled a summit where the U.S. and China were expected to sign a preliminary trade accord.

Get your daily fix of global markets here.

Key Data To Watch

- 10:30 a.m.: Markit India Manufacturing PMI for Oct., prior 51.4

Earnings Reaction To Watch

Thirumalai Chemicals (Q2, YoY)

- Revenue fell 26.1 percent to Rs 268.6 crore.

- Net profit fell 81.4 percent to Rs 9.9 crore.

- Ebitda fell 74.1 percent to Rs 22.8 crore.

- Margin stood at 8.5 percent versus 24.2 percent.

Spandana Sphoorty Financial (Q2, YoY)

- Net Interest Income rose 26.2 percent to Rs 202.8 crore.

- Net profit fell 37.9 percent to Rs 45.7 crore.

- Deferred Tax Expense rose 3.6 times to Rs 144.8 crore.

Laurus Labs (Q2, YoY)

- Revenue rose 21.1 percent to Rs 712.4 crore.

- Net profit rose 3.5 times to Rs 56.5 crore.

- Ebitda rose 82.3 percent to Rs 137.8 crore.

- Margin stood at 19.3 percent versus 12.9 percent.

Blue Dart Express (Q2, YoY)

- Revenue flat at Rs 802.2 crore versus Rs 800.2 crore.

- Net profit fell 35.1 percent to Rs 14.6 crore.

- Ebitda rose 87.1 percent to Rs 126.5 crore.

- Margin stood at 15.8 percent versus 8.4 percent.

