Shares of Aether Industries Ltd. saw a notable rise of more than 7% following the company's strong performance in its third-quarter earnings for the financial year 2025. The company reported a significant jump in profits, with net profit more than doubling year-on-year.

For Q3 FY25, Aether Industries reported a net profit of Rs 43.3 crore, compared to Rs 17.4 crore in the same quarter last year, marking a growth of over 150%. The company's revenue also saw a robust increase of 41.4%, reaching Rs 219.6 crore, up from Rs 155.3 crore during the same period last year.

Ebitda (Earnings Before Interest, Taxes, Depreciation, and Amortisation) also showed a strong performance, rising to Rs 64.6 crore from Rs 31.2 crore in Q3 FY24. This surge in profitability led to an increase in EBITDA margin, which stood at 29.4% compared to 20.1% last year.

The company also reported with it financials that it faced a significant operational challenge during the quarter. A fire broke out at its Manufacturing Facility 2 in GIDC, Sachin, Surat. This incident led to a closure notice issued by the Gujarat Pollution Control Board (GPCB) and an interim environmental damage compensation of Rs 5 lakh.

However, Aether Industries clarified that the full extent of damage to fixed assets such as machinery, equipment, and other office items is still being assessed, and no financial impact due to the fire was accounted for in the current quarter's results.

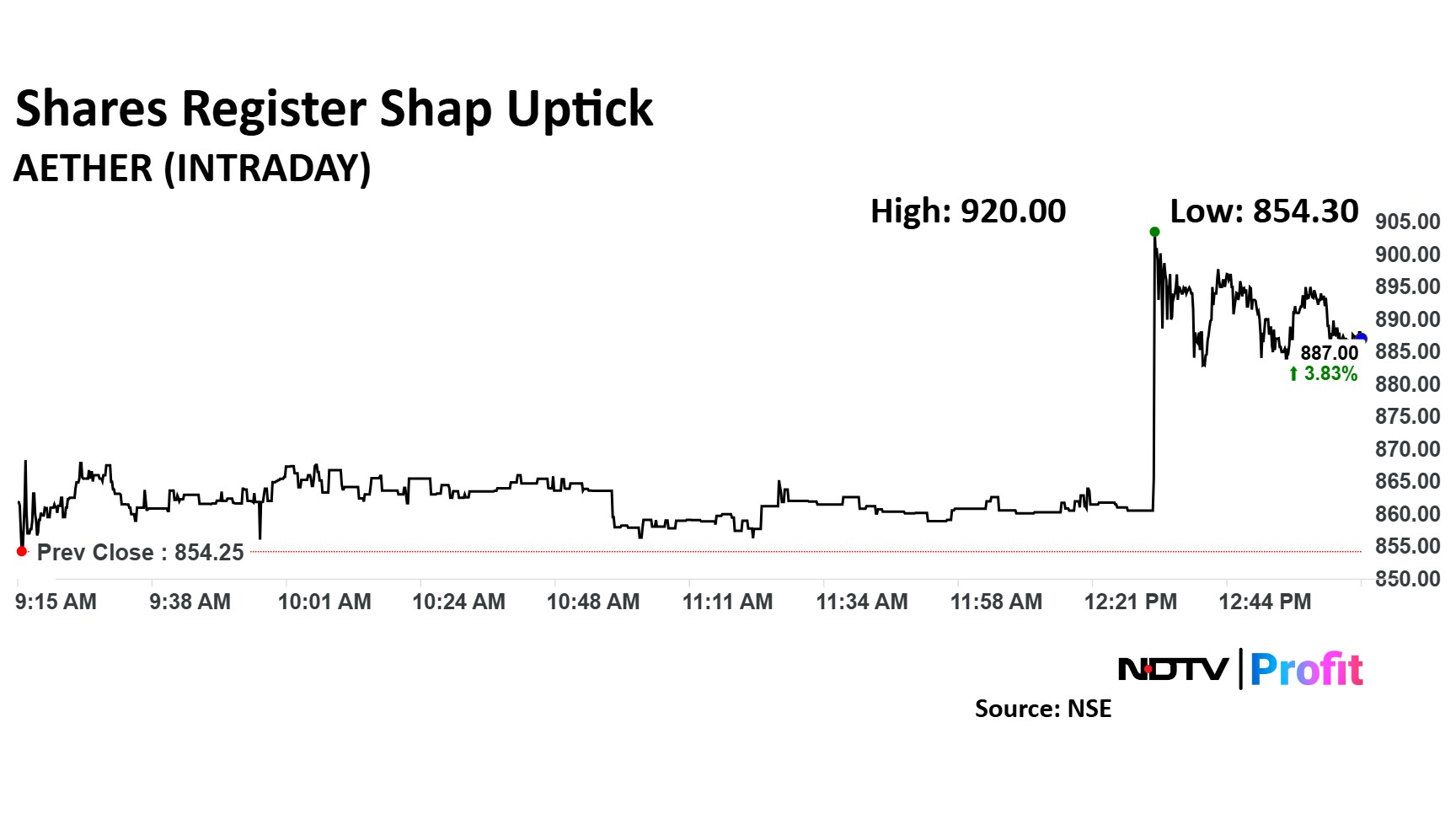

The scrip rose as much as 7.70% to Rs 920 apiece. It pared gains to trade 3.95% higher at Rs 888 apiece, as of 01:09 p.m. This compares to a 0.40% decline in the NSE Nifty 50 Index.

It has risen 1.32% in the last 12 months. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 53.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.