Shares of Aditya Birla Sun Life AMC Ltd. fell over 8% on Tuesday after it reported a decline in net profit in the third quarter of fiscal 2025.

The wealth management firm reported a 7.5% fall in net profit to Rs 224 crore in comparison to Rs 242 crore reported in the previous quarter. Total income for the quarter declined 7.2% to Rs 483 crore against Rs 520 crore reported in the quarter ended September 2024.

Average assets under management rose 3.6% to Rs 68,607 crore in the December quarter in comparison to Rs 66,213 crore reported in the earlier quarter. The mutual fund AUM for the quarter stood at Rs 3.83 lakh crore, while the equity AUM stood at Rs 1.79 lakh crore.

The SIP flow declined to Rs 1,382 crore in December quarter against Rs 1,425 crore reported in the September quarter, the company said in its investor presentation. Registration counts have also fallen to 6.70 lakh from the earlier 11.55 lakh reported in the September quarter.

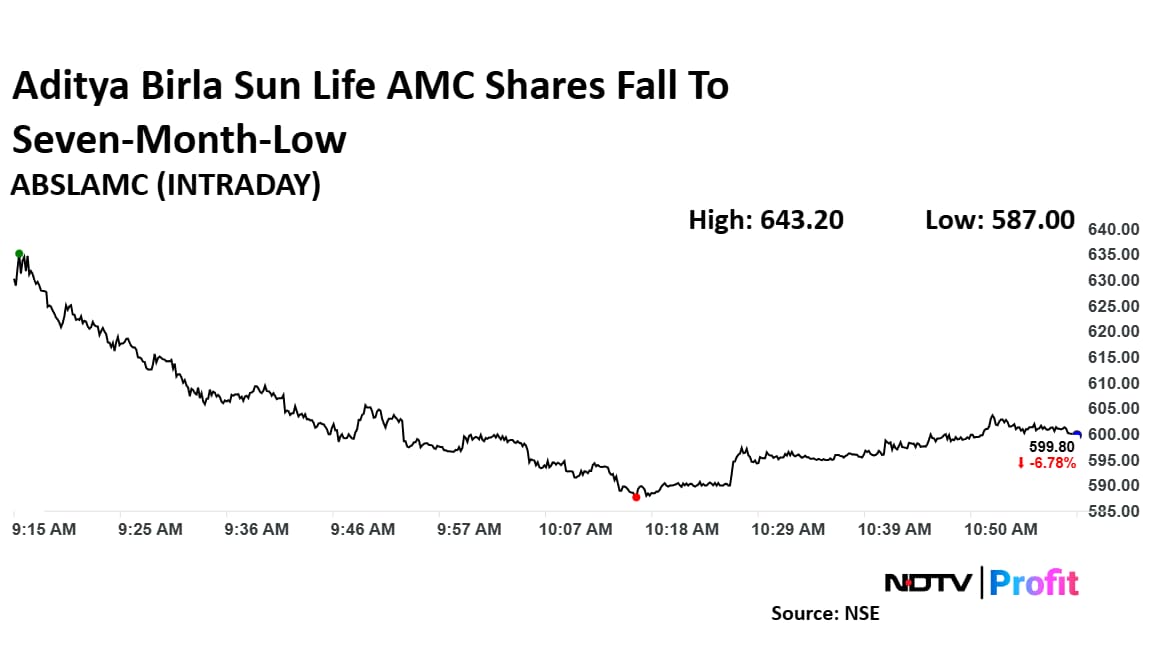

Aditya Birla Sun Life AMC Share Price

Shares of Aditya Birla Sun Life AMC fell as much as 8.77% to Rs 587 apiece, the lowest level since June 7, 2024. It pared losses to trade 6.50% lower at Rs 601.65 apiece, as of 10:55 a.m. This compares to a 0.28% advance in the NSE Nifty 50.

The stock has risen 26.09% in the last 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 20 indicating that the stock is oversold.

Out of 15 analysts tracking the company, nine maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 44.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.