Nifty Earnings To Watch

- Dr. Reddy's Laboratories

- Yes Bank

Other Earnings To Watch

- JSW Energy

- Central Bank

- Bank of India

- Kansai Nerolac Paints

- Karur Vysya Bank

- Mishra Dhatu Nigam

- Bank of India

- Butterfly Gandhimathi Appliances

- Cigniti Technologies

- GIC Housing Finance

- Hawkins Cookers

- Hindustan Media Ventures

- JK Lakshmi Cement

- LGB Forge

- V-Mart Retail

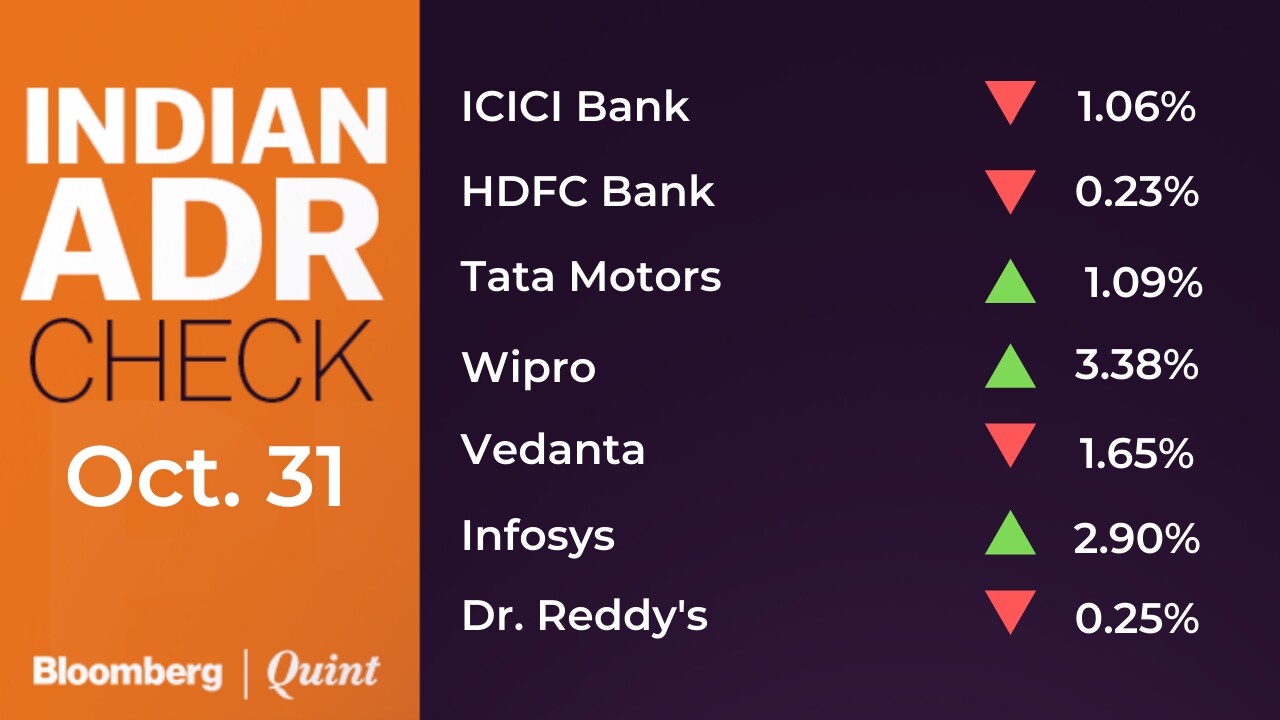

Indian ADRs

Stocks To Watch

- Automakers will be in focus as the companies are set to announce September sales data.

- Bharti Airtel: S&P has placed to company on Watch Negative on adverse Supreme Court Ruling, according to Bloomberg report.

- Indian Oil Corporation will undertake partial shutdown of Guwahati, Bongaigaon refineries in January and February. Refinery shutdowns are being taken for fuel upgrade and maintenance, Bloomberg reported.

- Vodafone Idea clarified that it is not aware of the news of Vodafone Group exiting from the India operations and denied that the company has gone to its lenders for a debt recast.

- SRF has commissioned and capitalised a facility to produce agrochemical intermediates at Rs 166 crore. The company said that there has been a cost overrun in the project due to change in the original design and installation of additional effluent treatment equipment, which was earlier estimated at Rs 140 crore. SRF has also commissioned a facility to enhance HFC capacity to 34,500 TPA from 17,500 MTPA at a cost of Rs 477 crore, which has earlier estimated at Rs 356 crore.

- IndusInd Bank has said that it has finalised the potential candidate for the position of managing director and chief executive officer who will take over the aforementioned position from April 2020. On the receipt of Reserve Bank of India's approval, the bank will make the required disclosure to the exchanges. The current MD and CEO of IndusInd Bank, Romesh Sobti will retire in March 2020.

- Sanofi India will lower the price of Rifapentine, a critically important drug used to prevent Tuberculosis, as a part of its agreement with Unitaid, the Global Fund to Fight AIDS, Tuberculosis and Malaria, according to PTI report.

- HCL Technologies has launched a dedicated Google Cloud Business Unit to accelerate enterprise cloud adoption.

- Bajaj Auto and TVS Motors have amicably settled a decade old patent dispute. Both the companies have mutually agreed to withdraw the pending proceeding release each other from all liabilities and actions.

- Ahluwalia Contracts received three construction orders worth Rs 521.7 crore. Total order inflow during 2019-20 stands at Rs 1,449.3 crore.

- Manappuram Finance: Board approved issuing non-convertible debentures up to Rs 250 crore. The committee will consider the proposed allotment on Nov. 7.

- GTPL Hathway: Acacia Partners increased their stake to 5.89 percent from 3.97 percent in the company.

- Sical Logistics: Board approved proposal to seek approval of the shareholders for the disinvestment of the company's units.

- Prakash Industries has expanded the installed capacity in its Steel Melting Shop by commissioning of 4 new energy efficient Induction Furnaces. The enhanced capacity now stands at 1.176 million tons per annum.

- Aster DM Healthcare to acquire 80 percent stake in Dubai's Premium Healthcare for AED 9 Million or Rs 17.4 crore approximately.

- Jai Prakash Power Ventures: The board approved conversion of part of outstanding loans of Canara Bank amounting to Rs 12.02 crore and outstanding loans of Corporation Bank worth Rs 22.5 crore into compulsory redeemable preference shares, respectively. The company will also restructure its Foreign Currency Convertible Bonds and will declare distribution from annual standalone profits of an amount equivalent to 50 percent of its free cash flow in form of dividend payments.

- Shree Renuka Sugars: Board will consider merger of its arm Gokak Sugars with self on Nov. 10.

- Quick Heal Technologies to make a strategic investment of $300,00 in Israel's based cybersecurity startup L7 Defense.

