Aditya Birla Capital Ltd.'s share price declined as BofA cut target price to Rs 250 from Rs 260, as it factored in lower net interest margin. The brokerage also cut earning per share estimates by 2–4%. However, it maintained a 'buy' rating on the stock as it sees growth opportunity.

Aditya Birla Capital posted third quarter earnings in line with BofA's estimates. NIMs in non-banking financial companies, housing finance spaces declined, BofA said.

In life insurance space, Aditya Birla Capital's margin declined because of higher unit linked insurance plan, and delay in non-par pricing. The company is expecting to see full benefit of product pricing change and commission structure as per new surrender norms, BofA said.

Aditya Birla Capital is aiming to deliver 17–18% margin for this financial year, with growth tailwinds in bancassurance space, BofA said. The company has a strong growth opportunities, according to the brokerage.

In the NBFC space, share of direct sourcing is rising with strong momentum, with acceptability of Udyog Plus B2B and synergies with ABCD application, BofA said.

Aditya Birla Capital is confident of delivering 25% asset under management growth in medium term, while it caps credit costs below 1.5%. The company targets retail premium growth CAGR of greater than 20% with VNB margins at 17-18% margins, BofA said.

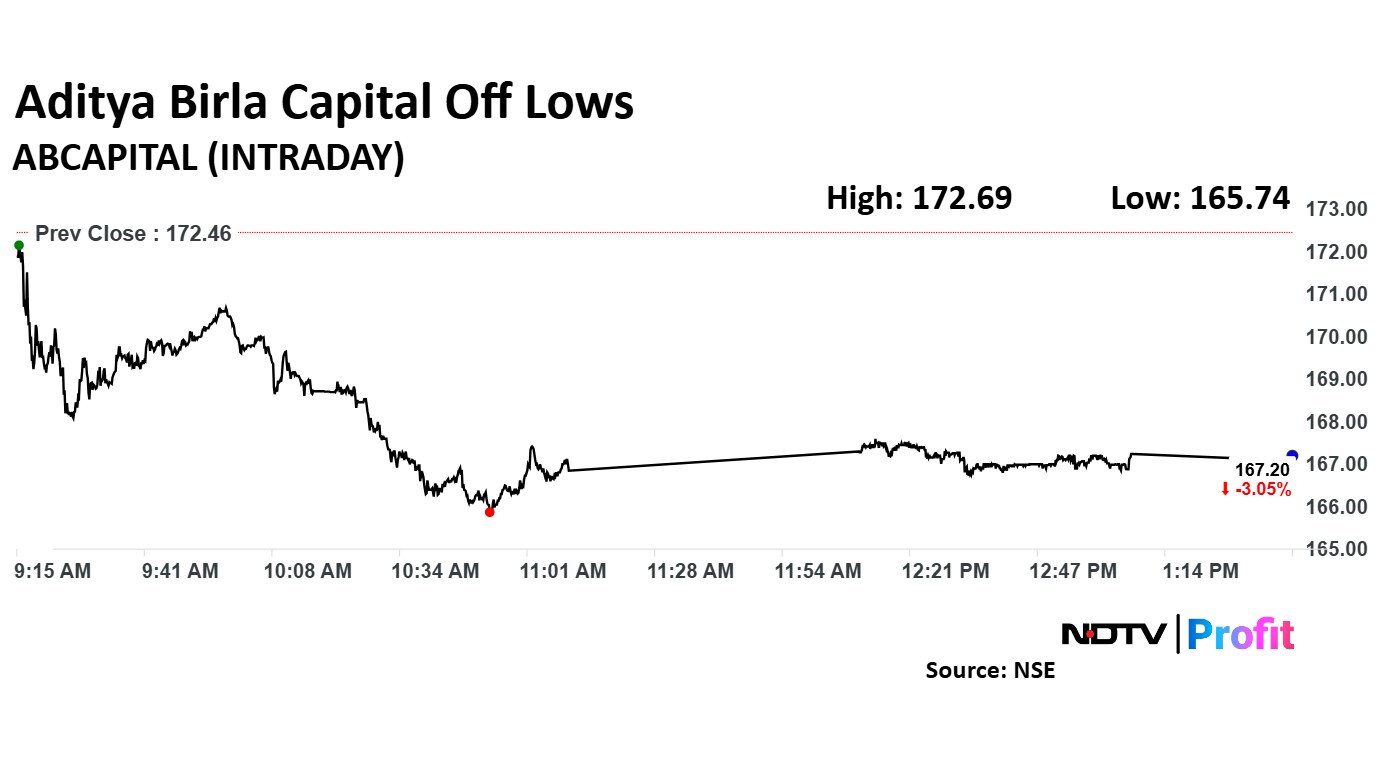

Aditya Birla Capital Share Price

Aditya Birla Capital share price fell 3.90% to Rs 172.69 apiece. It was trading 3.17% down at Rs 167 apiece as of 1:35 p.m., as compared to 1.38% advance in the NSE Nifty 50.

The stock declined 6.29% in 12 months. Total traded volume so far in the day stood at 1.33 times its 30-day average. The relative strength index was at 38.60.

Nine analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 44.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.