Bharti Airtel Ltd.'s share price recorded its best jump since Sept. 12 and was the top contributor to Nifty's gains on Friday, following ICICI Securities' rating upgrade to 'buy'.

The scrip was top gainer among Nifty stocks and also contributed the most to the rise in benchmark-50 stock index.

"We upgrade Bharti Airtel to 'buy' from 'add' as we believe its valuation rerating is supported by solid fundamentals," the brokerage said. It has kept the target price unchanged at Rs 1,875 per share.

"Five key parameters, which influence telcos' valuations, have shown remarkable recovery, and may either sustain or improve further," she said. "Therefore, Bharti's EV/Ebitda valuation, in our view, may hold with more headroom to increase."

"Our estimates for Bharti over FY25-28 suggest each of these five parameters could show further improvement, helping Bharti sustain valuations in base case or could enable further rerating," it said.

Downside risks for the brokerage's call include market share loss in India mobile business and rise in competitive and regulatory intensities.

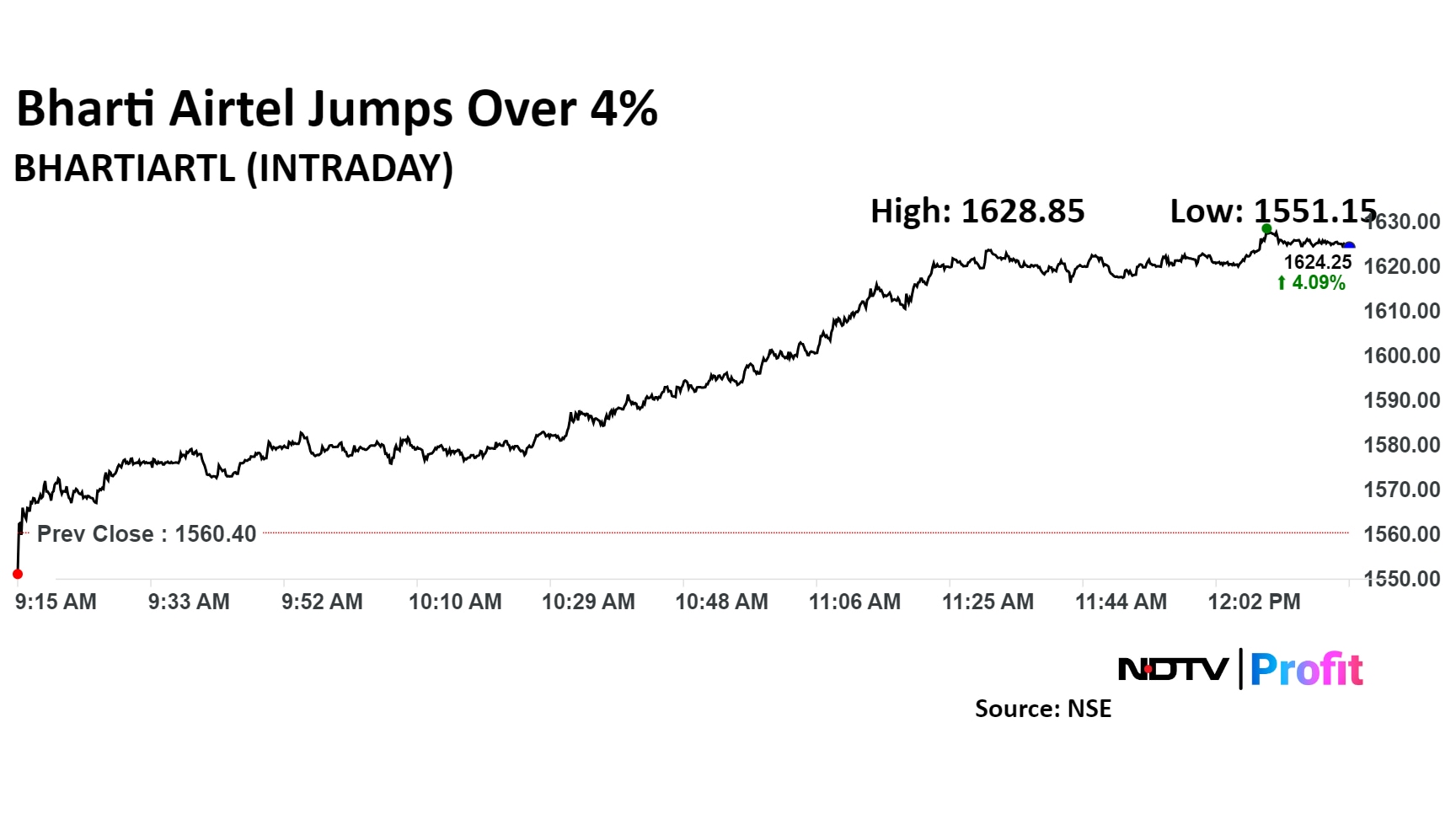

Bharti Airtel Share Price

Shares of Bharti Airtel rose as much as 4.55% to Rs 1,631.45 apiece, the highest level since Oct. 31. It pared gains to trade 4.44% higher at Rs 1,629.65 apiece, as of 11:35 a.m., compared to a 0.8% advance in the NSE Nifty 50.

The stock has risen 58% on a year-to-date basis. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 59.7.

Of the 35 analysts tracking the company, 29 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 64.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.