- Allahabad Bank has revised its external benchmark rates- RBI Repo Rate from 5.4 percent to 5.15 percent and Three Month MIBOR from 6.5 percent to 6.15 percent, with effect from Nov. 1.

- Punjab National Bank has reduced MCLR by 10 basis points across various tenors with effect from Nov. 1. One month MCLR at 7.8 percent and one-year MCLR at 8.15 percent.

ATF prices cut by 17% for the month of November 2019 compared to last year.

Read: https://t.co/6oYDbgGeDe pic.twitter.com/Y0h1oZoRTFBrokerage Radar

On Indian Oil Corporation

JPMorgan

- Maintained ‘Overweight' with a price target of Rs 205.

- September quarter missed estimates due to large inventory loss, forex hit and weak refining.

- Reported GRMs lower than estimates; gross debt higher.

- Expect negative reaction to the results.

SBICAP

- Maintained ‘Buy' with a price target of Rs 184.

- Earnings significantly lower due to weak core margin in both refining and marketing segments.

- Surprise inventory gain boosted marketing segment EBITDA; core margin was weak.

- Valuation attractive but government stake sale a key overhang.

Nomura

- Maintained ‘Buy' with a price target of Rs 170.

- September quarter was significantly weaker than estimates.

- Key reason for miss was much lower refining and large forex loss.

- GRMs have been weaker so far in the third quarter.

UBS

- Maintained ‘Buy' with a price target of Rs 200.

- Refining disappoints again; debt level continues to remain elevated.

- Think investors are expected to focus on potential upcycle in earnings with impending IMO 2020 implementation.

More Calls

Macquarie on United Spirits

- Maintained ‘Neutral' with a price target of Rs 592.

- Seeing lower growth in Royal Stag category vs Prestige category in Maharashtra.

- Price cut in Royal Stag of Pernod is to target larger volume segment.

- Expect a price cut by United Spirits will help get some volume shift in Royal Challenge.

Morgan Stanley on Yes Bank

- Maintained ‘Underweight' with a price target of Rs 55.

- Announced capital raise is positive and will limit downside.

- Funds raised at Rs 70, imply equity dilution of 45 percent and book value per share would be lower at Rs 98.

- Expect a gradual turnaround to limit upside; would stay away given unattractive risk reward.

Trading Tweaks

- IST ex-date for share split from Rs 10 per share to Rs 5 per share.

- Career Point to move into ASM Framework.

- Automotive Stampings and Assemblies, Kirloskar Electric Company to move into short term ASM Framework.

- Bharat Wire Ropes, Edelweiss Financial Services, Bliss GVS Pharma, Reliance Power, Zee Learn, Sharda Motor Industries, Shemaroo Entertainment to move out of short term ASM Framework.

- Strides Pharma Science price band revised to 20 percent.

- United Bank of India price band revised to 10 percent.

- SREI Infrastructure Finance price band revised to 5 percent.

Who's Meeting Whom

- MCX to meet ICICI Securities, Kontiki Capital and other investors from Nov. 1-8

- Graphite India to meet Polaris Capital Management on Nov. 1

Insider Trading

- Mindtree promoter Kamran Ozair sold 1,25,000 shares on Oct. 27.

Money Market Update

- The rupee closed at 70.93/$ versus 70.90/$ on Wednesday.

F&O Cues

Index Futures

- Nifty November futures closed at 11914.8, premium of 37 points.

- Nifty futures across series open interest up 7.4 percent, adds 12 lakh shares in open interest.

- Nifty Bank November futures closed at 30,107.5, premium of 41 points.

- Nifty Bank futures across series open interest down 8.6 percent, sheds 1.1 lakh shares in open interest.

- Rollover: Nifty 84 percent, Nifty Bank 64 percent.

Options

- Nifty PCR at 1.41 versus 1.48 (across all series).

Nifty Weekly Expiry: Nov. 7

- Max open interest on call side at 12,000 (14 lakh shares)

- Max open interest on call side at 12,000 (14 lakh shares).

- Open interest addition seen at 11,900C (+9.6 lakh shares), 11,800P (+9.3 lakh shares).

Nifty Monthly Expiry: Nov. 28

- Max open interest on call side at 11,800 (16 lakh shares).

- Max open interest on put side at 11,600 (17.4 lakh shares).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.